April 12, 2024

The larger-than-expected increase in the consumer price index for March combined with a robust employment report for that month, has ignited a fear that the Fed will not ease nearly as much as hoped for in the second half of this year. A month ago the markets expected four rate cuts by the Fed. That has now shrunk to one or perhaps two rate reductions, and some economists wonder if the Fed will cut rates at all in 2024. Without a doubt the inflation readings for the first three months of the year came in hot and the market reaction is understandable. But our sense is that the inflation readings will soften as the year progresses for several reasons, and we have not changed our expectation that the Fed will initiate three rate cuts in the second half of the year.

Before talking about inflation, let’s talk first about GDP growth. On Thursday morning, April 25, we will get our first look at GDP growth for the first quarter. The consensus appears to be for a growth rate of 2.0-2.5%. For what it is worth, we expect growth of 2.5% in that quarter. But be aware that GDP growth surprised to the upside in the second, third, and fourth quarters of last year. Economists keep expecting growth to slow and it has persistently not cooperated. Another upside surprise would almost certainly cause the Fed to table an easing move for the foreseeable future. If growth turns out to be steady at 2.5% or more, why ease? So mark your calendar. April 25 is an important date.

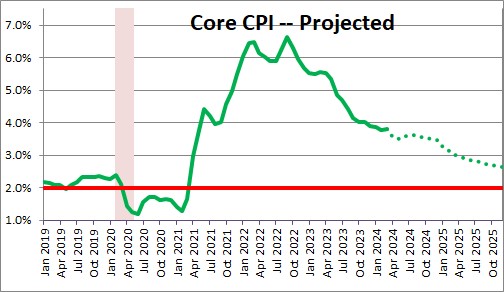

The core CPI has risen 0.4% in each of the first three months of 2024 versus 0.3% gains that were expected. This index rose 3.9% in 2023. In the past three months the pace has quickened to 4.8%. The Fed and most economists expected the core CPI to slow gradually so the early year performance is disquieting. The issue is whether it will continue to climb at the steamy first quarter pace. We do not think so.

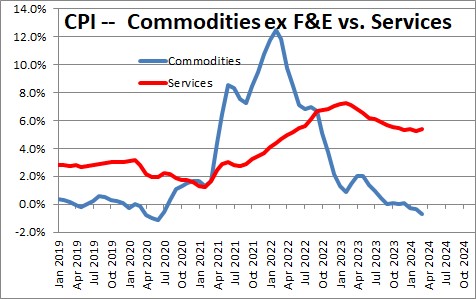

The stickiness in the core CPI is in service sector where prices have risen 5.4% in the past year compared to a 0.7% decline in core goods prices. This result is neither new nor surprising. Supply chain disruptions gave rise to the initial increase in goods prices, but as supply constraints disappeared and the flow of goods has returned to normal, prices in the goods sector have changed little in the past year. The same cannot be said for the service sector.

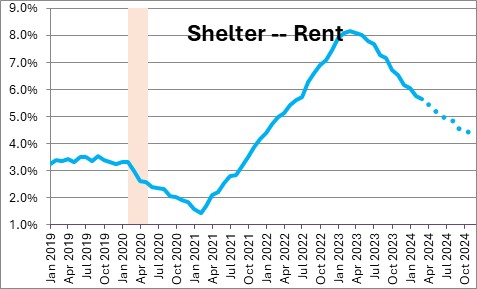

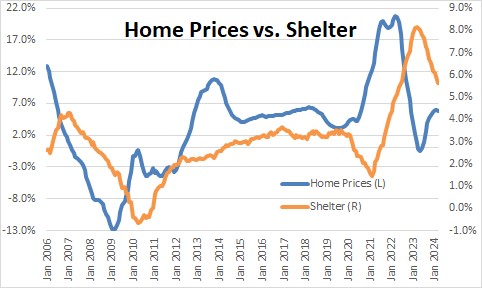

The primary culprit in the service sector is the shelter component. As home prices and rents surged in 2022 and 2023 this component of the CPI skyrocketed and at one point reached 8.0%. This series has been around since 2002 and that was the biggest increase on record. This is important because the shelter component represents one-third of the overall CPI index. It is hard to achieve a 2.0% inflation target when one-third of the index is rising at an 8.0% pace, or even at its current rate of 5.6%. The good news is that we expect this component to slow to 4.3% by yearend, and shrink farther to 3.5% in 2025.

