October 18, 2024

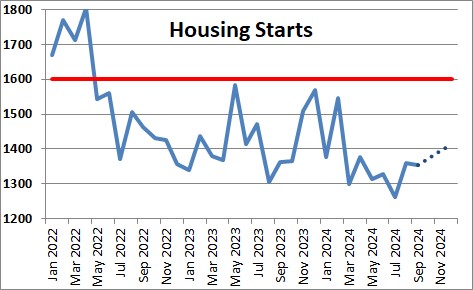

Housing starts declined 0.5% in September to 1,354 thousand after having jumped 7.8% in August after plunging 5.0% in July. The combo of Hurricanes Helene and Milton may have reduced the September construction data somewhat as starts in the South fell by 3.4%,

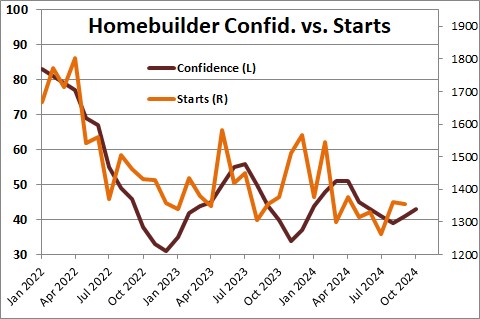

Builder confidence has edged upwards in the past couple of months. With mortgage rates having recently fallen to 6.2% potential buyers are waiting for rates to fall farther before resuming their home search, Builders appear to be doing the same thing — waiting for mortgage rates to fall. In addition, builders are dealing with an extreme shortage of available lots, and local red tape is retarding their willingness to boost the output of new homes and apartments.

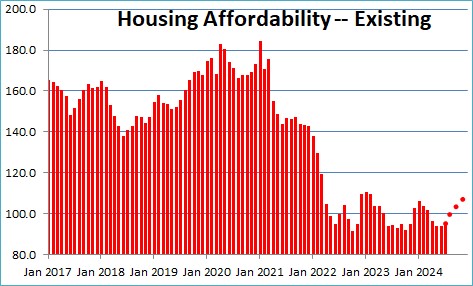

Housing affordability depends on three factors — mortgage rates, home prices, and consumer income. Mortgage rates should decline from 6.2% currently to 5.8% by yearend.. Home prices may remain at roughly their current level as the shortage of available housing puts upward pressure on prices.. At the same time, consumer income will continue to climb as jobs are created and hourly earnings steadily climb. As a result, housing affordability should increase somewhat as the year by yearend. A median-income family today has 5% less income than is required to purchase a median-priced home. We believe that by the end of this year that same median-income earning family will have 10% more income than is required to purchase a median-priced home.

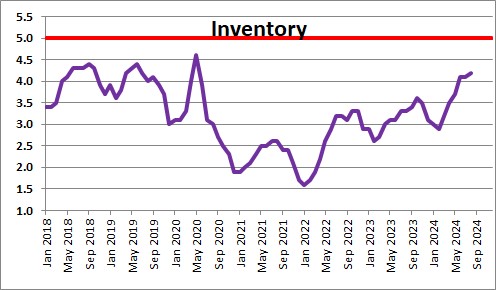

Potential home buyers today cannot find an adequate supply of existing homes to purchase. While the supply of existing homes on the market has risen in recent months it remains low. Realtors cannot sell what is not on the market. The problem is that the current owners are unwilling to trade a 3.0-3.5% mortgage rate for a 6.2% one.

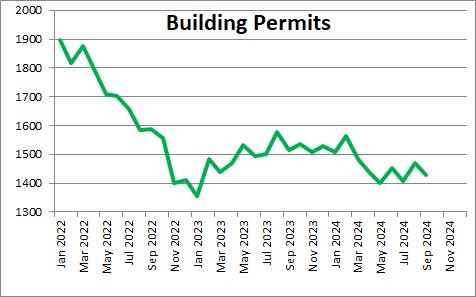

Building permits declined 2.9% in September to 1,428 thousand after having risen 4.6% in August after declining 3.3% in July. It is difficult for builders to find an adequate number of workers and available lots at affordable prices. This will curtail the number of houses that builders are able to start. However, in our opinion, the housing sector has hit bottom and will increase slowly in the months ahead. With permits in recent months consistently around 1,450 thousand, starts should be at roughly that same level.

We currently expect GDP growth of 2.5% in the third quarter and 2.5% growth in the fourth quarter.

Stephen Slifer

NumberNomics

Charleston, S.C.

Steve,

As always very informative information.

Clear sailing for at least a couple more years! Let me know when you get worried; I will do the same.

Steve –

How do you reconcile “clear sailing” (comment above) with the significant

overvaluation of equities (by traditional measures like P/E), fairly rapid increase in the spread between nominal and real 30 year interest rates, (indicating future inflation),

and the increasing anxiety about rapidly increasing national debt?