January 27, 2023

GDP expanded at a 3.2% growth rate in the third quarter and a solid 2.9% pace in the fourth quarter. But those results are history. They tell us nothing about what is happening currently. We know that economic activity plunged in December — retail sales sank 1.1%, industrial production fell 0.7%, and the PPI measure of inflation plunged by 0.5%. Those declines were all unexpectedly large and fueled the notion that has been building for the past several months. That is, the economy may have finally entered a mild recession, and inflation has begun a rapid descent. If that is true, the Fed should be cutting rates by the end of the year. That is a fascinating narrative, but it may not be right. We are not ready to buy into the recession scenario for a variety of reasons. First, December sales could have been soft simply because consumers had already done the bulk of their holiday shopping. In that case, the December drop in sales may not be the beginning a new soft-spending trend. Second, Fed policy is still not tight with the funds rate below the rate of inflation. Third, the economy continues to create jobs with no hint that they are about to slow down. And fourth, interest rates across the board have fallen rapidly in recent months. Since November 7, the 2-year note yield has fallen 0.5%, the 10-year has declined 0.7%, and the 30-year mortgage rate has dropped by 0.9%. These rate declines could boost GDP growth in the first half of this year, and re-ignite inflation. The economy may have hit the pause button in December, but these factors could make that a short-lived phenomenon.

First, December is part of the 3-month holiday shopping season and the pattern of consumer spending is never predictable. Consumers may spend early, in which case December sales could be a bust. Or they get off to a slow start but come on strong in December. You never know. Soggy spending in December may simply reflect a bad ending to the three-month holiday shopping season. Furthermore, weak sales in December do not necessarily mean that January and February sales will follow suit.

Second, it is hard to believe that the economy is on the cusp of a recession when the real funds rate remains negative. Fed policy is simply not tight. The funds rate today is 4.5% but the year-over-year increase in the core CPI is 5.7%. Thus, the real funds rate is negative by 1.2%. The Fed has told us repeatedly that it wants the funds rate higher than the inflation rate.

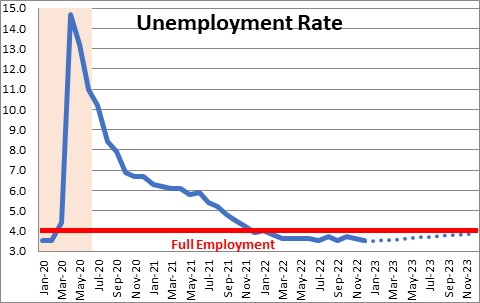

Third, the Fed has also said it wants the unemployment rate to climb to about 4.5% to take the pressure off wages. But yet the unemployment rate today stands at a 50-year low of 3.5%, and judging by the weekly initial claims data jobs continued to grow at a 200 thousand pace or so in January which will leave the unemployment rate essentially unchanged. These data do not seem even remotely close to a recession scenario.

Finally, we are well aware of the rate declines that have occurred in recent months. The Fed keeps raising the federal funds rate and attempting to tighten financial market conditions, but the markets are having none of that. They see some combination of a soft landing or recession, a rapid decline in the inflation rate, little if any additional Fed tightening, and lower rates by yearend. But the rate declines in recent months are nothing short of remarkable, particularly so given that the Fed is still raising the federal funds rate. In the past three months the federal funds rate has risen by 1.25% from 3.25% to 4.5%. But the yield on the 2-year note has fallen 0.5% from 4.7% to 4.2%, the 10-year has declined by 0.7% from 4.2% to 3.5%, and the 30-year mortgage rate has dropped 0.9% from 7.0% to 6.1%.

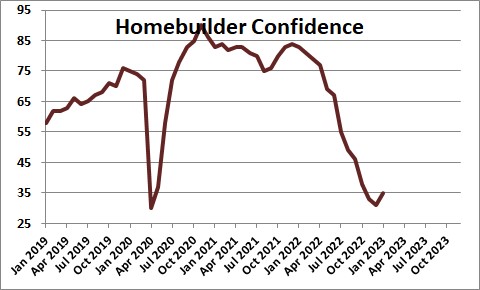

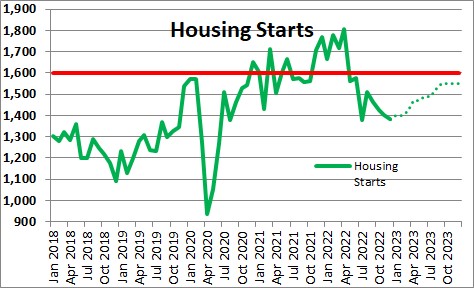

We are already beginning to see signs that the significant declines in home prices and mortgage rates are beginning to work their magic. For example, the homebuilder confidence index rose four points in January to 35. This is the first increase in this series since December 2021. It fell every single month throughout 2022. This means that housing starts and building permits could begin to climb as soon as January.

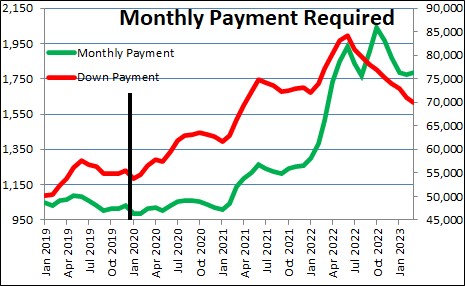

Lower mortgage rates and home prices mean that housing affordability will increase in the months ahead which in turn means that home sales will also soon turn upwards.

To look at the same data in slightly different fashion, by March the down payment on a median-priced home will have fallen from a peak of $84,000 in the middle of last year to $70,000. The monthly payment will have dropped from a peak of $2,000 to $1,788. These declines will make home ownership a far more viable option for many lower-income households.

Consumer sentiment has also turned upwards. It rose 8.1 points in December and January combined to 64.9. If consumers believe that current economic conditions have improved considerably and expectations have risen by a lesser amount, it is likely that their willingness to spend has also climbed.

We can understand how some market participants have looked at the surprisingly soft December data and jumped to the conclusion that the long-awaited recession may finally be underway. But, ironically, the furious rally in the fixed income markets has lowered interest rates enough to actually ensure that a recession does not happen – at least right now.

We believe that the 2023 scenario will result in a moderate pickup in growth in the first few months of the year which will cause the Fed to keep pushing interest rates higher. The real funds rate will finally turn positive in the spring. That will eventually generate enough bite that the economy falls into recession in the first quarter of 2024. A recession is still in the offing, but it may be a year away.

Stephen Slifer

NumberNomics

Charleston, S.C.

funds are short term money, and 3M inflation is around 3.5%. I would agree about the seasonality on sales, except hiring has slowed and real disposable income ex transfers rose at 2% SAAR in Q4 vs 4% in Q3. Add in the weak equity market, save for the last six weeks or so of the year, and it is easy to see slower spending as a function of something other than seasonality and bad weather. I am still looking for recession to begin in Q2, but right now a small negative for Q1 real GDP Q/Q is looking more likely than not

I guess for now I am looking for slowing not stalling but the stall part seems inevitable at some point.