December 8, 2023

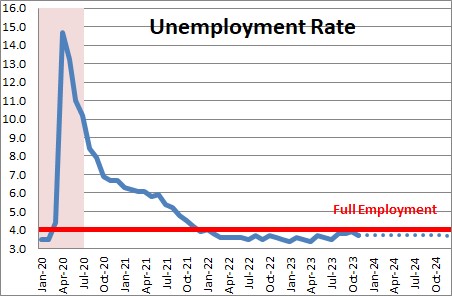

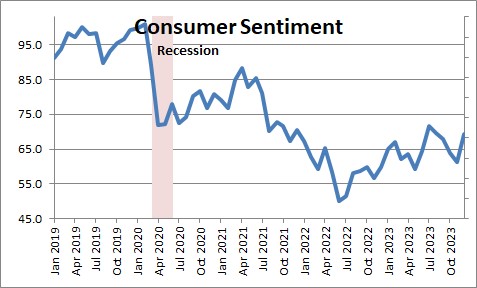

The employment report for November defied expectations as the economy generated 199 thousand jobs and the unemployment rate fell 0.2% to 3.7%. At the same time, consumer sentiment jumped 13% in December and is now close to its highest level in two years. Suddenly the economy no longer seems to be teetering on the brink of recession. It is charging ahead for now and likely to continue expanding at a moderate pace for the foreseeable future. That is a rather dramatic turnaround from the recession fears that were evident a few weeks ago. It is true that consumers are struggling as the savings rate has slowed and consumers are relying on their credit cards to maintain their lifestyle, but their spirits seem far brighter now as the economy enters the crucial holiday shopping season. As a result, a significant retrenchment in consumer spending does not appear to be imminent. Given all of the above we have boosted our first half of 2024 GDP growth forecast from 0.7% to 1.0% That is still not a vibrant pace of expansion, but it lessens the risk that a shortfall in the pace of consumer spending in January or February might cause the economy to slip into recession. Once again, the strength and resilience of the U.S. economy become evident.

It appears that economists misread the slower pace of payroll employment growth in November and the increase in the unemployment rate in that month to 3.9%. They thought that the economy was on the cusp of the long anticipated recession and were certain that the December employment report would confirm that outlook. They were wrong. Employment climbed 199 thousand in December, the nonfarm workweek surprisingly rose 0.1 hour to 34.4 hours, and the unemployment rate dipped by 0.2% to 3.7%. That is a robust employment report any way one slices it. It appears that workers continue to re-enter the labor force and are getting hired quickly. As a result, we expect further employment gains in the months ahead which will keep the economy on track.

An hour later the University of Michigan reported that consumer sentiment exploded in December with a gain of 13% to a level of 69.4. The gain represented improved sentiment across age, income, education, geography and political identification. The surge in sentiment could not happen at a better time as the all-important holiday shopping is underway.

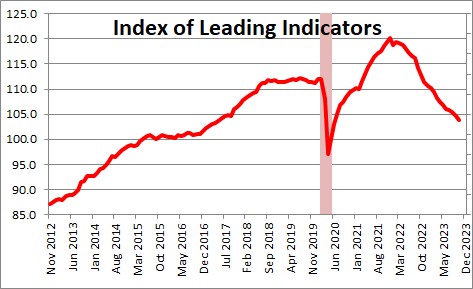

The long held view that a recession is imminent is based to a certain extent on the Conference Board’s index of leading indicators. It has fallen steadily for two years. Typically the index will give a 3-6 month heads up that the economy is about to slip into recession. This index suggests that a recession is long overdue. While it has given the occasional fake signal in the past, the index has never fallen this far for this long without resulting in a recession. So, has the relationship between the 10 leading indicators on which this index is based and the economy changed so much that they are no longer leading indicators? Or is the recession simply taking longer to play out? We believe it is the former.

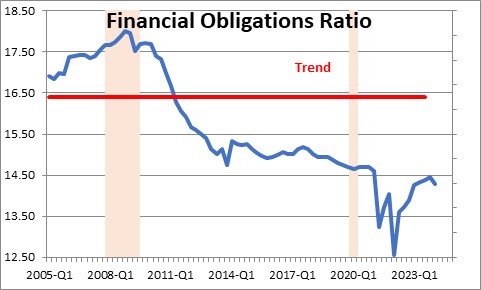

The results from the November employment report and the December index of consumer sentiment make it abundantly clear that the long awaited recession is not about to start any time soon. That means that the leading of leading indicators is completely out of whack with reality and will remain so for months to come. With observed inflation slowing and likely to shrink further in the months ahead, the stock market within an eyelash of an all-time record high level, and market rates having fallen sharply in the past month, the idea that the economy is suddenly going to fall over the edge into recession is simply implausible. It is true that the savings rate has dropped from its long-term average pace of 7.0% to 3.8%. It is also true that consumers have been relying on their credit cards to maintain their pace of spending. As a result, it is a sure bet that the pace of spending will slow at some point. But despite the faster pace of credit card borrowing, consumer debt payments as a percent of income remain low. It appears that to a large extent consumers used those stimulus checks in 2020 and 2021 to pay down debt to the point that the financial obligations ratio fell to its lowest level since the mid-1980’s. As a result, consumers can continue to run up their credit card bills and accrue debt for some time to come because they had so little debt initially.

In our opinion, it would be a mistake to be misled by the index of leading indicators. The 2020 recession and the government-indicate shutdown triggered by the pandemic has changed how , when, and where we want to work, the resulting surge in mortgage rates has made current homeowners reluctant to put their homes on the market, and it has made employers unwilling to lay off anybody for fear they may never be able to get them back once the pace of economic expansion quickens. As a result, the relationship between economic indicators today has changed so much that the old rules no longer seem to apply. The problem is that nobody yet knows the new rules. For now, the vast majority of economic indicators do not seem to be pointing to a recession any time soon. That is good news and makes it increasingly likely that the Fed can actually pull off the frequently elusive soft landing.

Stephen Slifer

NumberNomics

Charleston, S.C.

Steve,

How much of job growth (Nov or last 3-6 mo) has been jobs in the governmental sector vs. the sectors that produce GDP? Anything interesting there?

The answer is that government jobs have been rising and, as a result, the average payroll jobs exceed private sector jobs. But that is not unusual.

In the past three months payroll jobs have risen 204 thousand per month.

In the same three months private jobs have risen 145 thousand per month.

The difference is 50 thousand. In the same 3-month period last year it was 28 thousand. Does it explain some of the difference? Yes. Does it change the basic idea that the economy as a whole and/or the private sector continue to create jobs at a reasonable clip? Not in my mind.

The unemployment rate is still 3.7% when full employment is supposed to be 4.0%. The workweek rose 0.1 hour in December. Civilian employment (the employment measure used in calculating the unemployment rate) was 161 thousand in that same 3-month period. Initial unemployment claims hover at 190 thousand. They are barely budging. The ADP report had a jobs gain of 99 thousand. But that is not unusual. It has come in below the BLS jobs number in 6 of the past 8 months and, on average, it has come in below the BLS jobs data by 74 thousand.

The story seems to be fairly consistent – the labor market is doing OK.