May 5, 2025

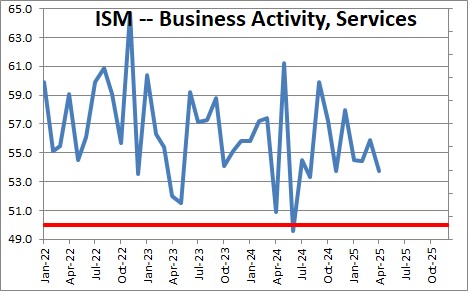

The Institute for Supply Management not only publishes an index of manufacturing activity each month, they publish two days later a survey of service sector firms. The business activity index declined 2.2 points in April to 53.7 after having risen 1.5 points in March. We tend to focus on the business activity component as a measure of “production” because it seems to track better with the pace of economic activity. It has been bouncy in recent months but still shows solid growth in the service sector despite Trumps imposition of tariffs, the early stages of federal government layoffs, and deportation of immigrants.

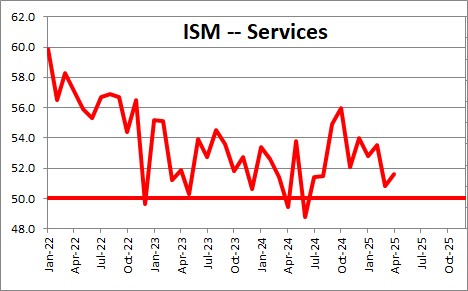

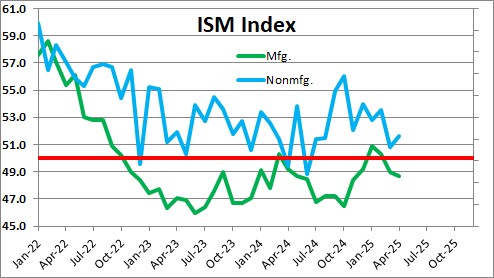

The composite index rose 0.8 point in April to 51.6 after having declined 2.7 points in March. Eleven industries reported growth in April, a drop of three from 14 industries reported in January and February. According to Steve Miller, Chair of the Institute for Supply Management’s Business Survey Committee, “April’s change in indexes was a reversal of March’s direction, with increases in three (New Orders, Employment and Supplier Deliveries) of the four subindexes that directly factor into the Services PMI®. Of those four, only the Business Activity Index had a lower reading compared to March. Employment continues to be the only one of these subindexes in contraction territory, with two straight months of contraction. From December through February, all four subindexes were in expansion. Regarding tariffs, respondents cited actual pricing impacts as concerns, more so than uncertainty and future pressures. Respondents continue to mention federal agency budget cuts as a drag on business, but overall, results are improving.”

At its current level the ISM group says that is consistent with 1.0% growth in GDP. Following a 0.3% decline in the first quarter we expect to see 2.5% GDP growth in the second quarter and 1.9% GDP growth in 2025.

Comments from respondents include:

- “Sales and traffic have improved on track with year-over-year seasonal trends. We seem to be outperforming some of the publicly traded restaurants reporting results.” [Accommodation & Food Services]

- “Tariffs are negatively impacting small business customers. Many small business customers source their products from China. They cannot afford to compete in the marketplace sourcing from other countries. We could not move products fast enough to beat the tariff starting dates.” [Agriculture, Forestry, Fishing & Hunting]

- “Business is steady.” [Construction]

- “There is great concern at my institution (medical school with a research institute and hospital) that changes from the current administration will severely and adversely affect many of the populations we are trying to help live healthier lives.” [Educational Services]

- “We are actively reviewing the impact of tariffs. We are seeing some vendors increasing their prices, and we are actively pushing back on those increases. We expect our vendors to honor our contracted pricing.” [Health Care & Social Assistance]

- “Generally, pricing is lower, but there is some uncertainty of actual, final costs due to tariffs.” [Other Services]

- “Our business is in a state of crises with uncertainty caused by both the ongoing trade war and the threats to federal funding of programs.” [Public Administration]

- “Uncertainty remains the dominating theme as the U.S. government has been maddeningly inconsistent with tariff implementation.” [Real Estate, Rental & Leasing]

- “Tariffs and concerns about government grants still impacting our procurement operations. Some projects are slowing or being held off to ensure we have funds to complete the current work.” [Transportation & Warehousing]

- “The tariff uncertainty is causing a lot of consumption of human capital. We are starting to see some tariff charges, some are significant given the price of the highly specialized units that were ordered over two years ago. Based on our spend over the last couple of years, we will have to adjust our capital and operations and maintenance plans.” [Utilities]

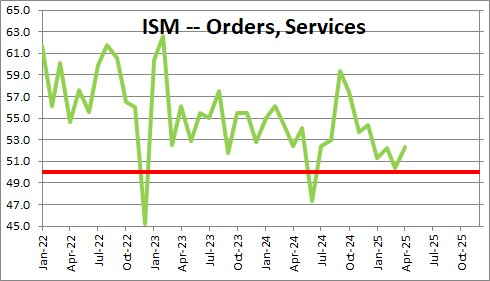

The orders component rose 1.9 points in April to 52.3 after having fallen 1.8 points in March. This index had been steadily declining since September of last year. Comments from respondents include: “Increased number of companies wanting to increase sourcing and manufacturing in the U.S.” and “Business has slowed dramatically due to new approval process required for all new purchases/acquisitions.”

