May 16, 2025

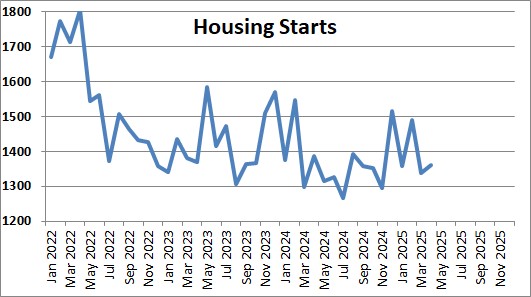

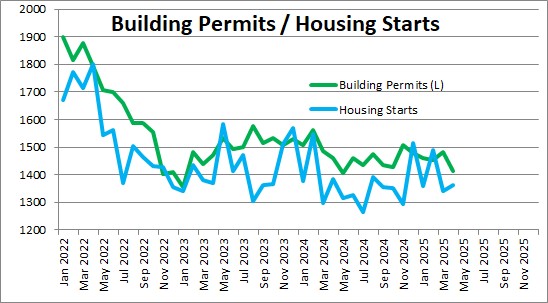

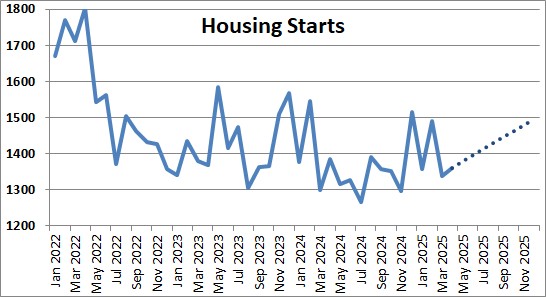

Housing starts rose 1.6% in April to 1,361 thousand after having plunged by 10.1% in March. Clearly, starts have been exceptionally volatile in recent months, rising or falling by double-digit amounts almost every month. This reflects weather conditions early in the year as well as uncertainty regarding tariffs and their potential impact on the economy as a whole and inflation.

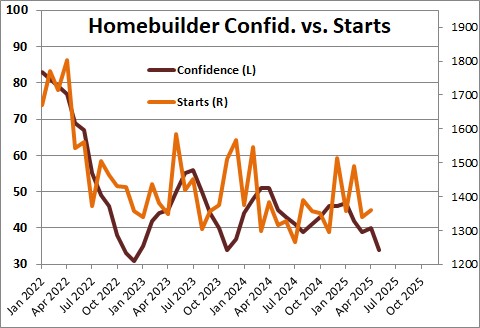

Homebuilder confidence remains low as builders are worried about the imposition of tariffs, still high mortgage rates, and the cost of materials so their confidence may not return fully until such issues are resolved. With 32% of appliances and 30% of softwood lumber coming from international trade, uncertainty over the scale and scope of tariffs has builders concerned about costs. But the recent tariff reductions announced by Trump should boost confidence, and starts, in the months ahead.

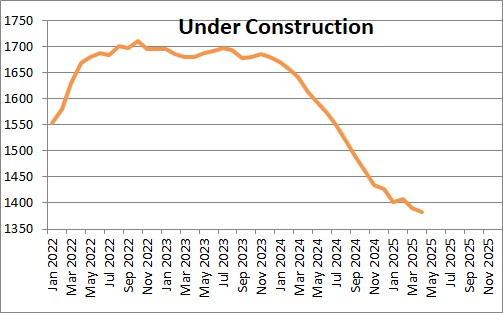

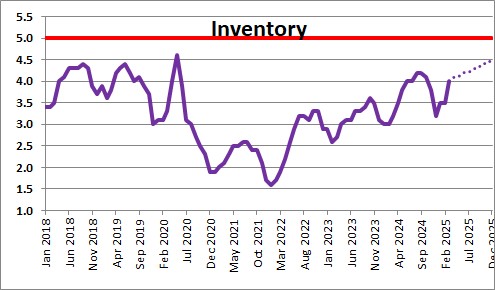

What seems to be happening now is that builders are still taking out permits to build a new home when they feel ready. But at the moment they are completing houses already under construction so they will not be caught with unsold inventory if the economy softens in the months ahead.

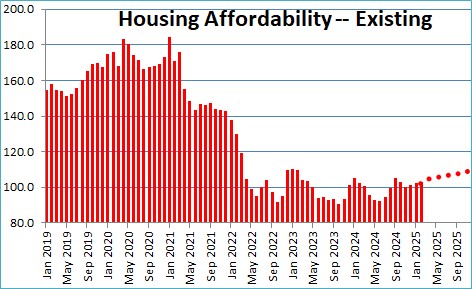

Housing affordability depends on three factors — mortgage rates, home prices, and consumer income. Mortgage rates should decline from 6.7% currently to 6.5% by the end of this year.. Home prices may remain at roughly their current level as the shortage of available housing puts upward pressure on prices.. At the same time, consumer income will continue to climb as jobs are created and hourly earnings steadily climb. As a result, housing affordability should increase somewhat as the year progresses. A median-income family today just enough income that is required to purchase a median-priced home. We believe that by the end of this year that same median-income earning family will have 15% more income than is required to purchase a median-priced home. That should help.

Potential home buyers today cannot find an adequate supply of existing homes to purchase. The supply of existing homes on the market has risen in recent months but it still remains low. The problem is that current owners have been unwilling to trade a 3.0-3.5% mortgage rate for a 6.7% one. But recent data suggest that they now feel they have waited long enough and are willing to pull the trigger and sell.

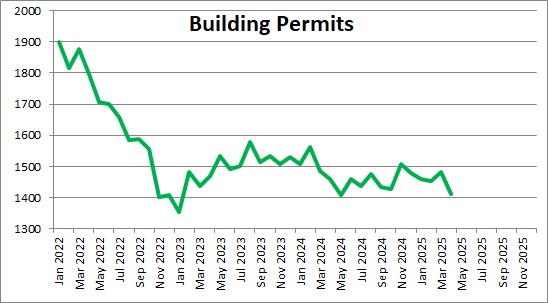

Building permits — which are less volatile than starts –fell 4.7% in April to 1,412 thousand after having risen 1.9% in March. But, as noted above, the reduction in tariffs announced recently should boost building confidence and starts in the months ahead. In our opinion, the housing sector has hit bottom and will increase slowly between now and yearend. With permits in recent months consistently between 1,450-1,500 thousand, starts should be at roughly that same level .

Our best guess is that starts will increase slightly in the next 8 months to 1,500 thousand or so by the end of this year.

Following a 0.3% decline in GDP in the first quarter we currently expect GDP growth of 2.5% growth in the second quarter and 1.9% growth in 2025..

Stephen Slifer

NumberNomics

Charleston, S.C.

Steve,

As always very informative information.

Clear sailing for at least a couple more years! Let me know when you get worried; I will do the same.

Steve –

How do you reconcile “clear sailing” (comment above) with the significant

overvaluation of equities (by traditional measures like P/E), fairly rapid increase in the spread between nominal and real 30 year interest rates, (indicating future inflation),

and the increasing anxiety about rapidly increasing national debt?