June 13, 2023

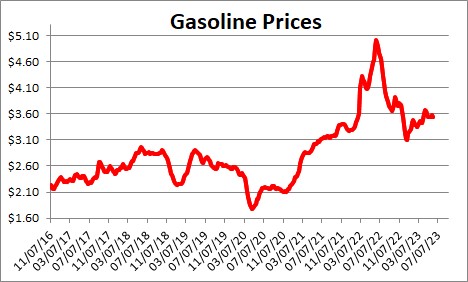

Gasoline prices fell $0.03 in the week ending June 5 to $3.54 after having risen $0.04 in the previous week. In South Carolina gasoline prices tend to be about $0.25 below the national average or $3.29. The EIA currently expects gasoline prices nationally to average $3.39 this year so expect gasoline prices to be largely unchanged for the rest of this year.

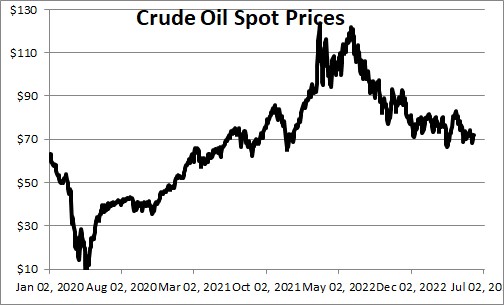

Crude prices were unchanged in the week ending June 5 at $72 per barrel. The EPA expects WTI prices to average $77.10 in 2023 so prices are likely to rise somewhat in the months ahead.

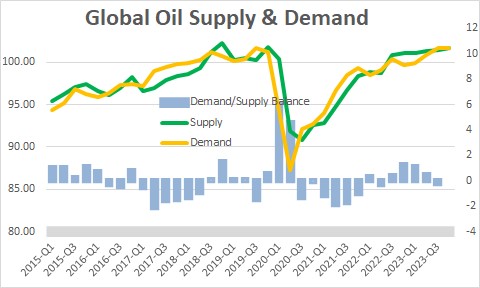

Both U.S. and OPEC supply and demand have been increasing and are expected be roughly in balance between now and the end of this year. .

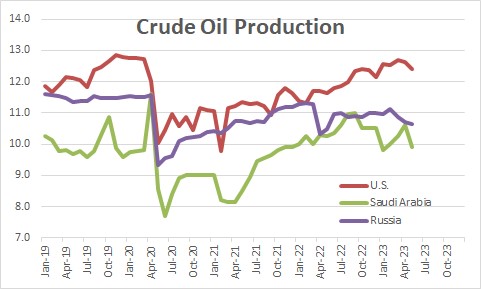

Since the war between Ukraine and Russia began, sanctions initially reduced the output of Russian by about 1 million barrels per day but Russian output has regained about one-half of that amount. Saudi Arabia has picked up the pace of production somewhat since the recessioon and production is now about the same as what it was prior to the recession. U.S. production, as noted below, has quickened but still remains about 1.0 million barrels of oil per day less that what was being produced prior to the recession.

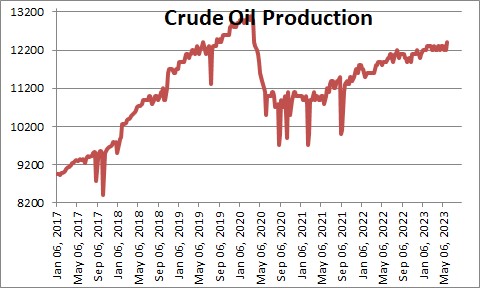

The 2020 recession caused oil production in the U.S. to decline from about 13.0 million barrels per day to about 11.0 million. Production has rebounded but to only 12.3 million barrels per day which is well below its pre-recession peak. One of the problems is that the current administration is doing everything in its power to drive the fossil-fuel industry out of business which is curtailing the willingness and ability of oil producers to significantly boost production. The EIA currently expects production to be 12.6 million barrels per day at the end of 2023 which means tht the pace of production will pick up in the second half of the year.

