January 25, 2020

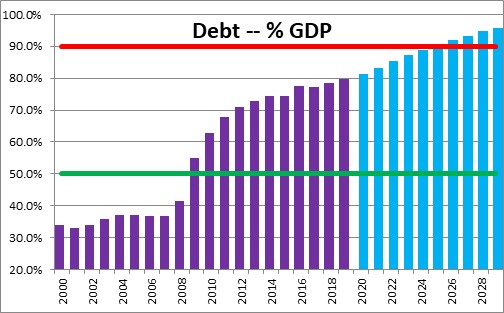

The Congressional Budget Office recently reported that the budget deficit for the current fiscal year is likely to be $1.0 trillion. A deficit of that magnitude will push debt held by the public to 80.7% of GDP. For the first seven years of the previous decade debt held by the public averaged about 35% of GDP. But the depth of the recession changed all that and debt as a percentage of GDP has exploded.

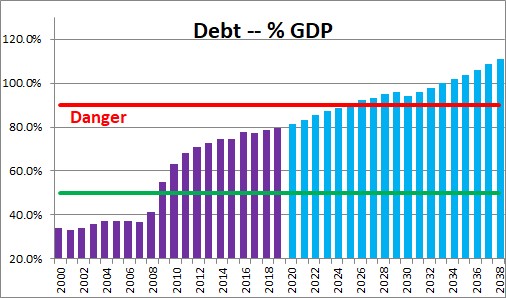

The budget outlook shows roughly comparable deficits for the next decade. As a result, by 2029 the debt to GDP ratio is expected to climb to 95% of GDP. Most economists would agree that a debt to GDP ratio of 50% would be sustainable, but if it should climb to 90% of GDP it could easily become a problem. At the 90% mark investors would be less willing to buy that country’s debt, interest rates would rise, the interest expense for the Treasury would increase, and budget deficits would widen. At 95% the debt ratio surpasses the 90% danger level.

However, the real deficit and debt problems begin immediately after the CBO’s 10-year forecast horizon. This is because the baby boomers continue to retire. They will start to receive Social Security payments and become eligible for Medicare. If one looks ahead 20 years rather than 10, the debt to GDP ratio climbs significantly higher. Indeed, by 2039 the CBO estimates that the debt to GDP ratio will be 113% rather than the 95% that they expect at the end of 10 years. That is way beyond the so-called 90% danger level.

To prevent this from occurring Congress and the President need to come to an agreement to shrink the deficit so that debt outstanding relative to GDP shrinks to a manageable level of 50% or less over the course of the next 30 years. It is do-able, but the question is whether our policy makers have the will to do what is necessary.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me