March 26, 2025

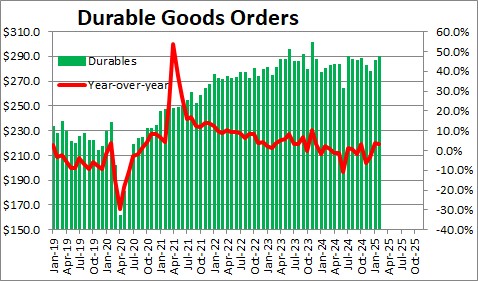

Durable goods orders rose 0.9% in February after jumping 3.3% in January . Durable goods orders have risen 3.4% in the past year.

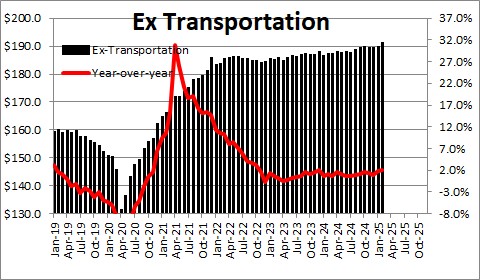

Much of the change in durables is frequently in the transportation sector — airplanes, cars, and trucks. In February transportation orders rose 1.5% after having surged by 10.2% in January as the result of a big increase in non-defense aircraft orders. As a result, non-transportation orders rose 0.7% in February after climbing 0.1% in January. The non-transportation sector has risen 2.0% in the past year. They are climbing, but slowly.

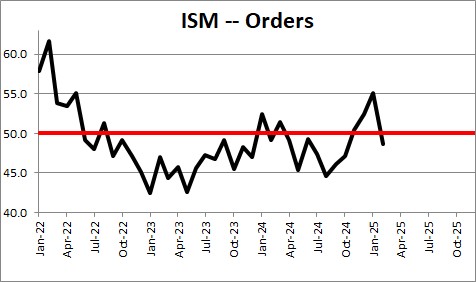

The orders component of the Purchasing Managers Index climbed for five months in a row before falling sharply in February. The spreading imposition of tariffs is having a retarding effect on the demand for goods.

.

.

We expect GDP growth of 1.5% in the first quarter followed by 2.5% GDP growth in 2025..

Stephen Slifer

NumberNomics

Charleston, SC

Stephen,

It fascinates me that in the middle of one of the most gummed up Congress in decades which does not seem to get much of anything done one way or the other, business continues to surge forward beyond expectations. Maybe we are better off with a government that does less instead of more. All we do have to be concerned about is how much more of the wealth of our country gets held in the hands of the “1%” while much of the “99%”, especially those in the lower segments of that large group live in a less than middle class environment. Maybe you have answers to that dilemma.

…Darrel

Dividing new orders by PPI for capital goods and the durables build in orders has been flat. I think this leaves upside for the year ahead. But only a guess on that.

I don’t typically look at the thing you mentioned, but it makes sense to me.