July 26, 2024

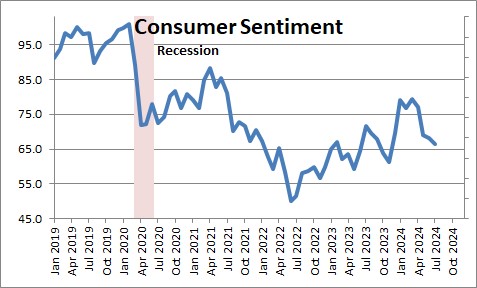

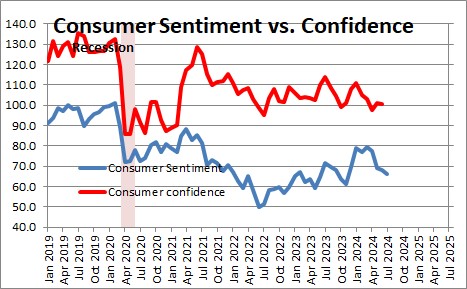

The final estimate of consumer sentiment for July declined 1.8 points to 66.4 after having fallen 0.9 point in June as consumers worry that inflation might remain higher than expected for a protracted period.

Surveys of Consumers Director Joanne Hsu said, “Sentiment has lifted 33% above the June 2022 historic low, but it remains guarded as high prices continue to drag down attitudes, particularly for those with lower incomes.”

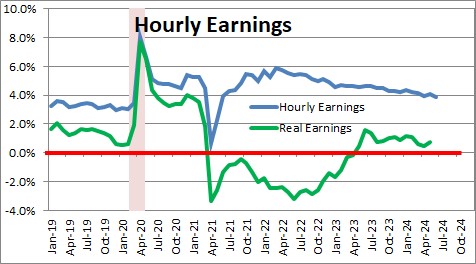

Many consumers have been concerned by the fact that while their nominal earnings were rising, inflation was eroding their purchasing power and, as a result, wages in real terms declined for roughly two years. They have begun to rise slightly in recent months, but consumer real income remains far below what it was prior to the recession.

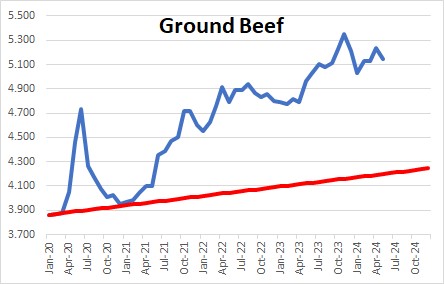

In addition, many consumer prices have risen sharply since the recession. The Fed promised that the increase in prices would prove to be “temporary”. That has not been the case. This is particularly problematic because so many of those price gains are on necessary commodities like food, shelter, and transportation which hit lower income families the hardest.

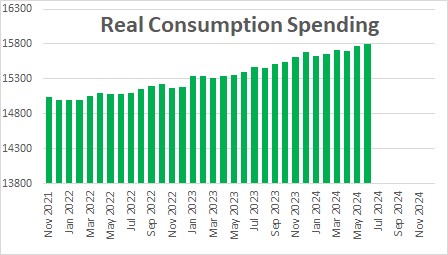

Real consumer spending has risen 2.6% in the past year. In the last three months that has slowed to 2.2%. But with real disposable income rising at a 1.0% pace consumer spending should slow further.

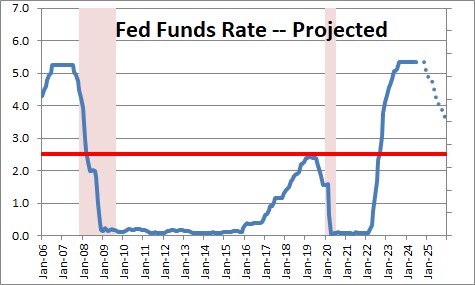

The slower growth should allow the Fed to ease at some point close to yearend. We expect the funds rate to fall from 5.3% to 5.1% by the end of the year and continue falling to 3.6% in 2025..

Both the University of Michigan’s consumer sentiment index and the Conference Board’s measure of consumer confidence both show a moderate rebound in the past couple of months. The two series can diverge from one month to the next, but the trends are similar.

