June 16, 2023

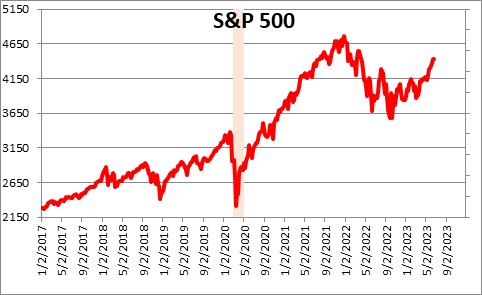

We are beginning to wonder if the economy has a lot more momentum than is generally believed at the moment. Virtually every economist on the planet expects the U.S. economy to slip into recession later this year or early in 2024 because, surely, real interest rates have risen high enough and the yield curve is sufficiently inverted that such an outcome is almost guaranteed. But what if it isn’t? The stock market is telling a different story. Week after week it continues to climb and it is now within 7.0% of its pre-recession, pre-pandemic record high level. The stock market is certainly not anticipating a recession any time soon. This steady run-up in stock prices will do several things. It will boost consumer confidence and, presumably, consumer spending. It will also raise business confidence and give business leaders both the willingness and the ability to quicken investment spending. If all of that happens the economy will grow quickly and it will be substantially more difficult to reduce the core rate of inflation. If that scenario unfolds the Fed will have a lot more work to do than the two additional rate hikes it envisions between now and yearend. Since the pandemic neither the economy nor the inflation rate has behaved in exactly the same way as it did in the past. Could we all have this wrong?

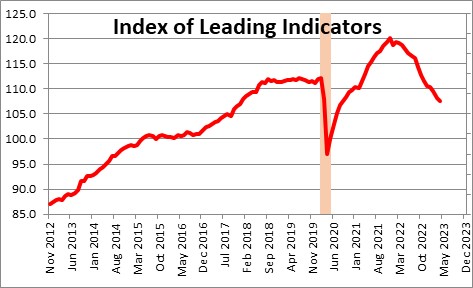

One of the reasons for this widespread expectation of a recession stems from the index of leading indicators which has been falling steadily since December 2021. It has been signaling recession for a year and one-half. This index is the compilation of a dozen indicators each of which are leading indicators. One of those components is the S&P 500 index.

But the stock market continues to climb. Week after week it shrugs off the fear of recession, worries about the impact of previous increases in interest rates, and tighter bank lending standards. Stock investors are not worried at all about a recession. Economists are. Somebody has this wrong.

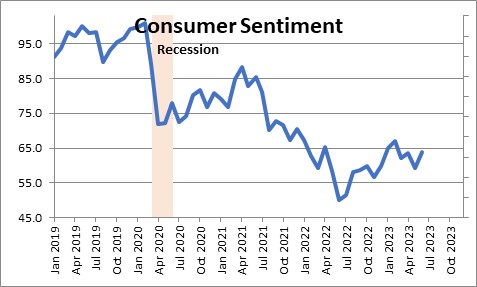

Right or wrong, the steady increase in stock prices is likely to bolster consumer confidence. Consumer sentiment for June rose 4.7 points to 63.9 The University of Michigan’s Director of Consumer Surveys, Joanna Hsu, said the following: “Consumer sentiment lifted 8% in June, reaching its highest level in four months, reflecting greater optimism as inflation eased and policymakers resolved the debt ceiling crisis. The outlook over the economy surged 28% over the short run and 14% over the long run. Sentiment is now 28% above the historic low from a year ago and may be resuming its upward trajectory since then.” While still at a historically low level its direction now seems to be upward.

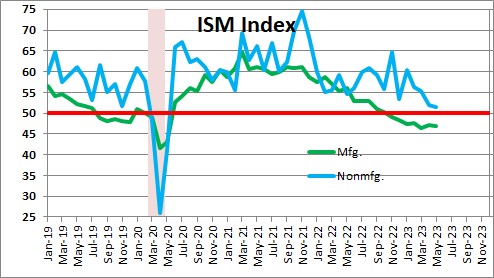

We suspect hat business confidence will also begin to climb. The first evidence of that will presumably show up in the Institute for Supply Management’s purchasing managers’ indexes for the manufacturing and service sectors of the economy for June that will be released in early July.

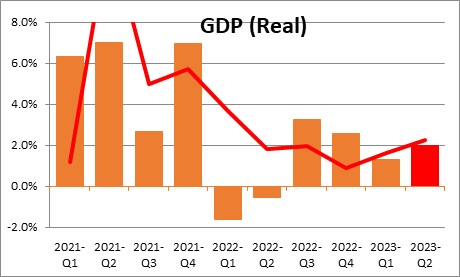

It is also interesting that economists expectations for the timing of the recession have steadily been pushed farther and farther into the future. Initially, first quarter GDP growth was expected to be about unchanged. It ended up at 1.3%. Second quarter growth was initially expected to be about 1.0%. We do not yet know what happened to GDP growth in the second quarter but the consensus appears to be about 2.0%.

