September 19, 2024

.

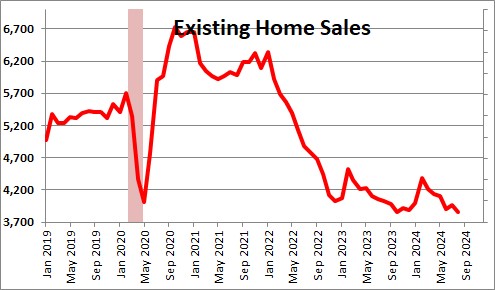

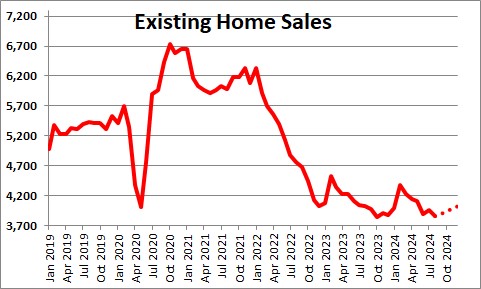

Existing home sales declined 2.5% in August to 3,860 thousand after having risen 1.5% in July. But the recent slide in mortgage rates and further Fed easing between now and yearend should propel sales upwards in the next few months.

Lawrence Yun, NAR chief economist said that,“Home sales were disappointing again in August, but the recent development of lower mortgage rates coupled with increasing inventory is a powerful combination that will provide the environment for sales to move higher in future months. The home-buying process, from the initial search to getting the house keys, typically takes several months.” He added that, “The rise in inventory – and, more technically, the accompanying months’ supply – implies home buyers are in a much-improved position to find the right home and at more favorable prices,”

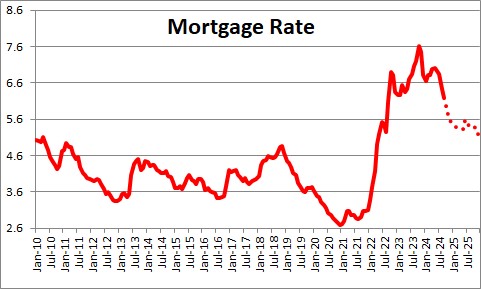

Mortgage rates climbed from 3.1% at the end of 2021 to 7.6% in October of last year. They have since declined significantly to 6.1% as the combination of a lower rate of inflation and the prospect of significant Fed easing in the months ahead have pushed mortgage rates lower. We expect them to retreat further to perhaps 5.5% by the end of the year.

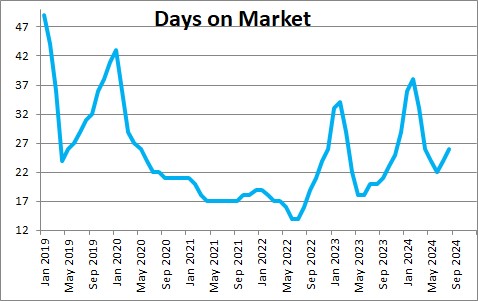

The average home sat on the market for 26 days in August which is a very short period of time. A decade ago homes would routinely sit on the market for 3 months or so. Even prior to the pandemic homes were on the market for roughly 45 days.That is no longer the case. Despite the extraordinarily slow pace of sales, properly priced homes continue to sell quickly.

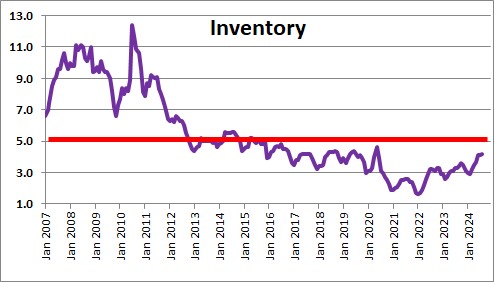

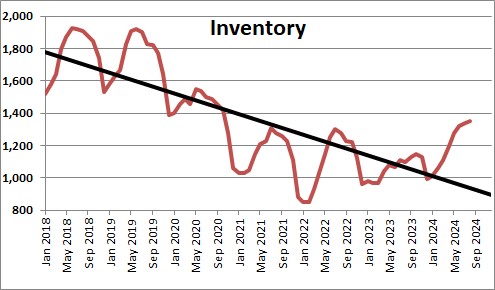

For a long time there were very few homes available for sale. However, that seems to be changing. Inventory rose 0.1 month in August to 4.1 months which is short of the 5.0 month supply that is required to balance the demand for and supply of homes. This measure is roughly where it was in May 2020. The actual number of homes available has been steadily rising in recent months and has increased 22.7% in the past year. Eventually it will get back to the desired 5.0 month supply which is the point at where demand is roughly in line with supply, but it is unlikely to reach that mark prior to yearend.

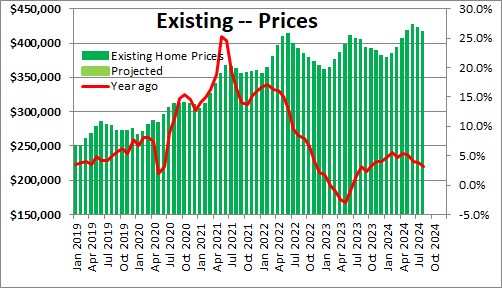

The shortage of homes available for sale is causing prices to rise. However, home prices fell 1.1% in August to $416,700 after declining 1.3% in July. The year-over-year change is now 3.1%.

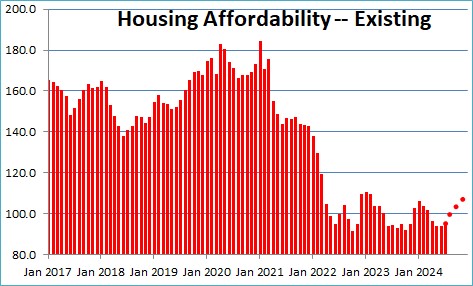

Housing affordability has dropped from where it was at the end of 2021 as home prices have risen sharply and mortgage rates climbed above the 7.0% mark%. Housing affordability is currently at 95.0 which means that potential home buyers have 5.0% less income than required to purchase a median-priced home. Many first time home buyers have been priced out of the market. But if mortgage rates decline further later in the year, job gains boost consumer income, and home prices are fairly steady, housing affordability should climb slightly and the median-income earning family will have about 10% more income than required to purchase a median-priced home by yearend.

.

Given all of the above we expect existing home sales to rise about 5.0% in 2024.

We expect GDP to rise 1.0% in the third quarter of this year followed by 1.7% growth in the fourth quarter. That sounds subdued but a lot of the slowdown is caused by a reduced pace of inventory accumulation. Final sales growth in those two quarters, which excludes the change in business inventories, is projected to be 2.2% and 1.7%, respectively.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me