.

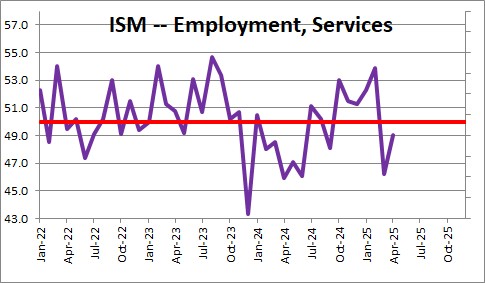

The ISM non-manufacturing index for employment rose 2.8 points in April to 49.0 after having plunged by 7.7 points in March. After increasing for five consecutive months, the employment index collapsed in March and rebounded only partially in April. Eight industries reported an increase in employment in March. Comments from respondents include: “Modest gain due to backfilling many empty positions” and “Hiring freeze due to uncertainty of government grants.”

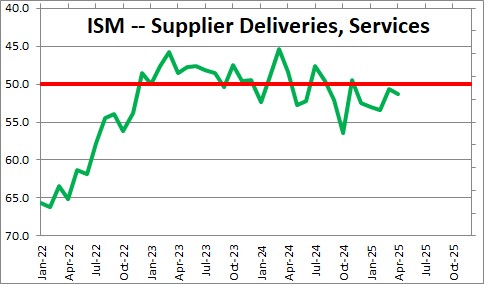

The suppler deliveries component rose 0.7 point in April to 51.2 after have declined 2.8 points in March. This component is reversed in the sense that a reading above 50 percent indicates slower deliveries to service sector firms, while a reading below 50 percent indicates faster deliveries. Thus, firms reported slower delivery times in April for the fifth month in a row. Comments from respondents include: “Still getting way too many substitutions for out-of-stock items with our distributors” and “Steel conduit lead times have increased due to factories unable to keep up with demand.”

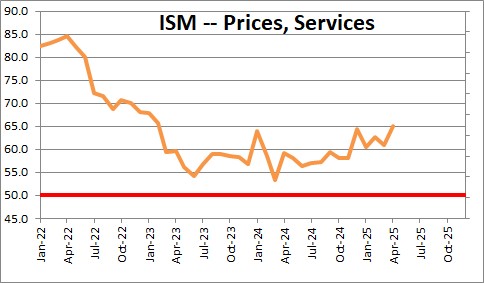

Finally, the price component rose 4.2 points in April to 65.1 after having declined 1.7 points in March. The April reading is the highest since March 2023 and is the 5th consecutive month with a reading above 60.0.. Seventeen of 18 service sector industries reported an increase in prices paid during the month.

The manufacturing sector of the economy contracted every month from November 2022 until January 2025. After rising in January and February the index has since resumed its decline. The service sector continues to expand at a respectable pace. Following a 0.3% decline in GDP in the first quarter we anticipate 2.5% GDP growth in the second quarter and 1.9% GDP growth in 2025.

.Stephen Slifer

NumberNomics

Charleston, SC

Steve –

How can the long bond interest rate remain immune to the very broad based

increases in wages, prices, and inflation? What is the specific linkage between prices

and long bond rates? The data you present seems to indicate that significant

inflation into the latter part of 2021 and 2022 is inevitable, and it’s unclear how

transient it will be.

Hi Frank,

Bond yields are influened by expectations about what is going to happen as much as what is actually going on. Powell says the current pickup in inflation is temporary and that by next year it will drop back to 2.0%. Let’s assume he is right. That means that for the next decade the real rate for the 10-year will be -0.7% (1.3% – 2.0%). In the past decade it has averaged +0.5%. In my world if inflation averages 3.7%, that would make the real 10-year average -2.4%. That is not sustainable. Who in their right mind wants to own a bond that yields 1.3% when its purchasing power is declining by 2.4%. Keep in mind, too, that the Fed is purchasing $120 billion of bonds per month. By the end of this year or early in 2022 the Fed will cut back. Seems almost inevitable that once that starts it will push bond yields higher. Then, with each passing month that inflation does not abate, that should contribute to additional upward pressure on bond yields. To me, a 1.3% 10-year rate is unsustainable.

Steve