May 22, 2025

.

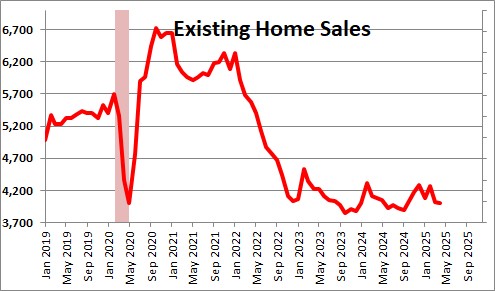

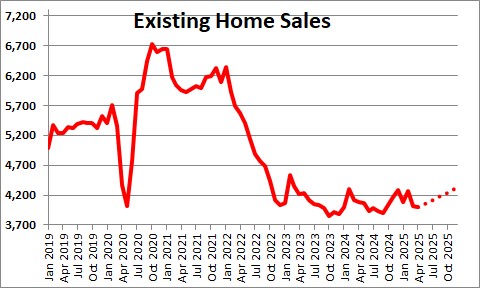

Existing home sales fell 0.5% in April to 4,000 thousand after having declined 5.9% in March.. Our expectation is that a steady increase in jobs will boost income, mortgage rates will be fairly steady in the months ahead, and prices should also be about stable or perhaps decline. As a result we expect home sales to pick up slightly during 2025.

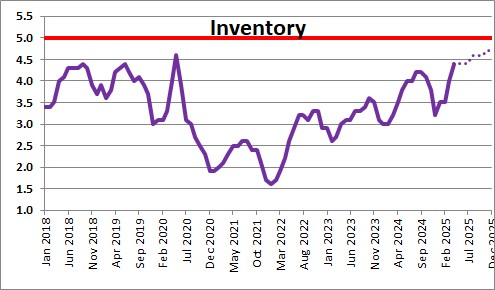

Lawrence Yun, NAR chief economist said that, “Home sales have been at 75% of normal or pre-pandemic activity for the past three years, even with seven million jobs added to the economy. Pent-up housing demand continues to grow, though not realized. Any meaningful decline in mortgage rates will help release this demand.” He added that, “At the macro level, we are still in a mild seller’s market. But with the highest inventory levels in nearly five years, consumers are in a better situation to negotiate for better deals.”

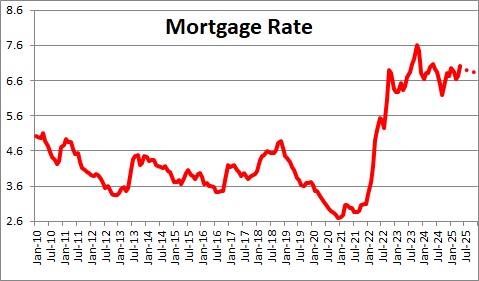

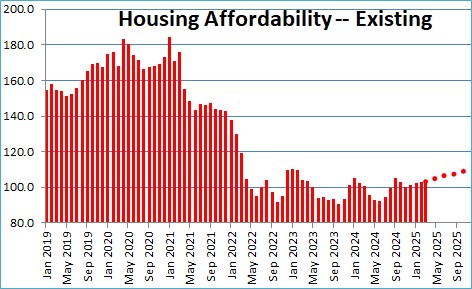

Mortgage rates are currently 6.9%. We believe inflation will be about unchanged in the months ahead which should keep mortgage rates relatively steady between now and yearend.

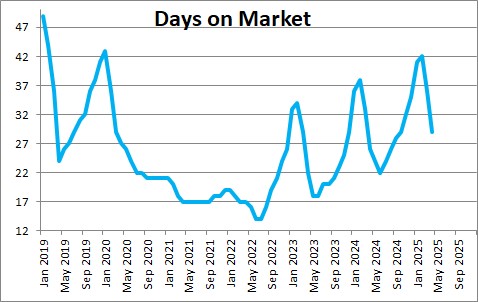

The average home sat on the market for29 days in April compared to 36 days in March. That is still a relatively short time period by any historical standard. A decade ago homes would routinely sit on the market for 3 months or so.

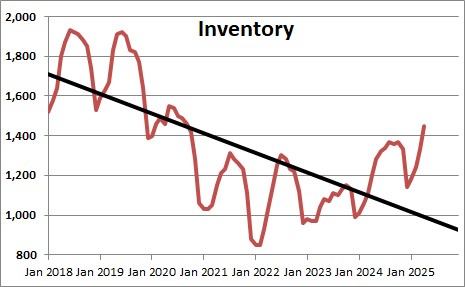

There are still few homes available for sale but the inventory is increasing. There was a 4.4 month supply of homes available in April That is still short of the 5.0 month supply that is required to balance the demand for and supply of homes. The actual number of homes available had been steadily rising in recent months and has increased 20.8% in the past year. Eventually it will get back to the desired 5.0 month supply which is the point at where demand is roughly in line with supply but that may not happen in 2025.

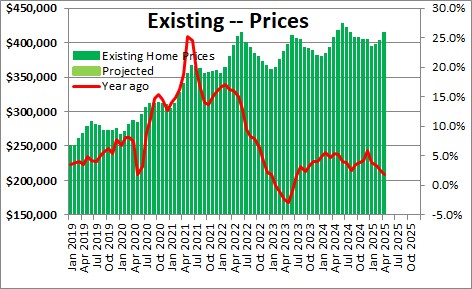

.The shortage of homes available for sale is preventing a sharp drop in home prices. Home prices rose 2.7% in April to $414,000 after having risen 1.6% in March. The year-over-year change is now 1.8%.

are fairly steady, job gains boost consumer income, and home prices are fairly steady (or decline), housing affordability should climb and the median-income earning family will have about 10% more income than required to purchase a median-priced home by the end of 2025.

.

Given all of the above we expect existing home sales to rise about 1.0% in 2025 to 4,320 thousand..

GDP declined 0.3% in the first quarter. We expect GDP to rise 2.5% in the second quarter and 1.9% in 2025.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me