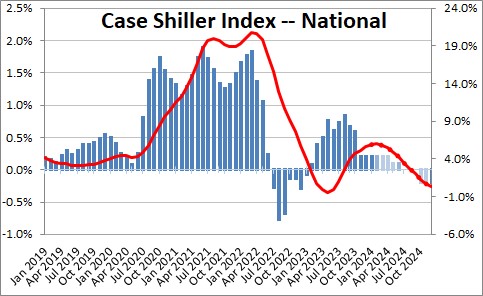

The shelter component of the CPI trails the change in home prices by about a year. The Case Shiller Index of national home prices has slowed considerably in the past couple of years from the 20% gains experienced in mid-2022 to 5.9% currently. Prices have risen even more slowly to a 2.4% pace in the first three months of the year. And with prices for both new and existing homes now declining, the Case Shiller Index could register some monthly declines as the year progress. If that happens, home prices for the year might rise only about 0.5% in 2024. There is a loose link between what happens to home prices and the shelter component of the CPI.

It turns out that growth in the shelter component of the CPI seems to lag the change in home prices by about a year. If home prices rise 0.5% in 2024, then we are likely to find that the shelter component of the CPI slows from 5.9% currently to 4.3% by yearend. Such a slowdown in the shelter component would reduce the core CPI inflation rate by about 0.5%.

The larger-than-expected increases in the core CPI in recent months has been largely, but not exclusively, attributable to the shelter component. The automobile insurance and car repair categories have risen 22.2% and 11.6%, respectively, in the past year and have contributed to the upside surprises. But two things. First, it is inconceivable that those two categories will continue to climb at their current pace for long. The monthly increases should slow considerably in the months ahead. Second, those two categories represent 3.0% of the CPI compared to 33.0% for the shelter component. The big gorilla is shelter.

Clearly, the current pace of GDP growth and the lack of improvement in the core inflation rate in the first quarter take a Fed easing move off the table for now. But we expect the first rate cut at the end of July. That is still three months down the road and the situation should look a lot more friendly by then.

Stephen Slifer

NumberNomics

Charleston, S.C.

Except that the M/M for services with and without shelter is the same

Has the GDP been propped up by government spending?

Question: I am currently buying a home. I did not lock the interest rate yet because they jumped last week. I’m not closing until June 3. Do you recommend I wait, do you see any relief in the near future?

The answer is yes. In the past four quarters GDP growth has been boosted 0.8% by government spending. GDP growth in the past four quarters has been 3.1% of which 0.8% came from government. Of the government spending 0.26% was from the Federal government, the remaining 0.55% was from state and local governments which have been spending because their tax receipts have been strong. Government spending is part of the story, but anyway one slices it the economy has been chugging along at a respectable pace for a year — defying economists expectations that it was going to slow or even fall into recession..

steve

Hi Kimberly.

If the time frame is between now and June 3, I am not sure I see a lot happening. Given the recent string of strong economic data from the employment report, yesterday’s retail sales report, and the CPI that came out last week, there is no chance the Fed is going to but rates at its June meeting. Later in the summer, perhaps, but not enough to do you much good in the meantime. The wild card is perhaps the situation in the Mideast. If that escalates there will be a legitimate fear that oil prices will rise which will boost inflation and push long-term interest rates — the 10-year note and the 30-year mortgage rate — higher. I am an economist and not an investment advisor but my opinion, for what it is worth, is that there is little chance of relief between now and June 3. If I were in your position I would probably lock in your rate. Remember, if rates should drop appreciably in the next couple of years, you can always refinance to a lower rate.

\

Good luck!

Steve