November 29, 2023

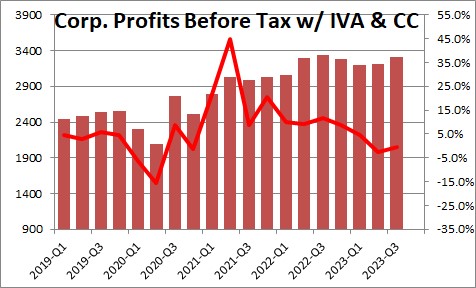

Corporate profits from current production (corporate profits before tax with inventory valuation and capital consumption adjustments) rose by $105.6 billion in the third quarter which works out to an annualized rate of increase of 3.3% after after having risen 0.2% in the second quarter. During the last year profits on this basis have declined 0.7%. The IVA and CC adjustment deals with the difference in depreciation allowances used for accounting and income tax purposes.

Corporate profits have held up remarkably well since the Fed has raised the funds rate from 0.0% in March 2022 to 5.5% today. Firms have been unable to find the number of workers that they require so they have begun to invest in technology to boost productivity which seems to be paying off in the form of higher profits.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me