May 11, 2018

Crude oil prices at $70 are higher than anybody anticipated at the beginning of the year. What is causing the increase in oil prices? What’s next? Does it matter for GDP growth? Inflation? The Fed?

Oil’s steady ascent has been caused by a combination of factors — some economic, some political.

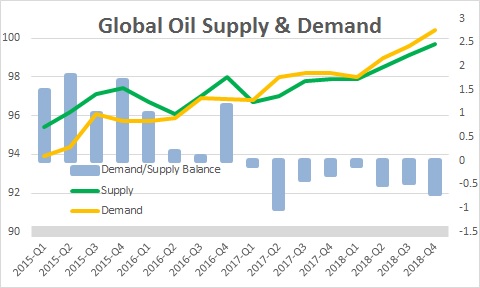

In January the International Energy Agency in Paris thought demand and supply for oil would be roughly in balance throughout the year which suggested that oil prices should remain at about $50 per barrel. But in the past several months demand has increased, supply has shrunk, and there is now a shortfall of $0.5 million barrels per day (the blue bars) which the IEA believes will persist through yearend.

The increase in demand appears to have been triggered largely by a faster pace of economic expansion around the globe. Last month, for example, the IMF revised upwards its estimate of global GDP growth in 2018 by 0.2% relative to what it expected in October to 3.9%. That would be the fastest rate of global growth since 2011. It boosted the U.S. forecast by 0.6% to 2.9% to reflect the combination of tax cuts and a faster pace of defense spending. It raised growth for Europe by 0.5% to 2.4% with forecasts for Germany, France, Italy, and Spain all ratcheted upwards. It lifted the growth estimate for China by 0.1% to 6.6%. Thus, the upward revisions to GDP growth were widely disbursed geographically. Faster global economic growth brings with it increased demand for oil.

On the supply side much of the shortfall can be attributed to Venezuela as its downward economic and political spiral worsens. From 2000-2015 Venezuelan oil production averaged 2.4 million barrels of oil per day. But by March of this year that figure had fallen 38% to 1.5 million b/d — its slowest rate of production in decades, and many expect it to fall below $1.0 million b/d by yearend as the economy contracts by an estimated 15% this year and the inflation rate soars to 14,000%.

Political factors have also come into play. Encouraged by higher oil prices, OPEC ministers recently suggested that the group could choose to extend its production cuts through 2019, or even trim them further. The OPEC ministers also noted that just because the inventory glut has been eliminated, that does not necessarily mean the end of the cutbacks. Those comments spooked the markets which now fear that oil prices could continue to climb to $80. Saudi Arabia is using higher prices in the near term to cover domestic spending. Higher prices have also made Russia a power broker for what happens in the mid-East.

Finally, this past week President Trump announced that the United States would exit the nuclear pact with Iran and re-impose sanctions on Tehran. Those sanctions would presumably not reduce the supply of oil from Iran until much later this year, but the risk of such an event means crude prices could continue to climb.

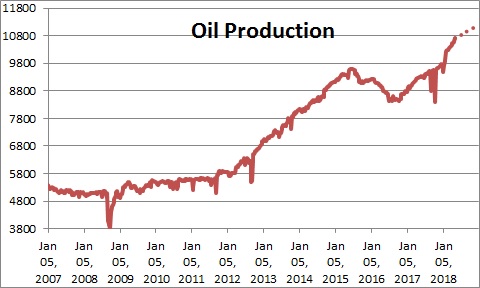

Another factor that is critical to the outlook for oil prices is U.S. oil production which is skyrocketing. Prior to the big drop in prices that began in late 2014, frackers could not drill profitably unless crude oil prices were about $65 per barrel. But with improved technology in the form of fracking and horizontal drilling, that number has declined to about $48 per barrel. Thus, prices of $70 are a bonanza for the oil industry and drillers are ramping up production as fast as they can.

