April 8, 2022

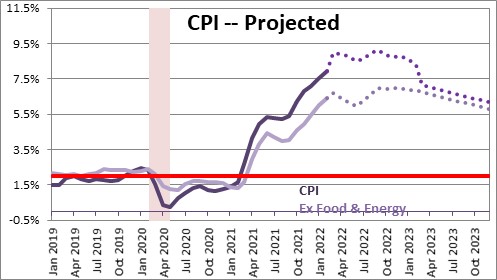

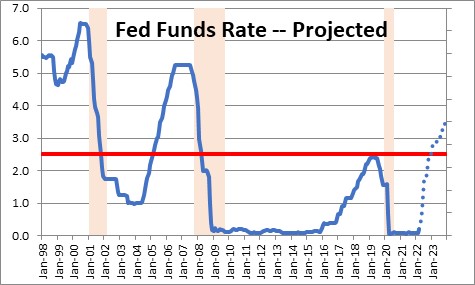

With a little help from Fed officials the markets finally woke up to the fact that the Fed is far behind the curve and will need to act far more aggressively than Powell described in mid-March. Based on speeches given last week the Fed seems intent on getting back to a more neutral stance by the end of this year. It believes that a neutral funds rate – which neither stimulates nor retards economic activity – is about 2.5%. Getting the funds rate from where it is currently at 0.25% to the 2.5% mark by yearend will require several 0.5% increases along the way. The Fed seems intent on front-loading those moves, so we should expect 0.5% increases at its meetings in May, June, and perhaps July. The problem is that a 2.5% funds rate is only neutral if inflation is at the 2.0% mark which it decidedly is not. That is a starting goal, not an endpoint. Nobody knows for certain what that endpoint might be. It depends to a large extent on when and by how much the inflation rate subsides. Pick whatever inflation measure you want, but they are all currently on the north side of 5.0%. Could the funds rate reach the 5.0% mark? Perhaps. But the Fed is going to give us a double-dose of tightening by raising the funds rate and simultaneously embarking on a course of shrinking its balance sheet by almost $100 billion per month. That will raise long-term rates. That combo of rate hikes and a shrinking balance sheet is unprecedented. It will make the appropriate dose of slow-growth medicine difficult to prescribe. The only thing we know is that between now and yearend the Fed intends to close the gap between where its policy is now and where it needs to be.

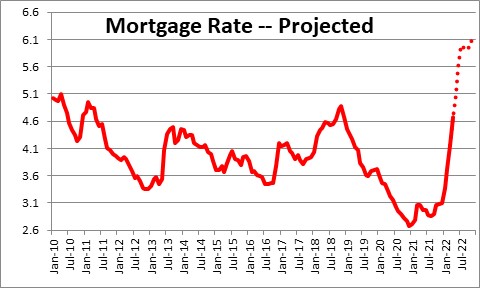

To reduce inflation the Fed needs to substantially slow the pace of economic activity. Negative real interest rates will not accomplish that objective. All real interest today are very negative. For example, a 4.7% 30-year mortgage rate is not going to have much impact on the housing market. Why? Because an individual in the 22% tax bracket gets to deduct the interest expense when calculating his or her taxes. That means that after tax that person is paying 3.7%, not 4.7%. And if inflation is 5.0%, the real after tax cost of borrowing is -1.3%. Not only can that person claim the interest expense as a tax deduction, but they get to pay it back with deflated dollars. A 4.7% mortgage rate is not going to slow the pace of home buying. We expect the combination of increases in the funds rate and the Fed’s shrinkage of its balance sheet to boost the 30-year mortgage rate to 6.0% by the end of this year. But even at that level it may not have much bite.

Let’s suppose that the Fed tightens further in 2023 and boosts the funds rate by another 1.0% from 2.5% to 3.5% and continues to shrink its balance sheet by $100 billion per month. At that point the mortgage rate is likely to have reached the 7.0% mark. Will that do the trick? To answer that question one needs to have some guesstimate about what might happen to inflation between now and then. The Fed is looking for inflation in 2023 to slow to about 2.5%. We think it will remain elevated at about 5.5%.

A three percentage point difference in the likely inflation rate next year is enormous and has very different implications about the level of interest rates required to slow the pace of economic activity. Unfortunately, we are in uncharted waters which means that all of us are guessing. The Fed cannot be any more certain about the paths for GDP growth, inflation, and interest rates over the course of the next two years than any of the rest of us. All we can say for certain is that interest rates are going to rise sharply. A year from now we may be better able to assess the rate levels that are required to slow the pace of economic activity without dumping it into a recession.

The problem is that nothing about changes in business cycles occurs slowly. The warnings signs may rise and tell us that trouble is brewing, but exactly when the economy will respond is difficult to predict. For example, back in the early 2000’s everybody could see that the housing market was booming and the situation was unsustainable. But if you had predicted that a recession was imminent you would have been wrong for years. Suddenly there comes a time when there is a collective gasp by consumers who suddenly pull in their horns and stop spending, and businessmen who decide that they need to lay off lots of workers in a hurry, and the bottom falls out. The Fed may see the problem coming but gets frustrated because the economy keeps chugging along. It then takes that final step and raises rates one last time. But then disaster strikes. Achieving a soft landing without stepping over the edge requires a delicate touch. Unfortunately, it rarely happens. The only thing we feel comfortable saying is that the edge of the cliff will not be reached between now and this time next year.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me