February 1, 2019

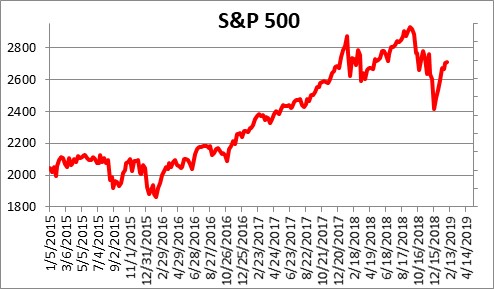

The stock market’s decline in the fourth quarter suggested that the economy was on the cusp of slipping into recession. As we turn the corner into a new year it is evident that many of those fears were exaggerated. We now know that employers ignored both the partial government shutdown and stock market turmoil and added 304 thousand jobs in January. The Fed has made it abundantly clear that it is on hold for the foreseeable future and will have to be persuaded to raise rates again. Manufacturing firms experienced an impressive rebound in orders and production in January. Thus, recent indicators provide reassurance that the economy is chugging along in the first quarter at a pace roughly comparable to other recent quarters.

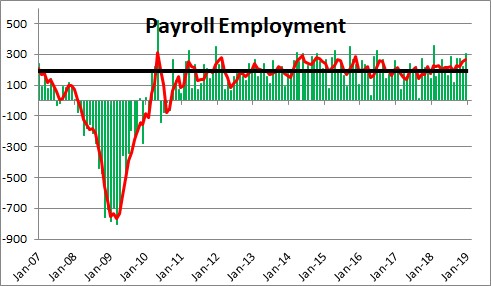

Two things are fascinating about the 304 thousand increase in employment in January. First, the partial federal government shutdown had no impact on hiring. Second, the jobs market seems to be strengthening. The economy cranked out 183 thousand jobs monthly in 2017, followed by 220 thousand per month in 2018, and 266 thousand in the most recent 3-month period. Perhaps the labor market is not nearly as tight as what most economists believe.

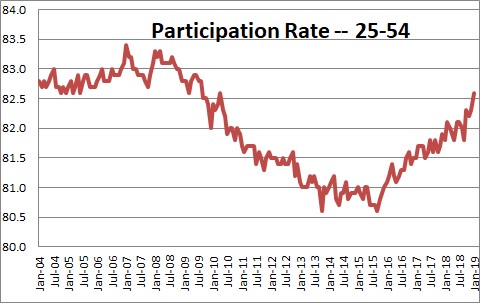

Where are all these workers coming from? The participation rate (which measures the share of the population that is working or looking for a job) was supposed to decline as the baby boomers retired. Instead, it has been on the rise. Prime age workers who had been on the sidelines have become encouraged by the clear economic strength in recent years and are now not only looking for jobs they are finding them.

Following the December FOMC meeting the Fed raised the funds rate one-quarter point to a range of 2.25-2.5%. Fed Chair Powell indicated at that time that while the Fed may keep rates steady for a while, he expected two additional rate hikes in 2019. However, this past week he said that the Fed will sit tight for some time and will need to be persuaded to raise rates beyond their current level. That is a distinctly different tone.

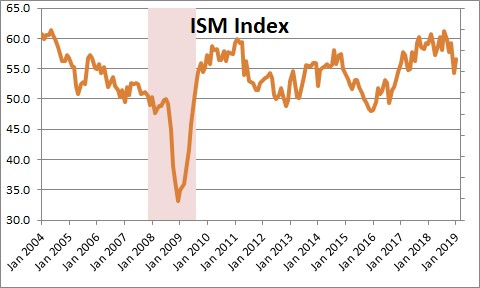

The Institute for Supply Management reported that its index for conditions in the manufacturing sector of the economy rose 2.3 points in January to 56.6. The increase was led by the two most forward-looking components – orders and production – which registered gains of roughly seven points. The overall series remains below levels attained late last summer. However, the current level of the index is consistent with 4.0% GDP growth. While no one anticipates 4.0% GDP growth this year, this index certainly seems to throw cold water on the notion that the pace of economic activity is succumbing to stock market gyrations, slower growth in China, tariffs, or rising inflation.

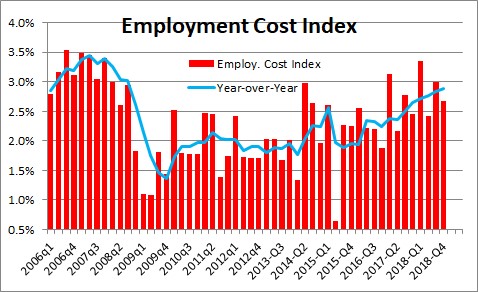

On the inflation front the employment cost index rose 2.7% in the fourth quarter and 2.9% for 2018. Clearly, the seemingly tight labor market is forcing employers to pay up to attract the workers they need. That means that workers are receiving fatter paychecks and that is a good thing. At the same time some worry that rising labor costs will push the inflation rate upwards.

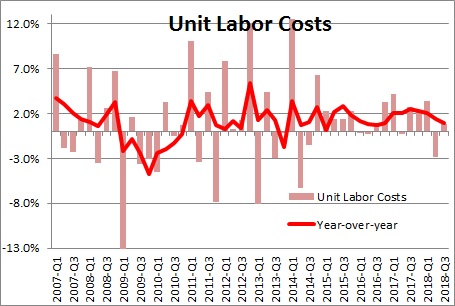

But thus far, there is no evidence that is happening because productivity growth is countering the increased labor costs. Unit labor costs, which measures labor costs adjusted for the increase in productivity, have risen just 0.9% in the past year – a 2.2% increase in compensation partially offset by 1.3% growth in productivity. The Fed has a 2.0% inflation target. If unit labor costs are rising by 0.9%, it is quite clear that the tight labor market is not putting upward pressure on the inflation rate.

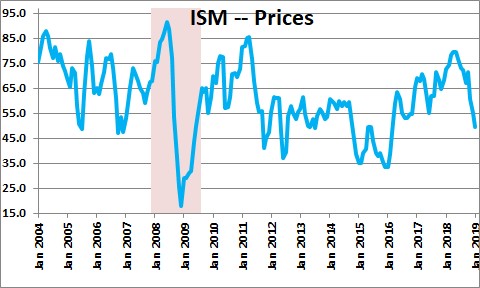

It is also worth noting that the ISM price component for January fell 5.3 points to 49.6 after having declined 5.8 points in December. That is the lowest reading for the price component since February 2016 and suggests that the PPI for January will register a decline. Clearly, there is no hint that the inflation rate is on the verge of accelerating any time soon.

All these tidbits of information are restoring the faith of stock market investors. The S&P 500 index has recovered about 60% of what it lost during the fourth quarter and now stands just 7.5% below its previous peak level.

The stock market’s slide late last year was unnerving and suggested to many investors as well as economists that an economic downturn was likely by the end of this year. Our sense was that the economic fundamentals remained solid and that the selloff was nothing more than exaggerated stock market noise. We are breathing a sigh of relief that, perhaps, we are on the right track.

Stephen Slifer

NumberNomics

Charleston, S.C.

Hello STeve,

you were right in your conference in December. I thought so and have always followed your guidance. good going. hope you and Mary are doing well. I have a note in my file to get you both out to the lighthouse some time this spring so she can take some photos. why don’t you sign up for our annual gala on March 21 over at Folly Beach. I know that is a drive but we really have a great function and have a good time. I will be sure to send you an email about it. will be in touch.

have good Feb, me? I am gone south for a week. KW