July 29, 2011

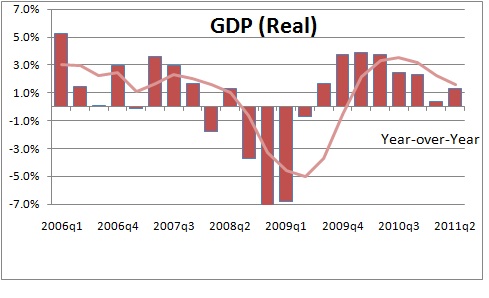

In July of every year the Bureau of Economic Analysis publishes its annual revision to the GDP data which changes history going back five years, in this case to 2007. The revision incorporates some data that were previously unavailable. The BEA also revises their seasonal adjustment factors which will not affect the growth rate for the year, but will reallocate growth from one quarter to the next. We not only got our first look at second quarter GDP growth this morning, but we also learned that the recession was a lot deeper than we had thought previously.

First, with respect to history, the growth rate for 2008 did not change much, but in 2009 we now know that GDP fell by 3.5% in that year versus the 1.9% decline that had been reported previously. That is a big downward revision and, while interesting, it tells us nothing about what is going on currently in the economy, or what is likely to happen in the future.

Data for the first two quarters of this year continued in that weaker-than-expected mode. Previously we thought that GDP growth in the first quarter rose by 1.9%. Now BEA says that growth in that quarter was just 0.4%. That is a huge downward revision! However, it is not quite as dramatic a revision as it appears on the surface because 1.0% of it was attributable to a revision to business inventories. Typically, when inventories come in weaker than expected in one quarter, they rebound in subsequent quarters. Thus, growth gets shifted from one quarter to another, but the trend rate does not change much.

Looking through all these inventory gyrations we find that when everything is said and done, final sales in the first quarter were unchanged (previously we thought they rose 0.6%). Any way you slice it the first quarter performance for the economy was pathetic. But we also know that during that quarter gasoline prices were rising rapidly which not only affected our confidence, but also negatively impacted our ability to spend on other goods and services.

Then, turning to the second quarter, we now learn that GDP rose 1.3%. Most economists had been anticipating a growth rate of 1.8-2.0% in that quarter. Once again the pace of economic activity was worse than what had been expected. That weakness was concentrated in consumer spending which rose just 0.1% in the second quarter. But before jumping to any conclusions about the underlying weakness in economic activity in general and consumer spending in particular, it is important to recognize that spending on motor vehicles and parts fell at a 16.9% pace in the second quarter because automobile manufacturers and dealers in this country could not get the necessary vehicles and parts that they needed from Japan following the tsunami. Between March and April motor vehicle production in Japan fell 60% so it is not too surprising that this had a fairly significant negative impact on growth here in the U.S.

As a result of all this, it is clear that the pace of economic activity slowed sharply in the first half of the year. These data are still hot off the press and we have obviously not had time to digest them thoroughly. But our sense is that GDP growth in the first half of the year was reduced by 1.0-1.5% by the combination of higher gasoline prices and an inability to get parts from Japan. So if we actually saw GDP growth in the first half of the year of 1.0%, we might have had growth of 2.0-2.5% in the absence of these special factors. That is still not stellar growth, but it is at least acceptable.

If this analysis is correct, the trend rate of GDP in the first half of the year would have been 2.0-2.5%. So that should probably be our starting point for growth in the third quarter. We also know that motor vehicle production in Japan rebounded sharply in May and that automobile output in Japan will be back to normal by August. That means that the headwind created by an inability to get parts in the second quarter should be completely reversed in the third and fourth quarters. The initial headwind will become a tailwind.

Similarly, we have seen at least a partial reversal of the earlier runup in gasoline prices. So if consumers had less money to spend on goods and services other than gasoline in the first half of the year, they will get some of that back in the second half. Once again, a headwind will become at least a partial tailwind in the next couple of quarters.

Putting together a trend rate of growth of 2.0-2.5% with a tailwind of 1.0-1.5% should produce GDP growth of 3.5% or so in the third quarter. Clearly, we need more time to dig a bit deeper into the data, but the basic idea remains – the economy should gather considerable momentum in the second half of the year.

We fully expect the Congress and President Obama to strike some sort of a budget compromise and raise the debt ceiling prior to the August 2 deadline. If that does not happen, then everything that we just talked about above will have to be revised – downwards. This is a major high stakes game that is being played in Washington and certainly both sides want to get the best possible deal that they can. But to play chicken with the debt ceiling is both counterproductive and outright dangerous. We believe that all of our policy makers in Washington understand the consequences of inaction and, in the end, will do what is in the best interest of the country – cut the budget deficit by a significant amount, and raise the debt ceiling.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me