.April 24, 2025

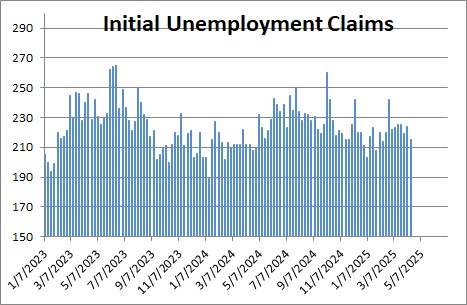

Initial unemployment claims rose 6 thousand in the week ending April 19 to 222 thousand after falling 8 thousand in the previous week. There is no evidence that the labor market has been affected by layoffs thus far. However, we know that some government workers are being fired. Keep in mind that federal government employment is only 2.0% of total employment so the impact for the economy as a whole should be fairly small. This series has changed very little in the past year. The 4-week average of claims was 210 thousand at the end of April 2024 versus 220 thousand today.

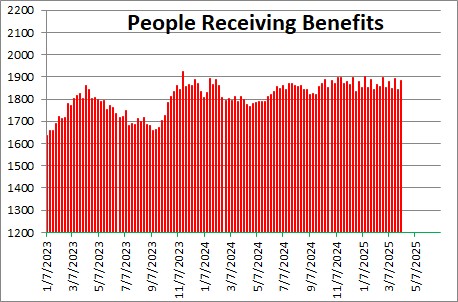

The number of people receiving unemployment benefits fell 37 thousand.in the week ending April 12 to 1,841 thousand after rising 34 thousand in the previous week. This series has changed very little in recent months.

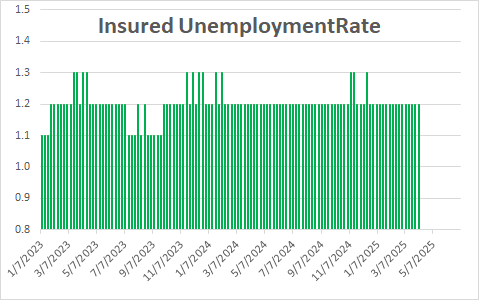

Given the small decline in the number of people receiving unemployment benefits, the insured unemployment rate was unchanged in the most recent week at 1.2% after being unchanged in the previous week. Before the shutdown started in 2020 it was at 1.2% so it is still at its pre-pandemic level. .

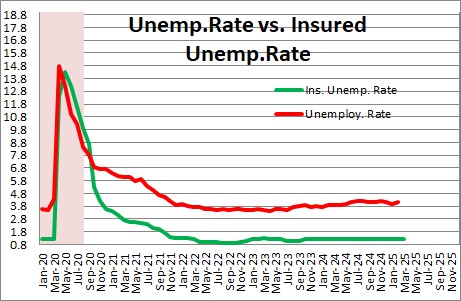

The insured unemployment rate tracks closely the unemployment rate. Given the level of the insured unemployment rate, we expect the unemployment rate to be unchanged in April at 4.2%. We also expect payroll employment to increase 150 thousand. These numbers will be released on May 2.

We expect GDP growth of 0.5% in the first quarter and 2.0% in 2025.

Stephen Slifer

NumberNomics

Charleston, SC

Dr. Slifer –

I hope you are correct in your optimistic assumptions, but am skeptical. The restrictions in the US are not as severe as in China, and are not enforced. The rate of increase in confirmed cases in the US (based on the Johns Hopkins Coronavirus Resource Center data) has been running at 40% per day and only in the last three days has any decrease been recorded – to about 25% per day. The curve is bending down only slowly, and it seems unlikely it will be flat by the middle of April. Even when the rate of increase is controlled, if less than half of the population has been infected (and acquired immunity), then a relaxation of restrictions may lead to a resurgence of the infection, requiring even longer quarantine. Lastly, if it goes on for a few months instead of a few weeks, bankrupticies and other business failures, as well as the worldwide collapse in trade, seem likely to impede a robust recovery. I know nothing of economics, but the other factors here seem unlikely to reverse soon.

Hi Frank.

Thanks for sharing your thoughts. Everybody seems skeptical. Most people have responded are in that camp. I seem to be the only relative optimist out there.

