May 3, 2024

Economists have been waiting for the economy to slow for more than a year. Their dire warning of a recession last year proved completely off base as firms continued to hire workers and consumers continued to spend, but perhaps the economy is finally beginning to cool. Typically changes in the pace of economic activity are signaled via the employment report which provides the first in-depth look at the state of the economy for any given month. But it is hard to find evidence of that in the employment report for April. This time the signal may have come from the Institute for Supply Management’s report on conditions in the service sector. After expanding at a robust pace for more than two years, this report on the service sector was hit hard in April. It is possible that consumers are finally concluding that they cannot continue to spend at the same robust pace as in the past year. It is also possible that some of the April softness represents an interruption in the flow of goods caused by the Panama Canal drought, the Red Sea and Suez Canal turmoil, and the collapse of Baltimore’s Key Bridge. It is not yet clear how widespread or long-lasting the April softness might be, but something clearly happened.

The employment report for April was roughly in line with expectations. Employment rose 175 thousand which followed unexpectedly large gains of 235 thousand in February and 315 thousand in March. Perhaps the best way of interpreting this report is to average the past three months which gives an average increase of 242 thousand which is still extremely robust. The unemployment rate edged upward to 3.9% but remains slightly below the Fed’s full employment threshold of 4.0%. Nothing too surprising in this report.

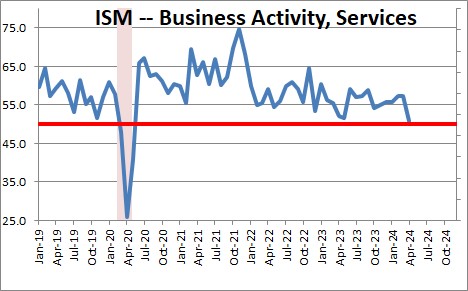

The same cannot be said for the Institute of Supply Management’s report on the state of the service sector in April. We like the business activity component of this index because it seems to track more closely with the pace of economic activity. This index plunged 6.5 points in April to 50.9. This index had been steadily fluctuating in a range from 55.0-60.0 for more than a year – until now.

It could be that the Panama Canal drought, the Red Sea and Suez Canal turmoil, and the collapse of Baltimore’s Key Bridge are finally taking a toll on the pace of economic activity. Maybe.

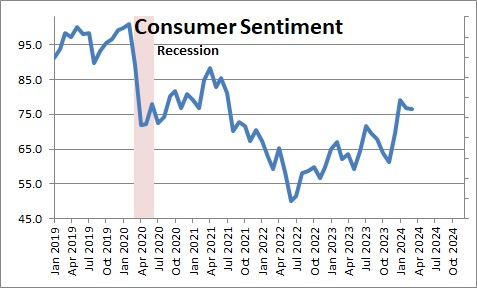

Alternatively, consumers could finally be trimming their pace of spending. We know that consumer sentiment plunged as inflation rose in 2021 and 2022, and it remains 20 points lower than it was prior to the recession. The problem is that after the recession prices rose sharply but never declined. The Fed said that the increase in inflation would prove to be “temporary” which suggested that the increase in prices would eventually be countered by a period of falling prices. But that never happened. Instead, the Fed seemed to mean that the rate of increase in prices would be “temporary”. After peaking at 9.0% the rate of increase in the CPI has slowed to 3.5% — but prices never declined. Some of biggest increase in prices over the past several years have been in necessities like food, shelter, and transportation. Those price increases are taking a huge toll on lower income families.

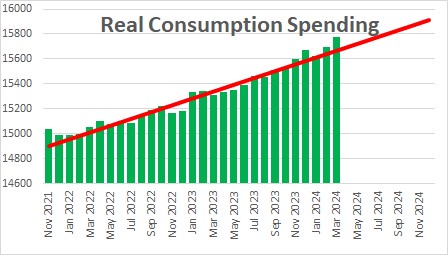

Typically, when sentiment falls sharply consumers cut back on their pace of spending. But not this time. They seem determined to maintain their lifestyle and have spent at a solid 2.7% pace in the past year.

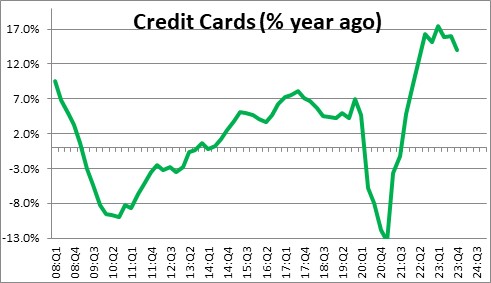

To do that they have increasingly relied on their credit cards which are an extremely expensive form of borrowing with interest rates ranging from 20.0-25.0%. At some point that has to end. Is it possible that at long last the pace of consumer spending is beginning to slow? We are not yet convinced, but the situation bears watching.

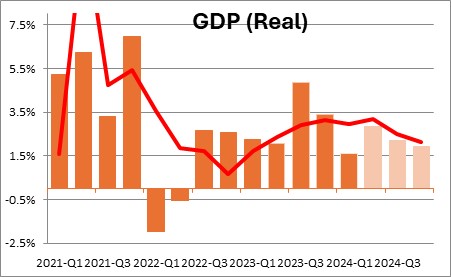

The bottom line is that the economy seems to be cooling. We expect GDP growth to slow from its current 3.0% pace to 2.0-2.5% in the second half of this year which would probably be welcome news.

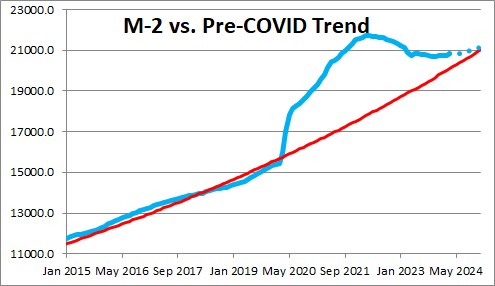

At the same time we fully expect the inflation rate to resume its downtrend as the year progresses. After buying trillions of dollars of U.S. Treasury securities and flooding the economy with trillions of dollars of surplus liquidity, the Fed has been shrinking its balance sheet for the past year and has eliminated much of that surplus liquidity. It will continue to shrink its portfolio through the summer which should eliminate the remaining surplus liquidity and pave the way for a slower rate of inflation.

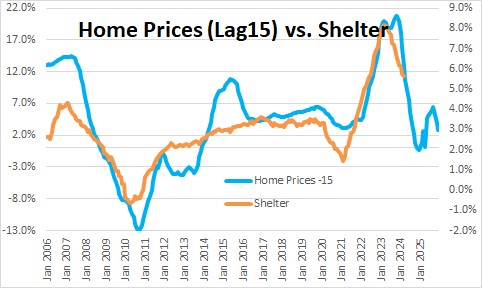

The core CPI remains excessive with 3.8% growth in the past year. A major factor keeping it elevated is the housing component which has increased 5.6%. That is a big deal because the shelter component represents one-third of the entire CPI index. But changes in the shelter component seem to lag the change in home prices by about a year. Thus, we expect shelter to slow from 5.6% currently to 2.5% or so by yearend which will allow the core CPI to resume its downtrend.

If we are truly seeing some early indications that GDP growth is slowing and the inflation rate cooperates, we may well be on track for the initial Fed easing move in December.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me