May 17, 2023

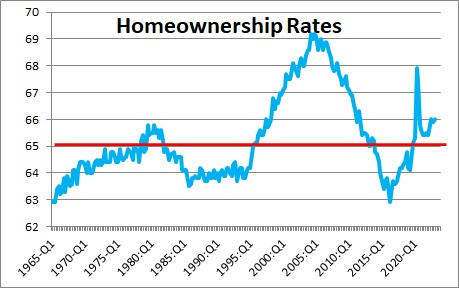

Home ownership rose 0.1% in the first quarter to 66.0 after having declined 0.1% in the fourth quarter. Homeownership had been rising gradually for several years before the pandemic hit. It jumped 2.6% in the second quarter of 2020 to 67.9, but has fallen back to a more normal level since but the earlier trend towards rising home ownership seems intact.

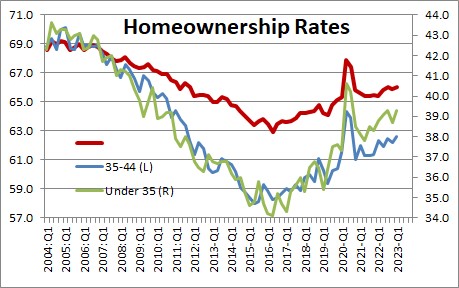

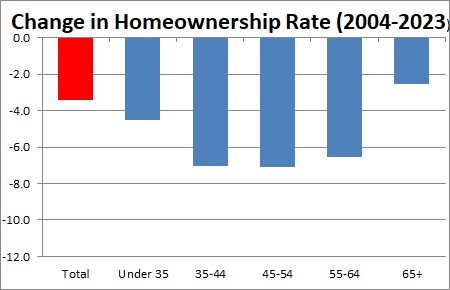

Prior to the pandemic the upswing in home ownership in the previous couple of years was most pronounced amongst younger borrowers, i.e. those under age 45. That is where most of the earlier decline occurred. Following distortions created by the pandemic it appears that these younger people are now getting somewhat older and raising families. As this occurs, they find home ownership increasingly attractive. Thus, demographics now seems to be working in favor of a steady rebound in housing in the years ahead.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me