October 2, 2015

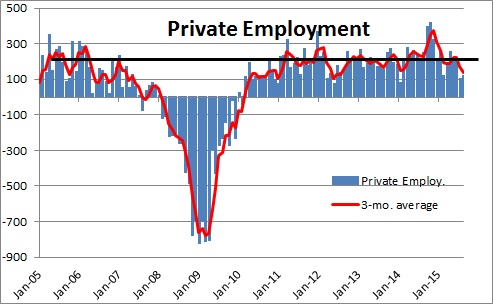

Private sector employment rose far less in September than expected. This is the second consecutive month that the Bureau of Labor Statistics has reported a smaller-than-expected increase. After reviewing the report we conclude that there is probably some legitimate softness in the two most recent reports. Having said that, we are unwilling to significantly alter our GDP outlook by any significant amount for a variety of reasons.

The U.S. economy appears to be expanding at a 2.5-3.0% pace in the third quarter which essentially matches its recent trend rate of expansion. But growth is uneven. Consumer spending is climbing at a relatively robust pace and showing no sign of slowing down. The manufacturing sector, however, has been hit by the combination of falling oil prices (which has clobbered the oil sector), and by the strength of the dollar (which has wiped out growth in exports).

The consumer has shrugged off the recent stock market turbulence and fears of economic weakness in China. Consumer spending continues to climb at about a 3.0% pace for a couple of reasons. First, jobs growth has been generating the income necessary for consumers to maintain a solid pace of spending. For that to change the recent smaller-than-expected increases in employment must be sustained – and that remains to be seen.

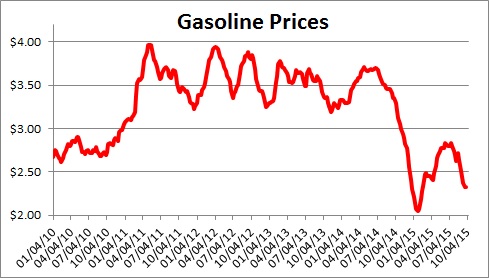

Second, falling gasoline prices mean that consumers spend less to fill the car with gas which leaves more money available to spend on travel, restaurants, and the movies.

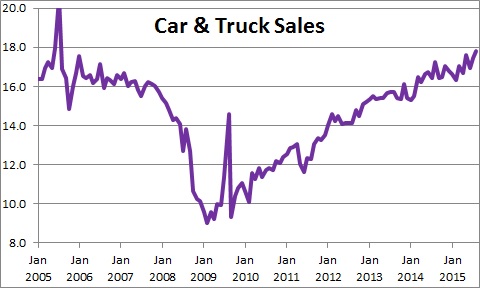

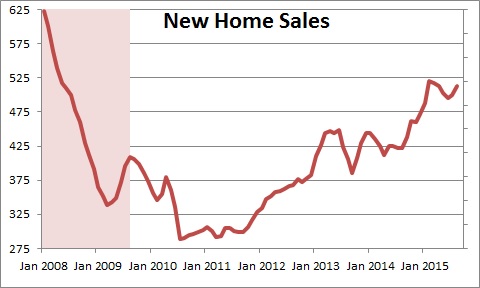

As a result, consumers continue to buy cars and houses at the fastest rates thus far in the business cycle. Given that those are the two biggest ticket items in our budget it is clear that the consumer has been unfazed by recent events. If we get nervous, autos and housing are typically the first two sectors to experience a downturn. That simply has not happened.

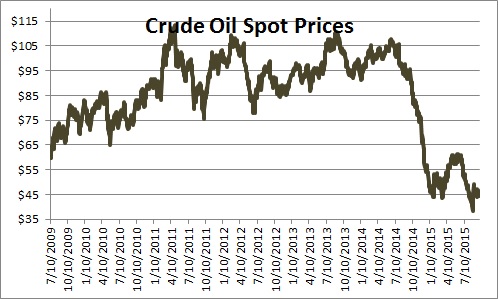

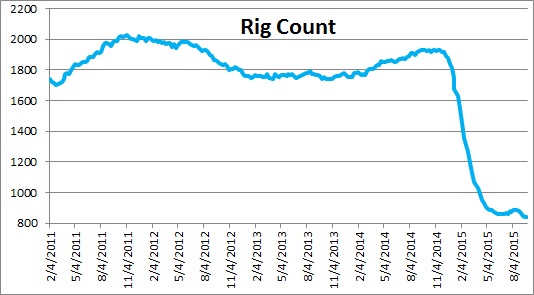

What weakness we are experiencing is coming from the manufacturing sector. First, the drop in oil prices has crushed the oil patch. At this time last year crude oil prices were $107 per barrel. Thanks to hydraulic fracturing and horizontal drilling the supply of oil has increased dramatically, the world is literally awash in surplus oil, and the price of crude has collapsed to its current level of $44.

