January 8, 2021

Following the $3.0 trillion fiscal stimulus package passed in the spring of last year, the government passed a second $0.9 billion corona virus relief spending package in December. Following the two Senate elections in Georgia the Democrats gained control of both the House and the Senate which almost guarantees that a third stimulus bill will be passed in the first quarter. From an economic standpoint we wonder when all this additional government spending is going to stop. The markets have concluded that this jump in government spending is going to boost the inflation rate. And, indeed, signs of faster inflation are popping up everywhere. The Fed has said it will tolerate an inflation rate slightly above its 2.0% target for a while to offset the inflation shortfall during the past decade. But exactly how much above target the Fed is willing to tolerate and for how long it must persist before they will raise rates is not yet clear. This discussion may take place a lot sooner than the Fed thought just a few months ago.

Why the need for all this additional government spending? Our sense is that our leaders in Washington want to get the unemployment rate back to its full-employment level of about 4.0% as quickly as possible. While we think that the unemployment rate could decline to the 4.0% mark by the end of this year, the Fed said in December that it did not expect that to happen until 2023. Hence, the Fed sees a need for additional government spending to make that happen sooner. With President-elect Biden, Nancy Pelosi, Chuck Schumer, and Fed Chair Powell on board there is no doubt that is exactly what is going to happen.

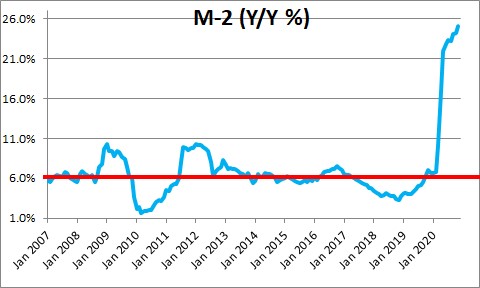

But the markets have a different view. They believe that all this government spending is excessive and will result in an increase in inflation. And they are right. Why? Primarily because the $3.0 trillion of government securities the Fed purchased last spring boosted growth in the money supply to 25%. Money growth typically rises at about a 6.0% pace. We have never experienced a 25% growth rate in the money supply. Inflation is going to rise simply because there is too much money chasing too few goods. The problem is that rapid growth in the money supply tells you that inflation is going to rise, but the lags between the pickup in money growth and a faster rate of inflation are both long and variable.

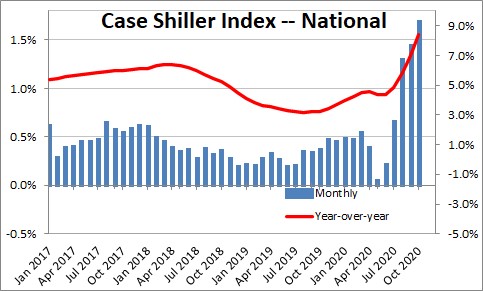

However, signs of rising prices are everywhere. In the housing market home prices in the past year have risen 8.4%. But for the past several months home prices have steadily accelerated which makes it likely that home prices will rise by 13% or so this year.

The Census Bureau reports that the asking rent for vacant rental properties has risen more than 15% in the past year.

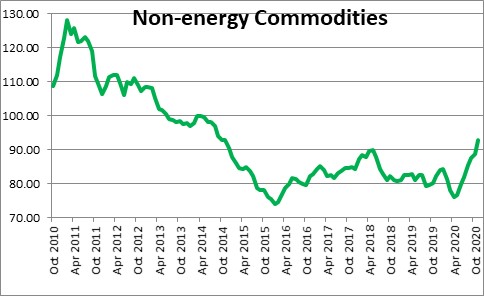

Commodity prices are on the rise and are now the highest they have been in five years. The list includes agricultural products like soybeans, rice, and lumber, base metals like aluminum, copper, lead, and zinc, as well as precious metals like gold and silver.

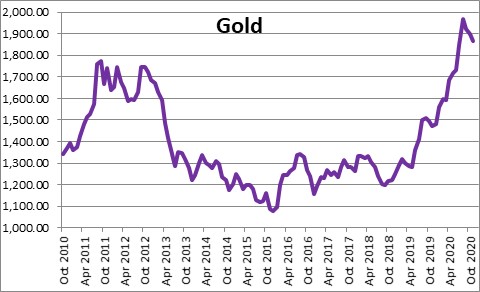

Amongst the many commodity prices that have been rising is gold which has climbed 27% in the past year to $1,900 per ounce. Investors often buy gold as a hedge against rising inflation.

Meanwhile, the dollar has been in a steady decline since the spring of last year as the result of negative long-term bond yields in the U.S. Over the past decade the 10-year note, on average, traded 1.3% higher than the inflation rate. But today, with the nominal U.S. Treasury 1-year yield at 1.0% and the CPI currently rising at a 1.3% pace, the real yield on the 10-year note is -0.3%. A negative real rate is unappealing to foreign investors.

As a result, the trade-weighted value of the dollar has fallen by 10% since reaching a peak in April of last year. And given the prospect of negative real interest rates for the foreseeable future the dollar is likely to decline an additional 5.0% or so during 2021. As the dollar declines the prices of imported goods rises which is yet another source of faster inflation.

So what is the outlook for inflation? For the Fed’s targeted rate of inflation, the core personal consumption expenditures deflator, we expect inflation to climb from 1.3% in 2020, to 2.1% this year, and 2.6% in 2022. The Fed has said it is willing to live with an inflation rate “somewhat higher” than its targeted 2.0% pace for a while to make up for the roughly 0.5% per annum shortfall in inflation during the previous decade. A 2.6% inflation rate in 2022 may not get the Fed to pull the trigger and start to raise interest rates, but it will almost certainly initiate the discussion.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me