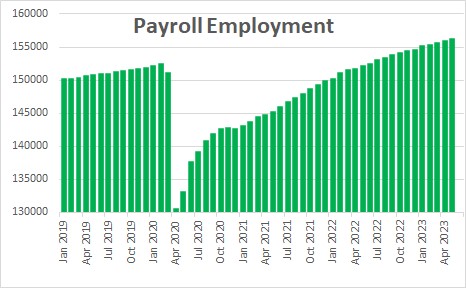

Each month payroll employment increases more than expected. The long-awaited slowdown in employment and the associated increase in the unemployment rate remains elusive. In the most recent 3-month period employment has risen on average 283 thousand.

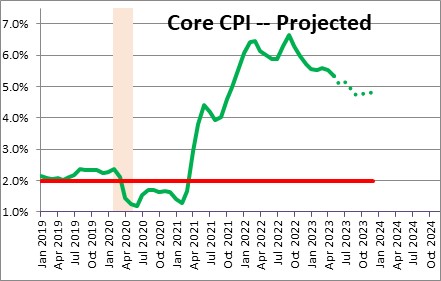

Even the Fed is beginning to recognize that the economy is performing better and inflation is not slowing as rapidly as it expected. At its May meeting the FOMC anticipated a mild recession in the second half of this year. At its meeting in June it now expects GDP growth in the second half of the year to be essentially unchanged. It raised its projection of the core PCE deflator for 2023 by 0.3% to 3.9%. Previously it expected the funds rate to remain at 5.25% through yearend. Now it says that two more rate hikes are likely during that period of time which would boost the funds rate to 5.75%.

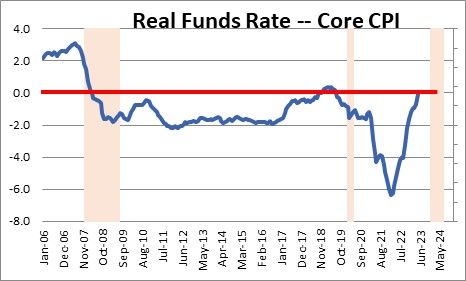

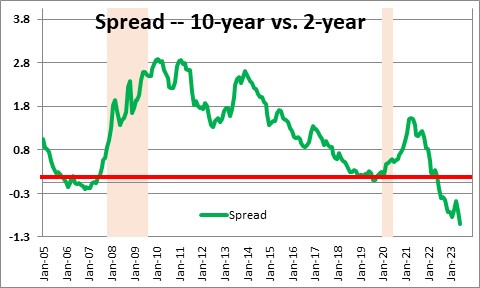

Thus far, the community of economists believe that the level of real interest rates is high enough, and the yield curve is sufficiently inverted, that a recession is inevitable. But as each month’s data confirm that the economy remains more robust than expected, the timing of the recession gets pushed farther and farther into the future. We expect the Fed to raise the funds rate to 6.0% by September which would boost the real rate to 1.4%. Presumably, a real funds rate of that magnitude should produce a recession in the first half of 2024.

But the unfortunate reality is that we are all guessing about how high the real funds rate needs to be to slow the pace of economic activity enough that the core inflation rate will begin to shrink more quickly. Thus far, the economy has refused to cooperate and inflation remains sticky.

Nothing about this three-year-old expansion has behaved exactly as economists had envisioned. Could the long-awaited recession remain elusive until such time as the Fed pushes the real funds rate substantially higher? We will soon find out.

Stephen Slifer

NumberNomics

Charleston, S.C.

Thought provoking and interesting. Beats my “What Tanks to Ukraine” article any day …;-)

Stephen, maybe we are in a new situation. The business community is in an exponential stage and most likely will continue in that vein for the rest of the century. We live in a very different time. The 21st century cannot be judged by 20th century norms. Maybe we need to rethink everything.

Hey Stephen!

Not withstanding your always soundly insightful commentary, maybe Econ experts and the FED need to harness GPD-4 LLM and apply some machine learning to economic forecasting. Probably gonna’ happen sooner than we think.

Hi Dean. Thanks for the kudos. Not so sure it is more interesting than yours. Your was a different but equally important topic.

All of our models are based on historical data which is fine if the world doesn’t change the way it hangs together. Unfortunately, it changes all the time. While frustrating in some sense, I find that is what makes economics fun. Always trying to figure out how today’s world is different.