July 25, 2024

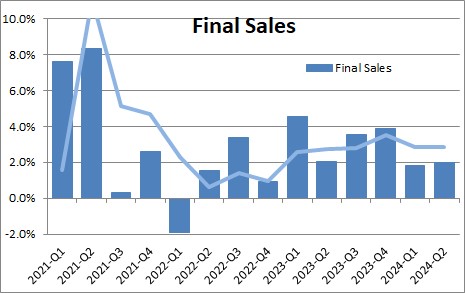

When the economy is slowing down, firms will accumulate unwanted inventories. Those inventories still show up in GDP, but they are unsold. Hence, GDP will be biased upwards. Similarly, in good times businesses will reduce inventory levels to satisfy demand. In this case, GDP growth will be understated.

To get a sense of the underlying pace of sales, economists will look at final sales which is GDP less the change in business inventories. Final sales rose 2.0% in the second quarter Given an increase in GDP of 2.8% and a 2.0% increase in final sales, the change in inventories added 0.8% to GDP growth in the second quarter.

Stephen Slifer

NumberNomics

Charleston, SC

Dr. Slifer –

I’m surprised that you view the stock market decline so benignly, (whether due to the Coronavirus or not) given that the Dow as of today is approaching a 20% decline from the peak. Given the relative overvaluation of the market going into this, the high level of margin debt supporting the market, the severe decline recently in the price of oil, and the likelihood that the market decline is not over, it seems there has been a massive amount of wealth destruction this week that will have major impacts going forward on the optimistic statistics you provide regarding past economic performance. A recession in the near future seems possible, and perhaps likely, which will surely have a major negative impact on many of the performance indicators. From my perspective I am unable to see this as “temporary”.

Hi Frank,

As always, I appreciate you taking the time to send me your comments. First of all, I hope you have seen what I wrote today on this topic. I have spent this week finding data on the corona virus as well as the other virus strains that are floating round out there. As you can read in this week’s commentary I believe that the number of active cases is declining which means that 25% fewer people are now able to spread the disease than there were in mid-February. Further, given the total number of cases of influenza this year roughly in line what it was in the 2018-2019 I think we are seeing a flu season that is relatively normal. The CDC did not declare the 2019-2019 flu season as a pandemic. In fact the CDC characterized it as mild. Furthermore, nobody ever talked about the flu as having any influence on GDP growth last year. The CDC’s declaration that this year we are seeing a pandemic was both unwarranted and ill-advised. It and the mainstream media have generated fear unlike anything we have seen in more than a decade. And, as you have noted, it has hit all of the various stock market indices, the bond market, and commodities. But the hard data through February continues to track well.

I am well aware that I am an outlier, but I guess I simply to not see any data to suggest that the U.S. economy is about to swoon. Global growth yes, but nothing that looks troublesome yet from the U.S. The markets are looking for several rate cuts by the Fed by midyear. I think they are unnecessary. Rates are not too high. They will do little to counter the impact from a flu virus. And the Fed is using up previous rate cut ammunition it may need when the economy really hits the skids at some point down the road. Furthermore, this whole situation could prove to be transitory. Having said all that this group at the Fed seems inclined to cut rates at the first sign of trouble so I cannot rule out a rate cut in mid-March. They claim to be “data dependent” in making their rate decisions. If that is the case, they should hold their fire. I guess we will see.

Steve