August 29, 2024

.

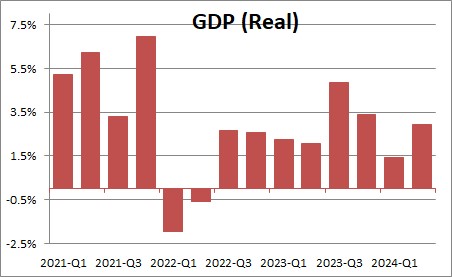

The .preliminary estimate of second quarter GDP growth was 3.0% compared to the advance reading of 2.8% and GDP growth of 1.4% in the first quarter. An upward revision to growth in personal consumption expenditures was partially offset by small downward revisions in other categories.

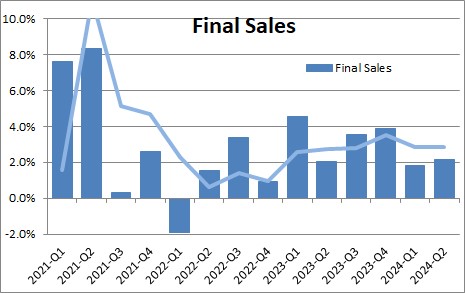

Final sales, which is GDP excluding the change in business inventories, rose 2.2% in the second quarter Given an increase in GDP of 3.0% and a 2.2% increase in final sales, the change in inventories added 0.8% to GDP growth in the first quarter.

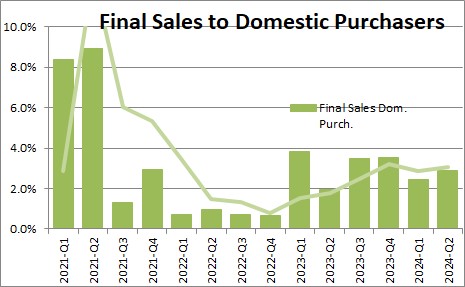

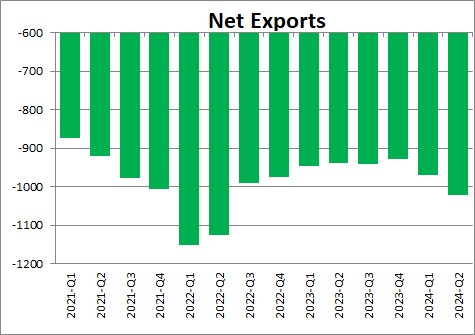

Final sales to domestic purchasers which excludes both the change in inventories and trade rose 2.9% in the second quarter. With a 2.2% increase in final sales and a 2.9% increase in final sales to domestic purchasers, the trade component subtracted 0.7% from GDP growth in the second quarter as exports rose 1.6% and imports rose 7.0%.

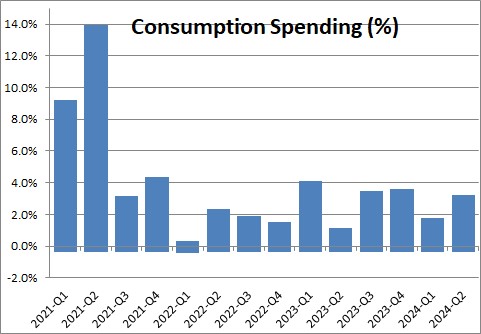

Consumption spending gained 2.9% in the second quarter (compared to an earlier reading of 2.3%) after having climbed 1.5% in the first quarter. . Consumers continue to shrug off higher inflation and higher interest rates but they are relying on their credit cards to make that happen. That is not a sustainable solution which suggests that slower spending lies ahead. Spending on goods rose 3.0% in the second quarter while spending on services climbed by 2.8%.

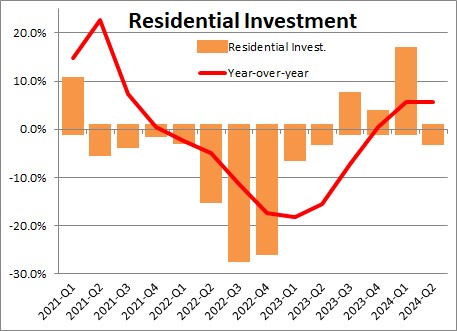

Residential investment fell 2.0%% in the second quarter(versus a decline of 1.4% earlier) after having jumped 16.0% in the first quarter. Builders clearly ramped production in the first quarter as mortgage rates quickly fell from nearly 7.5% to 6.8%. Rates have since declined to 6.5% but that was a third quarter development. Apparently potential buyers are waiting for a further decline in interest rates before stepping back into the housing market.

The foreign sector as measured by the deficit for real net exports widened by $49.9 billion in the second quarter to $1010.2 billion after having widened by $41.7 billion in the first quarter. Exports rose 1.6% in the first quarter while imports climbed by 7.0%.

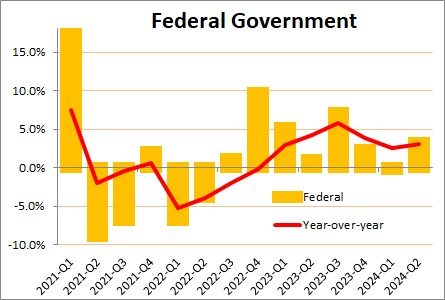

.Federal government spending frose 3.2% in the second quarter after having fallen 0.2% in the first quarter. Defense spending rose 4.9% while nondefense spending gained 1.2%.

After having risen 3.0% in the second quarter we expect growth to slow to 0.9% in the third quarter and 1.6% in the fourth quarter.. The economy keeps cranking out jobs and wages keep rising which will allow consumer income and spending to grow a slow pace in the second half of the year.

Stephen Slifer

NumberNomics

Charleston, SC

Mr. Slifer –

The fed in last 3 months since the September spike has injected approximately $60 billion/month into the “repo” market, and plans to potentially add as much as another half trillion by mid January, according to reports in the Financial Times. Mr. Powell rejected comparisons of this with earlier Quantitative Easing, insisting it was different. Since the repo market is for overnight or short term loans, one assumes these massive amounts will be repaid promptly, though there has been no mention of that in the papers. Such massive amounts of money would seem to contribute to the bullish equity markets we’re seeing. Can you educate me as to how these injections of credit influence the market, GDP, etc?

Hi Frank,

Thanks for your comment and sorry for the delayed response. Your question is not an easy one to answer so rather than a lengthy explanation here I will respond to your personal e-mail address. Thanks for your question. it is a good one.

Steve

Steve –

The second graph in this section, “Final Sales”, has the x-axis mislabeled in regard

to the applicable dates.

Hi Frank. Merry Christmas. You are right. The data shown are for the dates I wanted, but somehow the x-axis was messed up. I changed it in the original. Thanks for the catch.

Steve