April 29, 2011

GDP growth in the first quarter came in at a relatively anemic 1.8%. Back in mid-December when doing the year ahead forecast we anticipated first quarter growth of 5.0%. Then, along came the series of harsh snowstorms that devastated much of the country in January and early February. That was followed by unrest in the Middle East and North Africa which caused oil prices to rise. That was followed by the earthquake and tsunami in Japan, and concern about the spread of radiation given problems at several nuclear reactors in that country. Eventually, the growth forecast got trimmed to 3.0%. But 1.8% does not sound much like any of those numbers. The reality is that first quarter growth was well short of what we had anticipated. The question now is, to what extent does this surprisingly slow growth early in the year tell us about the pace of expansion in subsequent quarters? To answer that question it is important to understand the reasons why first quarter growth was so anemic.

The one category of spending that stands out most vividly is the sharp falloff in Federal government spending. Such spending declined at an annual rate of 7.9%, a drop which was entirely attributable to an 11.7% reduction in defense spending. Non-defense spending rose 0.1%. This unanticipated drop in defense spending subtracted 0.7% from GDP growth. But there is no earthly reason why defense spending should suddenly decline. The budget for this fiscal year has been approved. The Defense Department knows what it can spend between now and the end of the fiscal year on September 30. No significant decline in government spending is likely to occur until next year. Thus, the defense spending shortfall in the first quarter is likely to be reversed in the second and third quarters and add as much to growth in those quarters as it subtracted from the first.

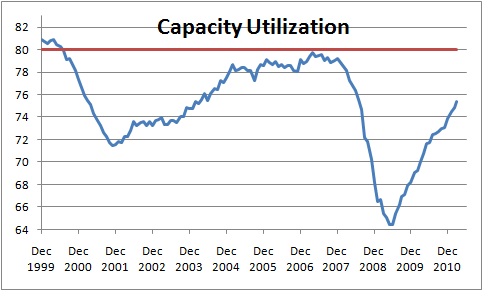

Then there was an enormous decline in “nonresidential structures” which fell at a 21.7% pace in the first quarter and subtracted another 0.6% from GDP growth. Basically, this represents spending on new offices and factories. Declines of that magnitude were recorded in the depth of the recession and shortly thereafter, but spending on these structures has been essentially unchanged since the first quarter of last year. Where did this precipitous drop in the first quarter come from? Probably from the extraordinarily harsh winter weather conditions that were evident throughout many regions of the country in January and February. With utilization rates in the manufacturing sector climbing fairly rapidly, there is no reason to believe that this type of spending should suddenly begin to fall. Thus, this category, like defense spending, is likely to add as much to GDP growth in the next couple of quarters as it subtracted from the first quarter.

In the absence of these two factors, first quarter growth would have been about 3.0% rather than the 1.8% pace that was reported. That would put it on a par with growth in the fourth quarter which came in at 3.1%. If all of that is reasonably accurate, and the drop in government spending and on factories and office buildings is reversed in subsequent quarters, then it is not unreasonable to anticipate a second quarter GDP growth rate of 4.5%. If that turns out to be the case, then GDP growth for the year as a whole should be about 3.5% — a great year, but obviously not as robust as the 4.0% pace we anticipated in mid-December.

The FOMC met on April 26-27 and, amongst other things, provided us with their economic forecasts for the balance of this year and next. The Fed was, apparently, equally surprised by the slow pace of expansion in the first quarter as its GDP forecast for the year was revised lower from the 3.4-3.9% range cited in January to 3.1 to 3.3%. To achieve that objective, the Fed needs GDP growth to average 3.75% over the subsequent three quarters. We expect growth over that same three quarter period to average 4.0%. Thus, we remain slightly more optimistic than the Fed, and considerably more optimistic than many of our colleagues.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me