April 4, 2024

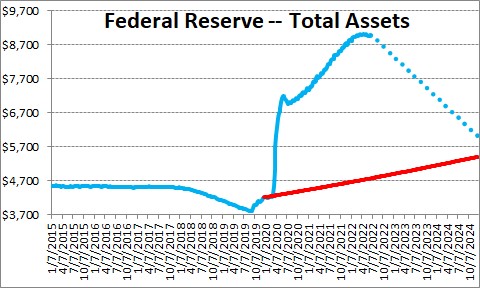

When extreme measures to combat the spread of the corona virus were put into place in mid-March 2020 and the economy fell off a cliff, the Federal government implemented a $3.0 trillion fiscal stimulus package to help stem the slide. At the same time the Fed increased the size of its portfolio by $3.0 trillion to $7.0 trillion. It has continued to buy securities every month through the end of March 2022. Of the $3.0 trillion increase in the Fed’s portfolio in March and April 2020 it purchased roughly $1.6 trillion of U.S. government securities, $0.5 trillion of mortgages, and the remaining $0.9 trillion was in a variety of other types of credit including repurchase agreements, loans to money market mutual funds for liquidity, loans to small businesses (paycheck protection program), loans to medium-sized businesses, and loans to state and local governments.

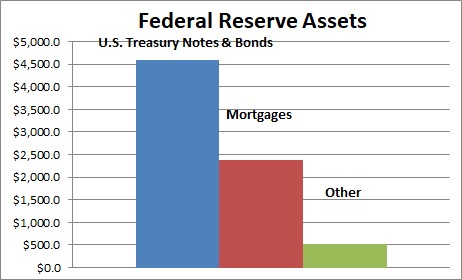

The Fed finally phased out its purchases of securities at the end of March 2022. It has now begin a program to shrink its balance sheet by about $100 billion per month. But at that pace its portfolio its portfolio will be larger than it should be through the end of 2024. That bloated level of Fed assets will make it difficult for the inflation rate to return to the 2.0% mark any time in the foreseeable future. Currently, the composition of the Fed’s portfolio looks like this:

Its holdings of U.S. Treasury securities are 61% of the total, mortgages 32%, and other assets including U.S. agency securities and the paycheck protection program are the remaining 6%.

Stephen Slifer

NumberNomics

Charleston, SC

Hoping you all can email me to feds balance sheet reduction (QT) each time they sale Bonds? Thanks for the great website and charts,

Hi Craig,

Sorry about the tardy response. I have been out of the country on vacation for the past several weeks.

On my website there is a section under the “References” section called “Federal Reserve”. One of the parts of that tracks the Fed’s balance sheet. It shows you what that balance is today (it is declining very slowly). It also shows you the Fed’s balance sheet relative to the target. It will take it another 5 years or so to shrink to where they would like it to be. I only update this about once a month because weekly (and even monthly changes) are so small.

If you want to follow this for yourself go to the Federal Reserve Board’s website, go to the data section, and look for the H.4.1. release entitled “Factors Affecting Bank Reserves.

I hope this is helpful.

Steve Slifer