February 22, 2019

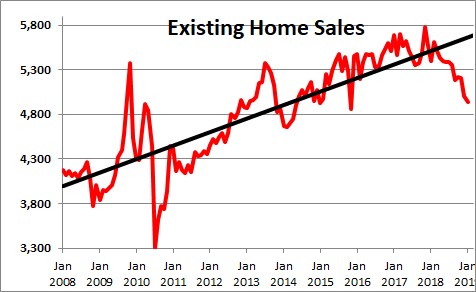

The housing slump continues. Existing home sales have been falling steadily for a year. Why? Is the slide attributable to a drop-off in demand? Or does it reflect some sort of a supply constraint? We think it is primarily the latter.

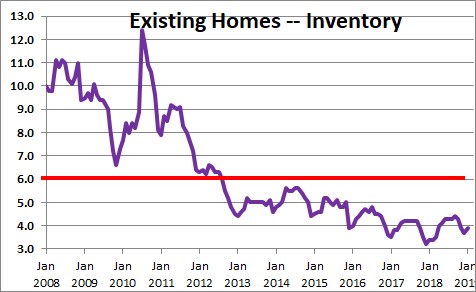

The National Association of Realtors indicates that there is a 3.9-month supply of homes available for sale, but a 6.0-month supply is required for demand and supply to be in balance. Thus, there is a significant shortage of homes on the market.

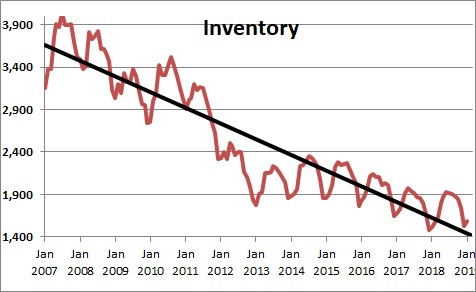

It may be more instructive to look at the actual number of homes available for sale rather than the month’s supply. Viewed in those terms we find that the number of homes available for sale has been falling steadily for a decade. Given that real estate agents cannot sell what is not on the market, it is no wonder that home sales are anemic!

Suppose for a moment that thousands of us suddenly decide to sell and the available supply jumps to 6.0 months. Would those additional homes be sold? Probably. At 3.9 months there is a shortage of homes available for sale; at 6.0 months demand and supply are in balance. Presumably those additional homes would get sold quickly.

What would home sales become with a 6.0-month supply? With almost 900 thousand additional homes available, home sales would quickly jump almost 20% to 5,800 thousand. With sales of that magnitude we would not be talking about “weakness” in the housing sector. Thus, the primary culprit underlying the seemingly troublesome slide in home sales is the dramatic drop in the number of homes available for sale.

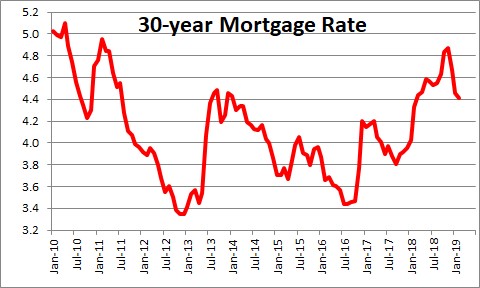

Why aren’t more homeowner’s selling their homes? Higher mortgage rates could mean that some potential sellers are “rate-locked”. There is little incentive for baby-boomers to downsize, for example, when the monthly payments on a somewhat smaller home are not much less than what they are paying currently.

Furthermore, with available homes in short supply some existing homeowners may have little motivation to sell for fear that they will be unable to find a new home that meets their needs.

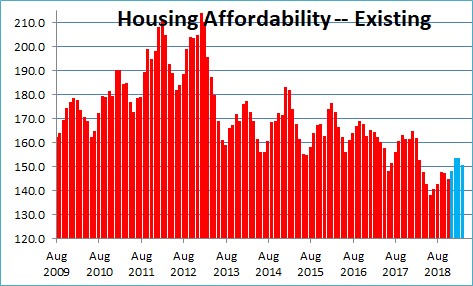

What about the demand for housing? Has the combo of higher home prices and higher mortgage rates made housing unaffordable? No.

Home prices have been rising steadily. A year ago, prices were rising at a steamy 6.3% pace. But in recent months – perhaps because of the reduced pace of sales — home prices have risen more slowly. In the past year prices have risen 4.3%. In the past six months the rate of increase has slipped to 3.2%.

Mortgage rates reached a low of 3.5% in early 2016. They peaked at 5.0% in November. As the stock market plunged and many economists began to fear a recession later this year or in 2020, mortgage rates retreated by 0.5% to 4.5%.

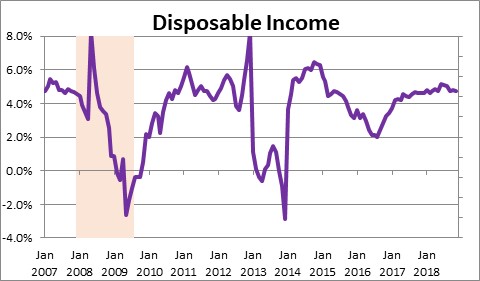

But there is a third piece of the housing affordability triangle that the economic naysayers have chosen to overlook. Income. In the past year disposable income has risen by an impressive 4.8%. Consumers can afford higher home prices and mortgage rates.

The National Association of Realtors compiles a monthly index of housing affordability which includes all three factors that affect affordability – home prices, mortgage rates, and consumer income. As home prices and mortgage rates climbed in recent years, housing became progressively less affordable. While less affordable than it once was, did it become unaffordable? No. In the days leading up to the 2008-09 recession consumers had just 14% more income than required to purchase a median-priced home. Housing was very expensive at that time. In recent months as home prices have risen more slowly and mortgage rates have declined consumers now have 50% more income than required. Insufficient income is not a constraint for most buyers.

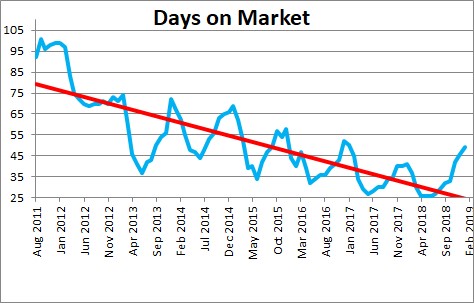

Keep in mind, too, that on average home sits on the market today for just 49 days. Indeed, 38% of the homes listed in January sold within a month. A few years ago, it took 3-4 months to sell a home. That suggests that even with the earlier run up in home prices and higher mortgage rates the demand for homes remains robust.

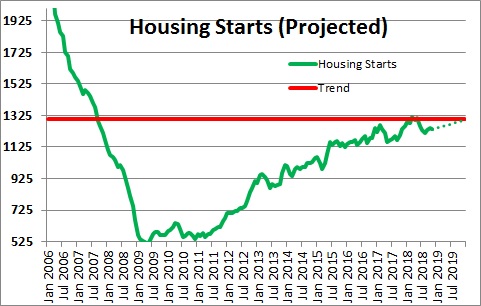

The recent slower rate of increase in home prices and lower mortgage rates should help, but don’t expect a dramatic pickup in either sales or starts. Large numbers of homeowners are not suddenly going to put their homes on the market. And builders will be unable to find a treasure chest of currently unemployed construction workers to hire. So, while home sales and housing starts will rise, look for moderate gains in both.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me