Your concerns are all valid. Given that Trump did not declare an emergency until March 13, and many of the governors did not impose stay at home orders until this past week, I suspect it is still a bit too soon to expect some improvement. I am hoping my mid-April time table is not too far off the mark. I keep going back to the China data. They imposed stringent controls towards the end of January, saw hints of improvement by mid-February, and had the thing well under control by mid-March. And, at least thus far, as their economy starts opening up they have not seemed to experience any resurgence of the virus. Not exactly sure why we should be significantly different here, but almost everybody questions my timetable. Who knows? everybody else could certainly be right.

I need this to be a short-term event.

If it goes on a lot longer than I envision, I certainly share your concerns. Businesses, particularly small businesses have contingency plans and lines of credit to hold them over for roughly a month. Longer than that we will have a lot of problems. I think it raises a legitimate question whether the economic fallout from the so-called cure will turn out to be worse than if we had simply let the virus run its course and opted instead for a more targeted approach — isolation and help for the elderly, encourage and provide incentives for manufacturing firms to ramp up production of ventilators, masks, and protective gear for health care workers, and financial assistance for those directly impacted by the virus. We do not need $1,000+ checks for every American

As always, I guess we will see. Stay healthy.

Steve

Steve –

It’s been about 5 months since my previous comment on March 27, and the stock market is back at or exceeding previous highs. Nevertheless, 10% unemployment is still a large number, and at even 0.4% decrease per month (which will probably become less over time), it’s going to take a long time to get back to 5% or below.

Many areas like restaurants, hotels, tourism (particularly international), airline travel, industrial production related to airplanes, and school and college teaching, will probably not get back to normal for more than a year. Are these areas in totality a small enough part of the

economy that they can be offset by the segments doing well (Amazon, Facebook, Google, Apple, bicycles, RV’s, financials), so that the total economy does OK? What

about those folks whose unemployment bonuses are over (assuming nothing further is forthcoming from Washington). The job losses, evictions, unpaid bills

and mortgages, would seem to ensure misery and dislocation among a lot of the

population. Is there enough employment among everyone else to offset this

economically?

It seems amazing that overall things are not worse, given the number of people

affected, but maybe MMT is correct that if you throw enough money at a problem,

it will get better.

Would appreciate your further insights, including your recommendations for no

further supplementation.

HI Frank,

Nice to hear from you. Everybody seems to be talking about the apparent disconnect between the stock market and the economy. I am not sure the two are as far out of sync as they appear.

When people talk about the economy what they are talking about is the 32.9% GDP decline i =n the second quarter. Admittedly, we dug a deep hole. But, as I wrote about this week, some sectors are doing surprisingly well — notably housing and retail sales which are higher now than they were when we sent into the recession. But, as you point out, other sectors of the economy are not doing so well — hotels, restaurants, hotels, air travel, etc. And, as you also point out, the unemployment rate is still 10.2% and I (one of the optimists) peg it at a still relatively high 6.2% at the end of next year.

But the stock market is not looking at where the economy is currently, but where it is going to be a year or more down the road. They see tech stocks that are obviously doing extremely well at the moment. That is important because it is technology that has led is going to lead us further out of this mess. Look at what has happened in the medical industry. We really began to suffer from he virus in March. A vaccine typically takes 10 years to develop. But the talk currently is that several vaccines may be available by yearend. That is less than one year. And now we have blood plasma treatments that are going to made more widely available to help those worst case sufferers. This is technology in action. Then think about Amazon and even Walmart. Amazon hired 175,000 workers and Walmart 100,000 during the recession to cope with the massive amount of on-line purchases from all of us. Once again, technology is helping to lift us out of the recession.

The stimulus money was the primary reason that we are where we are. But that money will eventually get spent. So the economy needs to get a life of its own fairly soon. My forecast assumes that a vaccine will be available by yearend. Once we get a vaccine the stock market will soar. And you and I will feel far more comfortable going out to eat, shop, travel, fly, etc. All of those sectors that are still having a difficult time will do much better. That is what we need to get a sustainable recovery in my view. A vaccine.

For this reason, I do not think that the economy needs more stimulus. It does not look today anything at all like it did when the last stimulus package was adopted in April. The stock market is at a record high level. The unemployment rate, which still high, is quickly heading in the right direction. GDP growth in the 3rd quarter is likely to rebound by 28% following the 32.9% drop in the second quarter. If the economy stumbles at some point down the road, then revisit additional stimulus at that point in time. But right now we are improving rapidly and there is no reason to needlessly run up the size of budget deficits and debt.

I hope this helps.

Best.

Steve

Thanks for your detailed analysis and comments. You have definitely called it

correctly to date, and I hope it continues.