December 2, 2022

The world is focused on the combination of GDP growth, inflation, and expected Fed action, and certainly those topics are important. But there has been little discussion of the damage done by the government’s debt explosion in the past couple of years. Similarly, nobody has focused on the fact that the Social Security and Medicare programs will be insolvent within a few years – Medicare by 2028, Social Security by 2034. Democrats are currently focused on passing an omnibus spending bill by yearend to fund the federal government through September 30 of next year. Republicans want a one month expansion of the debt ceiling to keep the government functioning until they take control of the House in January. There is no discussion on Capital Hill about reining in spending or concern about the looming insolvency for Social Security and Medicare. This is inexcusable. With a divided government for the next couple of years the chances of soon passing any meaningful legislation to rein in government spending or save Social Security and Medicare are slim to none. The longer Congress waits, the bigger the adjustment that will ultimately be required.

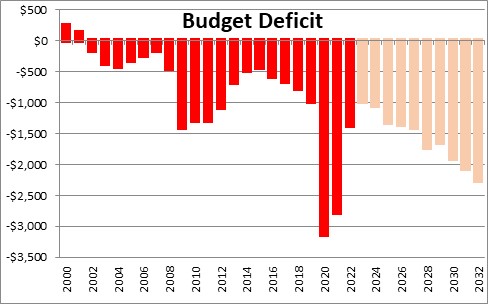

The series of fiscal stimulus packages in 2020 and 2021 ballooned the budget deficits for those two years to $3.2 trillion and $2.8 trillion, respectively. The Administration is touting the fact that the budget deficit for 2022 shrank to $1.4 trillion. Since when do we get excited about a budget deficit that is “only” $1.4 trillion (or 5.6% of GDP)? We have lost touch with reality. Whenever the government runs a budget deficit, the Treasury has to issue an issue an equivalent of debt.

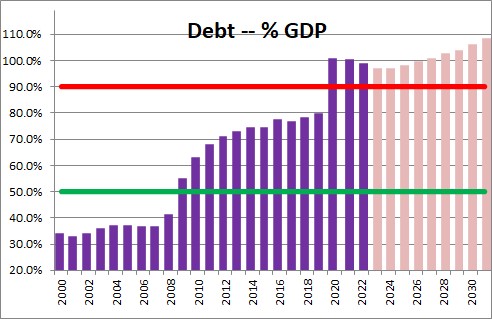

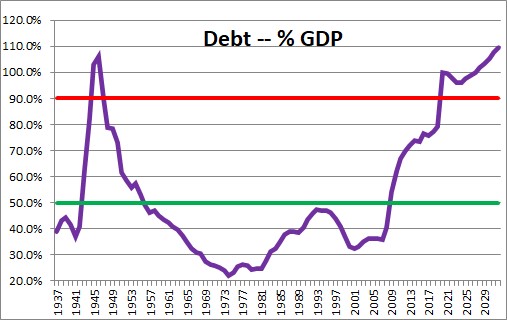

The deficits cited above mean that the Treasury issued $7.4 trillion of additional debt in the past three years. As a result, the ratio of debt to GDP jumped by more than 20 points from 79% to 100%. Economists generally believe that a debt/GDP ratio above 90% is problematical. We are there.

To put this into perspective, the previous record debt/GDP ratio was at the end of World War II when it reached 106%. It then declined quickly as defense spending shrank once the war ended. That is not going to happen this time. In fact, the Congressional Budget Office expects this ratio to climb to 109% of GDP ten years from now in 2032 as baby boomers continue to retire which will further boost Social Security payments and Medicare expenditures. Keep in mind that the CBO forecast makes no allowance for a recession which virtually every economist expects in either 2023 or 2024. If that happens the debt/GDP ratio may reach 110% by 2025. Despite a record amount of debt in relation to GDP (a measure of our ability to pay it back), nobody cares. But a wake-up call is coming.

In November the Social Security Administration told us that its Medicare program will be insolvent by 2028 – just 6 years from now. If Medicare actually becomes insolvent, the law says that Medicare payments will automatically be cut by 10%. This means that payments to all beneficiaries — like hospitals, doctors, nursing home facilities, and Medicare Advantage plans will experience a 10% drop in revenue. Who will make up the difference? Us.

If Social Security becomes insolvent in 2034 its monthly payments will shrink by 20%. Imagine the damage that will do to the monthly income of lower-income households and the further widening of the income gap between rich and poor.

For a politician, a vote to cut Social Security benefits has been likened to touching the “third rail”. It will virtually guarantee that you will be voted out of office at the next election. But the problem can no longer be ignored. The expiration date is getting closer and closer. Any economist can tell you what needs to be done to solve these two programs. What is lacking is the will to do so. Tough choices lie ahead. Is Congress up to the task?

Stephen Slifer

NumberNomics

Charleston, S.C.

Solution is to pay more and wait longer for SS. For Medicare, it’s a single payer system that will deliver some solvency.

Hi Patri ck,

For what it is worth, the Erskine Bowles Committee back in 2010 made the following recommendations re: Social Security:

Reduce benefits, particularly for high income individuals,

Increase the retirement age gradually to 68.

Increase the payroll tax max from $147,000 currently (I think) to $180,000.

Remember, those recommendations were made 12 years ago, but the game plan still seems solid.

And for Medicare, EB recommended:

First $500 not covered.

$500-$5,000 coverage is 50% of the expenditure.

Raise eligibility age from 65 to 68,

Malpractice suits must include workman’s comp and insurance in determining the award./

Again, sounds reasonable to me. We will be putting some skin in the game.

But nobody in Washington seems to be talking about any of that.