We got 2.8% GDP growth second quarter. We expect to see GDP growth of 0.9% in the third quarter and 1.6% in Q4.

Consumers’ assessment of current conditions fell 3.2 points from 65.9 to 62.7.

Consumer expectations for six months from now declined 0.8 point from 69.6 to 68.8.

Stephen Slifer

NumberNomics

Charleston, SC

Going forward to the next reporting point will consumers focus on President Trump’s positive commentary for “Negative Interest Rates” and “Refinancing the US debt”

Since a lot of folks have savings accounts one would think :negative interest rates” would create negative consumer sentiment

Most people associate “refinancing” with financial difficulties

I wonder if that will have a negative on consumer sentiment

HI Allen,

Good question. But, at least in my mind, it is a moot point here in the U.S. I don’t think we will ever see negative rates but, then again, some of these other countries around the globe never thought they would get there either. If we should get to the point where negative rates become possible let’s keep an eye on confidence as you suggest. The soonest that might occur would be in the midst of the next downturn — whenever that is.

Steve

Steve

The rise in inflation and interest rates appears inevitable.

I am concerned about the effect this will have on our ability to meet our federal debt obligations.

At some point in the future will we reach a tipping point where cannot pay the interest on the debt?

Then what happens?

Hi Bill,

I have been worried about debt for some time. The path we are on seems unsustainable to me. Debt as a percent of GDP has climbed to 103%. The record was 106% right after WWII. But at that point you cut defense spending sharply and the ratio shrank quickly. This time 70% of the deficit each year is entitlements. Those will be difficult to cut and, hence, the ability to shrink the deficit to something manageable (3% of GDP) is unlikely.

Specifically, with re: to your question about inflation, inflation helps to shrink the deficit. If we get nominal GDP growth of, say, 10% (4% real growth + 6% inflation) revenue growth should be roughly 10%, Yes, interest rates will rise, and interest on the debt outstanding will climb. At the same time some government expenditures will shrink (think welfare payments, Medicaid). An easy way to resolve the budget/debt problem is some good old fashioned inflation.

While inflation may help the government, it hurts the rest of us, especially older people trying to live on a fixed income, and lower income individuals who do not get the benefits of higher home prices and higher stock market valuations.

The reality is that debt/GDP of 103% is not sustainable. If we have a problem like in 2020, when the Treasury loses tax receipts and government spending increases, the budget deficit explodes, and debt in relation to GDP takes a huge jump. Having said that, I have been worried about debt for ages and nothing bad has happened — yet. That does not suggest that we are supposed to ignore it. There will be a day of reckoning, but you and I may not be around to see it.

Steve- great information, is there any data on the distribution of consumer net worth i.e. is it even across income levels or aggregated in one or more segments? Could this explain some of the differences in consumer sentiment?

Hi George. Net worth is decidedly NOT evenly distributed. I have not looked for that information specifically, but just a quick check I found online which seems to give us a sense. It turns out that a PEW Research Center study noted that upper income families (which I guess it defines as income greater than $207,400 in 2018) held 79% of the wealth. The middle income group which I guess ranges from $28,700 in 2018 to $207,400 held 17% of the wealth, and the lower income category (less than $28.700) had 4%. The data are obviously old, but I am sure the numbers have changed not all that changed much. The bulk of that wealth comes from the stock market and home ownership. Thus, low income earners do not share much in the wealth of the country. Middle income earners have more, but still relatively little. The wealthier Americans have by far the biggest share of the pie. Thus, it seems to make sense that if you do a survey of consumer confidence, lower income earning families included in the survey are being hit hard and their confidence has plummeted. A big portion of their income goes to housing, gas, and food — all of which have risen sharply in price. They were just getting by before and now they have to make a choice — Pay the rent? Buy food for the family? Fill the car with gas?

But what bothers me the most is that the U of Michigan survey has confidence plummeting — below the 2020 low, and below the 2008-09 recession low. I am not sure that makes sense to me. The Conference Board measure of consumer confidence has it dropping, but the decline is not nearly as dramatic. So which is the better measure? The Conference Board data seem more consistent with the consumer spending data — some slowdown but not dropping off a cliff. I guess we will see.

Steve

another great article, Steve! Thanks as always

Thanks Michelle. Nice to hear from you. Hope all is well.