November 18, 2022

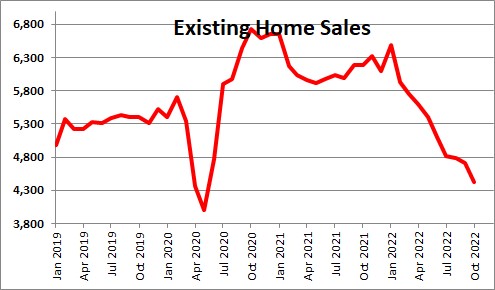

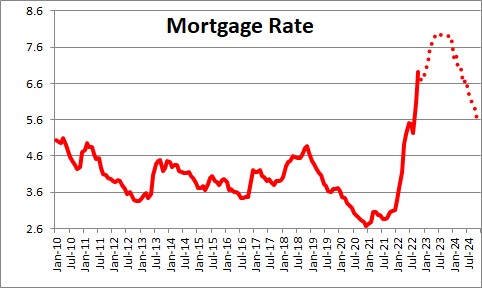

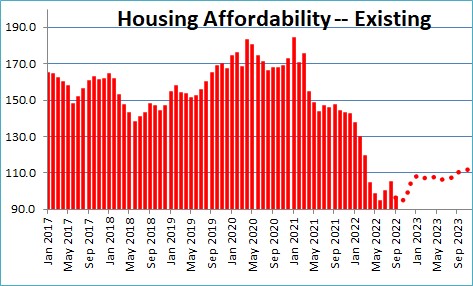

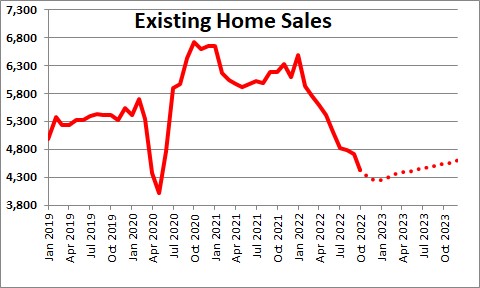

The housing market has taken the brunt of the Fed’s tightening initiative thus far as home sales have slowed from a 6.5 million pace in January to 4.4 million. But how much farther might they shrink? Mortgage rates are likely to climb from a near 7.0% rate today to 7.9% by midyear if the Fed continues to tighten. That will obviously be a drag on the pace of home sales. But home prices are falling rapidly. As a result, housing affordability will reverse direction and actually increase somewhat in that period of time. And if affordability increases, home sales should also climb. This means that one important sector of the economy will no longer act as a brake on growth. If the economy is going to slow further – which is what the Fed would like to see –it will have to come from elsewhere and that will not happen without higher interest rates.

Existing home sales have fallen 32% from a peak of 6.5 million in January to 4.4 million. One could argue that with 7.0% mortgage rates few sellers will be anxious to trade their current 3.0% mortgage rate for a 7.0% rate. That is true. If homeowners do not put their homes on the market, sales could fall farther.

But a couple of things are important. First, mortgage rates will not be 7.0% forever and one will have the option to re-finance at a more friendly rate a couple of years down the road. If, as we expect, the economy slips into recession in the first half of 2024, mortgage rates will decline to 5.5% or so by the end of that year. A 7.0% mortgage rate today may not be viewed by potential homebuyers as a major negative factor.

\

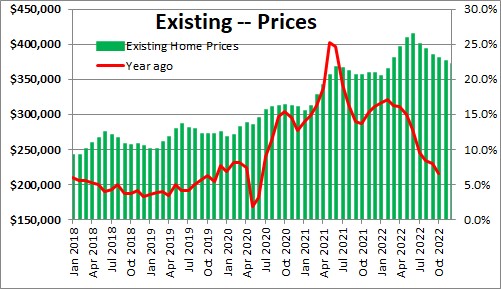

Far more important, in our view, is that home prices have been falling steadily and rapidly since July and will continue to decline. They have already backtracked from a peak of $413,000 in June to $379,000. If they continue to decline 1.0% per month, prices will fall to $350,000 by midyear which is where they were at the end of last year, prior to the panic buying that occurred in the first half of this year.

If the Fed keeps tightening until the first half of next year and mortgage rates climb to 7.9% but home prices keep falling rapidly, the housing affordability index will actually rise somewhat between now and then. That should be enough to stop the hemorrhaging in housing.

So how much farther might home sales fall?

In the so-called “Great Recession” in 2008-09 existing home sales declined to 3.8 million. But at that time one-third of homeowners had adjustable rate mortgages. As the Fed tightened and rates rose, those mortgages eventually re-priced upwards. In many cases home owners could not afford the higher monthly payments. At the same time many homeowners had negative equity and simply handed the keys over to the bank and walked away. The bank then sold the property for whatever it could get.

But those conditions do not apply today. Currently only about 8% of homeowners have adjustable rate mortgages so the pain of an upward adjustment to the monthly payment will impact a much smaller group of homeowners.

Also, as shown in the earlier chart, in the past two years home prices have risen 39% from $272,000 at the end of 2019 (prior to the recession) to $379,000 currently. If a homeowner sells they may not have as much profit as they once had, but they will not be selling at a loss.

Given all of the above, we believe that the pace of home sales at the bottom will not be anywhere close to the low point of 3.8 million in 2009. We will take a stab that home sales may soon hit bottom at roughly a 4.3 million pace.

If that is true, then the slower pace of economic growth that the Fed would like to see is unlikely to emerge until such time as the Fed makes it happen by raising the funds rate further. Think about the fact that retail sales jumped 1.3% in October. In real terms that is an increase of about 0.8%. And spending on goods is the softest part of consumer spending. Spending on services is climbing at a 3.0% pace. Consumers continue to hang in there.

The labor market is still humming along. Payroll employment in the past three months has risen 289 thousand per month. Given the weekly data on layoffs and the number of people receiving unemployment benefits we see more of the same in November. For what it is worth, we expect payroll employment to increase 250 thousand in that month and the unemployment rate to be unchanged at 3.7%. Not much of a slowdown thus far in the labor market.

We estimate GDP growth in the fourth quarter of 2.0% after rising at a 2.6% pace in the third quarter. The widely followed Atlanta Fed GDPNow estimate for the fourth quarter is 4.2%. While growth may not be nearly that rapid, the important point is that there is not a lot of evidence that growth is on the cusp of a slowdown. If that is the case, the Fed will have to keep going. Our best guess is that the funds rate will reach 6.0% by the middle of 2023. If the core inflation rate at that time has slowed to 4.9% the real funds rate will be +1.1% which could be high enough to produce a recession by the early part of 2024.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me