May 12, 2023

Once again our leaders in Washington are playing a dangerous game of chicken with debt limit legislation. Thus far the markets are largely ignoring the issue, and for good reason. Congress has acted on 78 separate occasions since 1960 to raise the debt limit. It has become an annual ritual During that time the Treasury has never defaulted although it has come dangerously close on several occasions. However, concern about a possible default caused Standard and Poor’s to downgrade the credit rating of Treasury debt from AAA to AA+ in August 2011 and the deficit/debt problem has only gotten worse in the interim. But it is important to recognize that this recurring problem is self-imposed. Congress votes every year on the amount of new spending which results in a projected budget deficit. In order to finance that deficit the Treasury must issue an equivalent amount of debt. Subsequently, Congress votes on a separate bill that authorizes the Treasury to issue the debt required to finance the previously agreed upon level of spending. The debt limit is not about new spending. It is about paying for spending choices that policymakers have previously approved. This makes absolutely no sense. In our opinion, the debt ceiling should be abolished. Nobody knows exactly what would happen if the Treasury did default, but the scenarios range from bad to catastrophic.

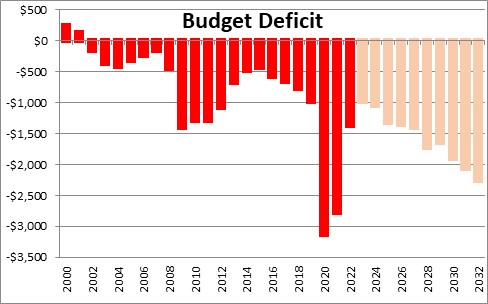

Every year Congress must determine how much money each government agency is authorized to spend. Combining that information with estimated tax revenues results in a projected budget deficit for that year. If the end result is, say, a projected $1 trillion budget deficit, the U.S. Treasury will have to issue $1.0 trillion of debt to pay its bills. The debt ceiling legislation authorizes Treasury to issue the required $1.0 trillion of debt. The legislation was designed to limit the amount of government spending. But that has not worked. Budget deficits continue to climb and now routinely exceed $1.0 trillion with $2.0 trillion deficits becoming far more common.

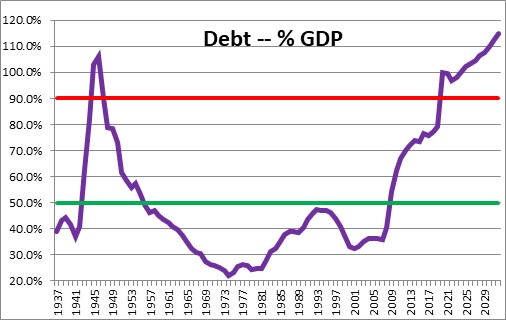

As the annual deficits accumulate, debt in relation to GDP has climbed to and will soon exceed its post-World War II record. Debt ceiling legislation has not in any way curtailed government spending. The process is similar to consumers taking out a new car loan or running up their credit card bills, but then refusing to pay the debt. If you cannot afford the payments, don’t spend the money. Get rid of the debt ceiling! It makes no sense. To highlight its uselessness, only one other advanced country in the world – Denmark – has a separate debt bill and it is not used a political football.

The current debt limit is $31.4 trillion. The Treasury reached that limit on January 19. But the Treasury can take well-established “extraordinary measures” — i.e., account gimmicks — to borrow additional funds without breaching the debt ceiling. Treasury Secretary Yellen has indicated that the likely date that the Treasury would run out of wiggle room could come as early as June 1. But that depends on tax receipts. If the Treasury can get to the June 15 tax date, the Treasury can perhaps make it until the Social Security payment date in mid-July. The problem is coming and Congress needs to do something soon.

The consequences of the Treasury running out of money to pay its bills would lead the Treasury to default on the government’s debt obligations or delay payments on a host of other activities – payments to Social Security beneficiaries, Medicare providers, veterans benefits, welfare payments, military pay, government contractors, tax refunds. People count on those payments to pay their mortgage or rent, make car payments, pay their utility bills, and buy food. The law is unclear about which claims are senior and who makes that determination. The courts would ultimately have to make that decision and that process will take time.

In 2013 the Federal Reserve simulated the effects of a binding debt ceiling that lasted a month. It estimated the impasse would lead to two-quarter recession, a 1.25 percentage point increase in the unemployment rate, an 80 basis point increase in the 10-year Treasury yield, a 30% decline in stock prices, and a 10% drop in the value of the dollar as well as a hit to both household and business confidence that continued for a 2-year period.

We suspect that ultimately something will happen to prevent this catastrophic scenario from unfolding. But we don’t know exactly what that might look like. A temporary increase in the debt ceiling to last through the November 2024 election? A temporary suspension of the debt ceiling? But that does not mean that economic damage will not occur even if the debt ceiling is lifted. One or more of the credit agencies could downgrade the Treasury’s rating which would further increase the interest cost for the Treasury which would, of course, increase the already large projected budget deficits.

Ladies and gentlemen in Congress, do the right thing for your country. Raise the debt limit quickly or, better yet, eliminate this useless piece of legislation. Return your focus to the myriad problems that truly deserve your attention.

Stephen Slifer

NumberNomics

Charleston, S.C,

Well said Steve!

Stephen, I wholehearted agree with your commentary.