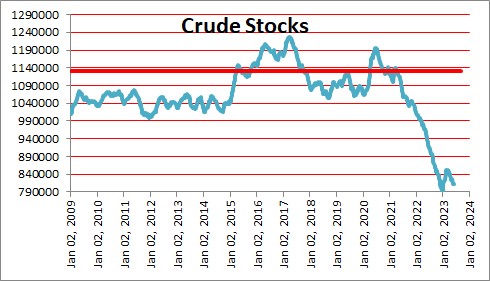

In the U.S. inventory levels fell sharply in every month last year as the U.S. dipped into its Strategic Petroleum Reserves in an effort to drive down the price of both crude oil and gasoline. They have been successful, but the drawdown has slowed considerably since the end of last year. Without additional supply from the SPR either domestic production needs to increase or imports need to rise to satisfy the demand. That certainly seems likely to push crude and oil prices higher towards the EPA’s expectation for crude prices to average $77.10 in 2022 (vs. $72.00 currently).

.

.

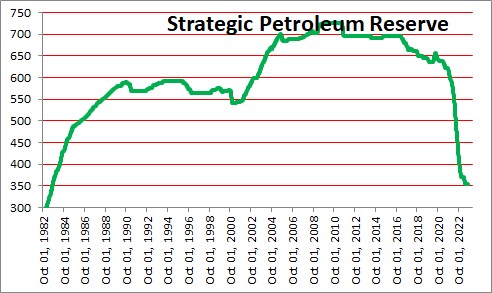

At 352 million barrels the SPR is now at its lowest level since 1984. The SPR was established in 1975 following the 1973 Arab oil embargo. The law was designed to provide a cushion in the event of severe energy disruptions. It started last year at 638 million barrels and has now been cut by 40%, With domestic production having been cut from 13.0 million barrels per day prior to the recession to 12.3 million barrels per day we wonder if the recent decline in the SPR provides an adequate cushion in the event hostilities break out somewhere in the world.

Stephen Slifer

NumberNomics

Charleston, SC

Steve, I am loving the low gas prices. Car dealers are too I would assume.

…Darrel

Stephen, I find it fascinating that the costs for oil fracking have been reduced almost in half and you predict costs will soon be even lower. If OPEC does not change course, gas prices could remain low for quite some time into the future. On the other hand, if OPEC does reduce its oil flow, other sources will increase and the results could mean continued lower prices at the pump. Fascinating. Darrel

Hi again,

I have been trying to tell people that oil prices are going to be lower permanently for the reasons you just outlined. All those wells that have been closed since October 2014 are, in my mind, acting just like oil storage facilities. They can be reopened with very little cost as needed. We used to think of oil as trading between like $80-110 per barrel. The range today will still be wide, but I would take a crack that the new range should be something like $30-60. We have de-fanged OPEC. Unfortunately, what I don’t know is how they will choose to respond. These lower oil prices are hurting every OPEC and non-OPEC oil producer — including the Saudi’s. I think their game is to push prices low enough to drive the frackers out of business. But thus far technology has improved so quickly that the frackers cost of production has fallen by about 40% or so in the past year. And I see no reason to think that the technological advancements are necessarily going to stop now. Certainly is fun trying to figure all this out!

Steve

Steve- I think we all love low gas prices, but I find one thing interesting. If I drive from Wadmalaw to IOP I will pass 20+ gas stations and there is maybe a 10 cent difference between the lowest and highest price for Regular, but those same 20 stations might have a 30+ cent difference for diesel. They must all pay about the same price at wholesale; do they just not feel they have to be competitive for other fuels besides Regular gas? As a diesel user I really have to shop around. John’s Island is usually the cheapest, by the way.

Good morning Johnny,

Thanks for your comment. Being a gas user as opposed to diesel I only pay peripheral attention to diesel prices. I have noted that they seen really high for a product that is not refined as vigorously as gas prices. Your point strikes me as being entirely reasonable — less competition. When you get out on I-26 or I-95 and see those big truck stops like Love and some of the others, how are diesel prices there? More competitive? Diesel prices obviously matter to the trucking community.

I do not pretend to be a great oil and gas expert. My primary concern is are those prices going up or down, and how quickly. And how quickly will that boost or lower the inflation rate. I do believe that the fracking and horizontal drilling here in the U.S. has changed the entire ball game. The days of $100 oil are over. My guess would peak that peak crude prices today are about $60. Anything higher than that will stimulate oil drillers here in the U.S. who will quickly fill in the production shortfall.

Thanks for your comment.

Steve