May 13, 2011

The inflation rate acceleration has been troublesome ever since commodity prices began their ascent in October of last year. This run-up in prices was partly attributable to a faster pace of global manufacturing activity, and partly to unrest in several countries in the Mideast and North Africa. As inflation rates rose, consumers and businesses worried that the extended period of low rates might soon come to an end.

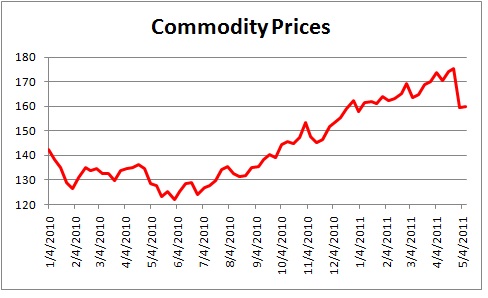

But suddenly, in early-May commodity prices began to retreat. The precipitous slide started in the silver market where prices have fallen by about 30%. But falling prices quickly spread throughout other sectors. Crude oil and gasoline prices have declined by about 10%. Corn, wheat, cattle, and pork prices have done about the same thing. Copper and cotton joined the party. As shown in the chart below, commodity prices in general have reversed about one-half of the price gains recorded between late September, when the escalation began, and early May.

Falling commodity prices do a lot of good things for our economy.

- As commodity prices rose producers had to pay higher prices for their materials, but with little pricing power they were largely unable to pass them along. Thus, profit margins were shrinking. While food and gasoline prices rose at the retail level, consumer prices in general were largely unaffected. However, at some point manufacturing firms would have been forced to raise prices. But now, the decline in commodity prices should enable them to widen margins which will enhance earnings and reduce the likelihood of higher consumer prices in the second half of this year. And because the stock market is a reflection of expected corporate earnings, higher margins are good for the stock market.

- As food and energy prices decline in the months ahead consumers will have extra money to spend on other items. If rising gasoline prices caused a household to pay $100 more each month to fill the car with gas. that was $100 less that was available for spending on other goods and services. But now those same households will get back some portion of the money they had been spending on higher-priced food and gasoline. As a result, the economy will get additional stimulus in the months ahead as consumers re-direct their spending to other goods and services. Expect faster GDP growth in the second, third, and fourth quarters.

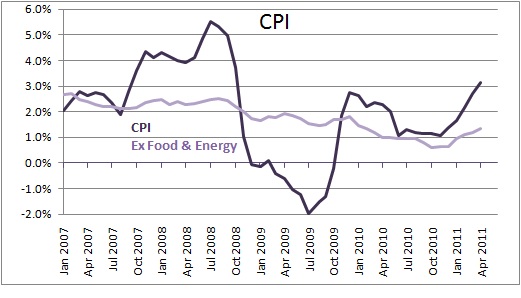

- As food and energy prices retreat the Fed can breathe a sigh of relief. With the unemployment rate hovering near the 9.0% mark and the economy performing at a subpar pace, the Fed wanted to keep interest rates low to bring the unemployment rate down as quickly as possible. But given the steady acceleration in the consumer price index the Fed was coming under increasing pressure from Congress, as well as internally from some Fed governors and Reserve bank presidents, to end the extended period of near zero interest rates. However, as Fed Chairman Bernanke correctly argued, and as shown below, most of the time rising food and energy prices do not spill over into a more widespread pickup in inflation. Oil prices rose dramatically in late 2007 and early 2008, but the so-called “core” rate of inflation – i.e., prices excluding the volatile food and energy components – was unaffected. During the recession when oil prices collapsed, the core rate slowed only slightly. And since September when oil prices once again began to rise rapidly, the core rate has once again been largely unaffected.

Chairman Bernanke on numerous occasions has suggested that the recent run-up in food and energy prices would prove to be temporary. But expecting these prices to decline and actually seeing them fall are two very different events. As lower commodity prices work their way through the economy and slow the rates of increase in the overall CPI and PPI, the Fed can breathe easier. The Fed will eventually have to boost rates, but this recent development extends the time period until the Fed feels compelled to do so. We were (and still are) expecting the Fed to begin that process in the spring of 2012, but we were getting worried that it might happen sooner.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me