May 15, 2025

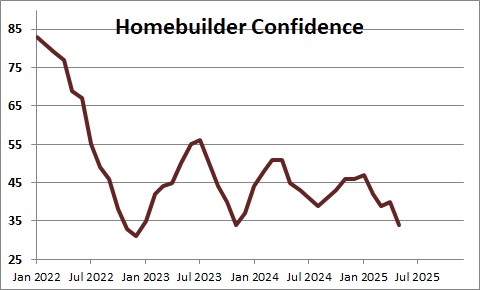

Homebuilder confidence dropped 6 points in May to 34 after having risen 1 point in April. Builders are worried about the imposition of tariffs, still high mortgage rates, and the cost of materials. Keep in mind that the breakeven point for this series is 50 so at 34 it is clear that builders are still being very cautious.

NAHB Chairman Buddy Hughes, a home builder and developer from Lexington N.C. said, “The spring home buying season has gotten off to a slow start as persistent elevated interest rates, policy uncertainty and building material cost factors hurt builder sentiment in May. However, the overwhelming majority of survey responses came before the tariff reduction announcement with China. Builders expect future trade negotiations and progress on tax policy will help stabilize the economic outlook and strengthen housing demand.”

Chief Economist Robert Dietz said, “Policy uncertainty stemming in large part from the stop-and-start tariff issues has hurt builder confidence but the initial trade arrangements with the United Kingdom and China are a welcome development. Still, the overall actions on tariffs in recent weeks have had a negative impact on builders, as 78% reported difficulties pricing their homes recently due to uncertainty around material prices.”

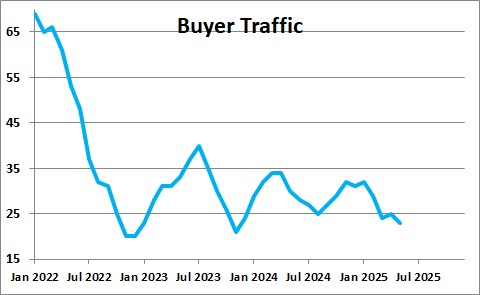

Traffic through the model homes declined 0.2 points in May to 23 after having risen point in April. Traffic through model homes remains low as still high mortgage rates are reducing the number of interested buyers and some buyers may be re-thinking their purchase intentions given the economic uncertainty that exists today with respect to tariffs in particular and their potential impact on inflation.

.

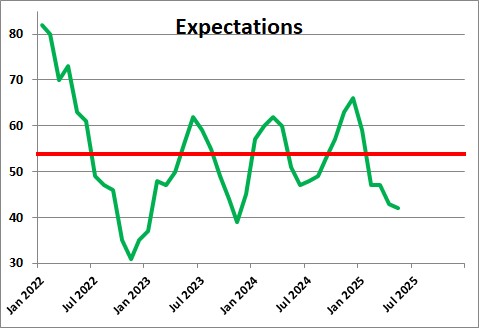

The homebuilders expectations index fell 1 point in May to 42 after having dropped 4 points in April. The declines in recent months reflect builders concerns about both their cost of materials given the tariffs and the willingness of their potential buyers to buy given the uncertainty that exists today.

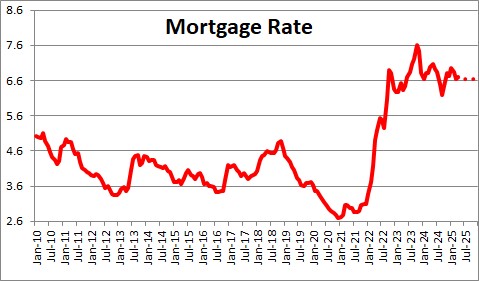

Mortgage rates have recently declined to the 6.7% mark which is slightly lower than it has been in other recent months. We expect mortgage rates to inch lower to 6.5% by the end of the year.

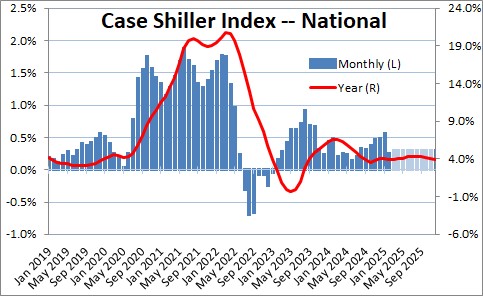

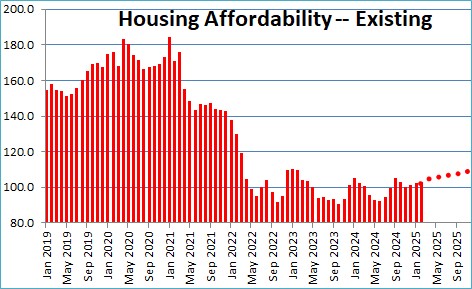

An acute shortage of homes available for sale has caused prices to climb slowly in recent months. Anemic demand should push prices lower as the year progresses. But the shortfall of homes available for sale will prevent prices from falling very much. We expect little change in prices for the remaining 8 months of this year.

If home prices are relatively steady, the economy continues to crank out jobs, wages rise, and mortgage rates gradually decline to the 6.5% mark, housing affordability should increase by the end of this year.

Following a 0.3% decline in the first quarter we expect GDP growth to be 2.5% in the second quarter and 1.9% in 2025.

Stephen Slifer

NumberNomics

Charleston, SC

Good afternoon Steve. How are multiple unit structures or congregant living structures counted in “housing starts?” Thank you.

Hi Sidney.

I can only answer your question about multiple unit structures. The Census Bureau publishes data for housing starts overall and breaks that down into single-family and multi-family units. I do not know how they count congregant living structures by which I guess you refer to old-age facilities, nursing homes, assisted living facilities, and shelters. However, someone in the group that produces the housing starts data can undoubtedly help. 301‐763‐5160