In response, oil drillers have closed down half the wells that were in operation at this time last year. But if oil prices stabilize at anything close to their current level the bulk of the weakness in this sector should be largely behind us.

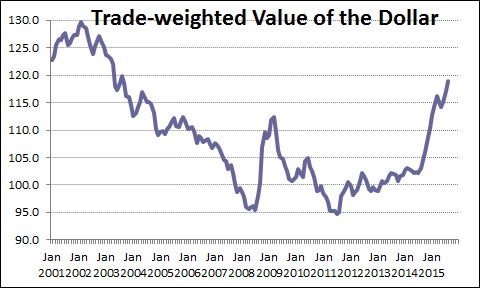

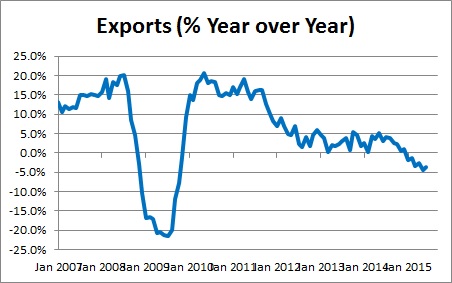

Second, the combination of slower growth in China and a stronger dollar have wiped out growth in exports. Given global uncertainly and a precipitous worldwide drop in stock prices, the dollar has risen 15% during the past year as investors sought the safety of dollar-denominated investments.

When the dollar rises U.S. goods become more expensive for foreigners to purchase. As a result, U.S. exporters are finding this a very challenging environment. Exports rose 1.0% in 2014 but are on course to decline about 4.5% this year.

This combination of vigorous consumer spending partially offset by softness amongst firms in the oil and export industries is producing steady but unimpressive GDP growth of about 2.5%. That does not appear to be changing.

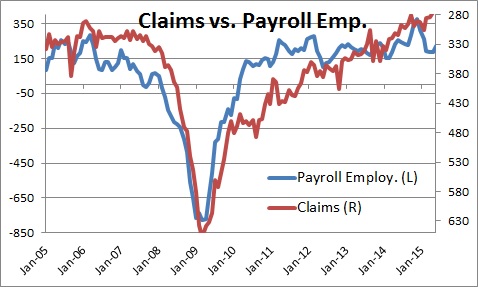

Two final points. First, if the labor market has softened by any appreciable amount, why haven’t initial unemployment claims (a measure of layoffs) begun to rise? When the labor market begins to weaken typically claims start to rise prior to seeing smaller gains in payroll employment. But claims have been steady at about 275 thousand for months which suggests that monthly increases in payroll employment should continue to exceed 200 thousand.

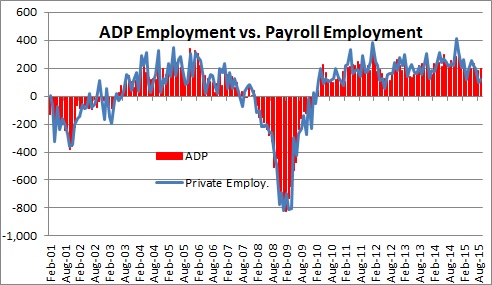

Second, if the labor market has weakened, why hasn’t the ADP report been similarly affected? ADP employment rose 200 thousand in September and has climbed on average 185 thousand per month in the most recent 3-month period versus 138 thousand per month reported by the BLS. No one can know which series is telling the more accurate story. In all likelihood, truth is somewhere in the middle. If so, that implies some softening in the labor market, but far less than the recent BLS data suggest.

In short, we acknowledge the unexpected weakness in the employment statistics for both August and September. But we are not yet ready to alter our GDP forecast by any appreciable amount in large part because other labor market indicators do not confirm any weakening, consumer spending remains robust, and the oil sector should soon stabilize at a lower level. Given all of the above we expect GDP growth rate to increase at about a 3.0% pace in the third quarter and 2.6% for 2015 as a whole.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me