September 12, 2023

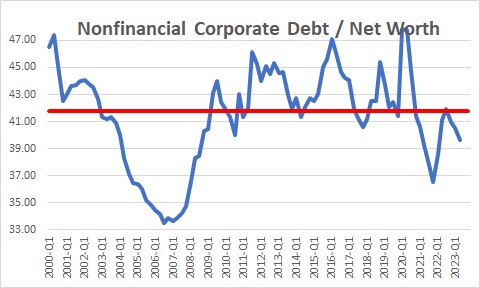

Economists like to keep an eye on the amount of leverage amongst corporations. When corporations take on huge amounts of debt in relation to their net worth, any economic downturn will be much more severe than it would otherwise be as corporations become unable to service their debt from cash flow.

This ratio rose sharply in the first half of 2021 during the recession as the the stock market plunged and the net worth of corporations declined sharply. But the stock market has since recovered and this ratio has fallen to 39.7%. This compares to an average ratio of debt to net worth since 2000 of 41.8%.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me