July 25, 2024

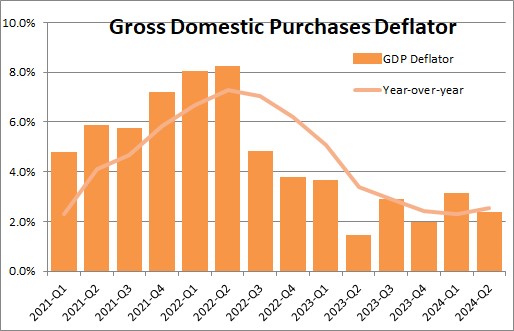

There are many different deflators that are available. This one is for gross domestic purchases which measures prices paid by U.S. residents. It is the one measure of inflation that the Commerce Department talks about when it releases the GDP report. It is our broadest measure of inflation and contains more than 5,000 goods and services.

The gross domestic purchases deflator rose 2.3% in the second quarter after climbing 3.1% in the first quarter. During the past year this measure of inflation has risen 2.5%.

Excluding the volatile food and energy components this index climbed by 2.5% in the second quarter after rising 3.3% in the first quarter. In the past year it has risen 2.6%.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me