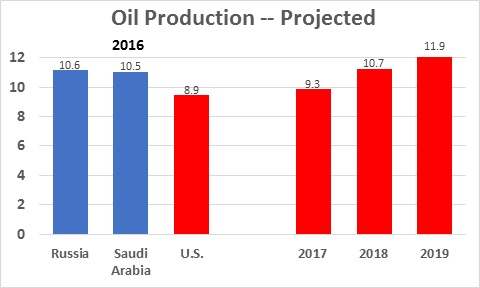

Production is expected to surge 15% this year to a record 10.7 million barrels per day versus 9.3 million in 2017. The Energy Information Administration (EIA) expects production to climb an additional 10% next year to 11.9 million b/d. If those forecasts are accurate the U.S. would surpass both Russia and Saudi Arabia and become the world’s largest producer of oil. Surging U.S. oil production should put a cap on how high oil prices can go.

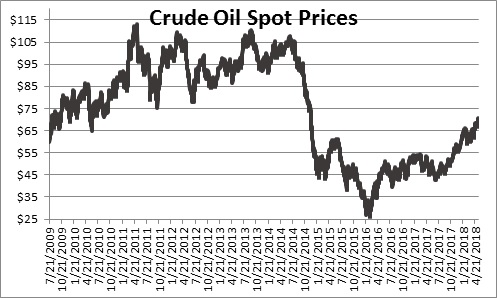

Are oil prices at $70 per barrel a problem for either GDP growth or the inflation rate? Not really. Oil prices were routinely in a range from $90-105 per barrel from mid-2011 to late-2014. GDP growth in those three years was 1.7%, 1.3%, and 2.7%. Unimpressive to be sure. But the economy weathered the storm. Today with tailwinds from tax cuts, de-regulation, and re-patriation of corporate earnings, oil prices at $70 or even $80 per barrel should not be a problem for the economy.

The EIA expects crude prices to average $65.58 per barrel this year versus about $70 currently. Thus, prices should remain high or go a bit higher in the short-term, but then begin to fall somewhat in the final few months of the year.

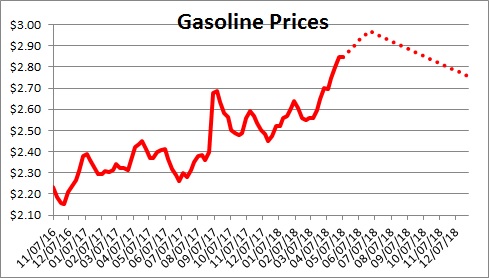

For those of you planning a summer driving vacation this year, the EIA expects gasoline prices to peak at about $3.00 per gallon by late June (versus $2.85 currently), but then decline slowly to about $2.75 by the end of September. Clearly, those prices are higher than last year, but probably not high enough to deter us from doing whatever we had planned (although if we spend a bit more on gas we might have to spend a bit less elsewhere).

On the inflation front, it is important to remember that energy prices are only a small part of our various measures of inflation. For example, the energy component of the CPI (which includes gasoline prices as well as the price of natural gas and electricity) is only 8% of the total. Food accounts for another 13%, and the CPI excluding food and energy represents the remaining 79%. Given the recent runup in gas prices we have raised our forecast of the overall CPI for the year by 0.1% from 2.5% to 2.6%. Oil prices will have to move a lot higher to have any meaningful impact on either GDP growth or inflation. Our forecast for the core CPI remains at 2.4%.

What does the Fed do with all of this? Nothing. It needs to continue on its path towards a 3.0% funds rate. That will include two or perhaps 3 more rate hikes this year which will boost the funds rate to 2.1% by yearend and raise rates an additional three times or so in 2019 to get to the 3.0% mark. The tiny uptick in the overall inflation rate caused by the recent runup in oil prices will not alter its game plan. Remember, its inflation target is the so-called core rate which excludes the volatile food and energy components.

Crude prices of $70 and gasoline prices approaching $3.00 per gallon are disturbing and capture headlines. But stay calm and remember that their impact on the pace of economic activity and inflation will be well contained and not induce the Fed to adopt a more aggressive policy stance.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me