October 17, 2024

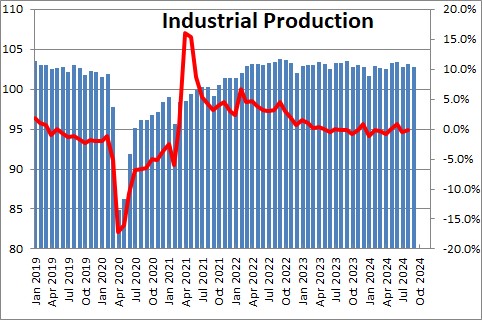

Industrial production declined 0.3% in September after rising 0.3% in August after having fallen 0.6% in July. The Fed reported that Hurricanes Helene and Beryl subtracted about 0.3% from the index and the Boeing strike subtracted another 0.3%. Adjusting for these factors eliminates the decline in the series and turns it into a small increase. In the past year industrial production has declined 0.6%.

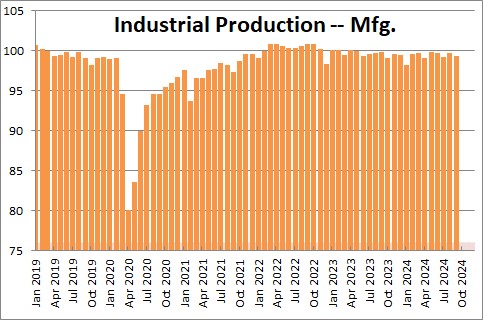

Breaking industrial production down into its three basic categories — manufacturing, mining, and utilities. Manufacturing production declined 0.4% in September after having risen 0.5% in August after having fallen 0.5% in July. In the past year manufacturing output has declined 0.5%.

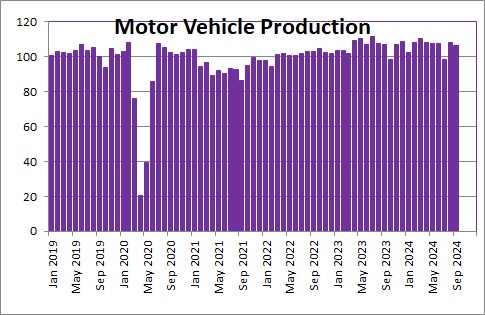

In the motor vehicle sector production declined 1.5% in September after having jumped 9.9% in August after having plunged by 8.7% in July. In the past year motor vehicle production has fallen 0.6%. However, this component is extremely volatile from month to month.

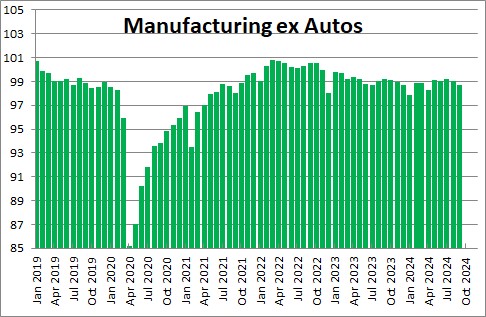

Excluding the motor vehicle sector, manufacturing output declined 0.3% after having fallen 0.2% in August after having risen 0.2% in July. In the past year it has declined 0.5%.

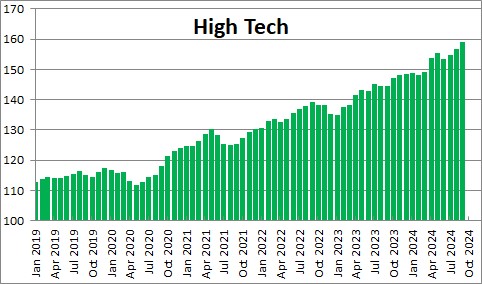

High tech production rose 1.5% in September after having jumped 1.3% in August after having gained 0.9% in July. High tech production has risen 10.0% in the past year. We would suggest that if firms are unable to find an adequate supply of workers, they will turn to technology in an effort to boost production and satisfy the demand for their products. At the same time firms are all experimenting with AI in an effort to figure out how it might help them boost productivity. Thus, we expect high tech production to continue to climb rapidly in the months ahead.

Mining (14%) output fell 0.6% in September after having risen 0.7% in August after having declined 0.9% in July. Mining has fallen 2.2% in the past year.

Utilities output was rose 0.7% in September after having declined 1.3% in August after declining 1.1% in July. Over the past year utility output has risen 0.6%. This component is extremely volatile from month-to-month as the weather fluctuates.

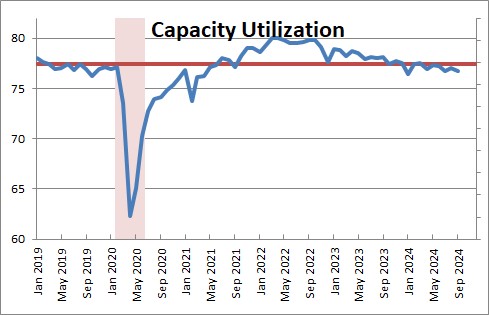

Capacity utilization in the manufacturing sector declined 0.4% in September to 76.7% after having risen 0.3% in August to 77.2% after having declined 0.5% in June. It is currently slightly below the 77.4% level that is generally regarded as effective full capacity utilization.

GDP appears to be on track to grow at a 2.5% pace in the third quarter as firms keep hiring at a relatively rapid pace. We expect GDP to be 2.5% in both the third and fourth quarters.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me