February 2, 2024

At first blush the employment report for January appears to be an upside blowout. Payroll employment surged by 353 thousand when a gain of 175 thousand had been expected. Average hourly earnings jumped 0.6% in January versus an increase of 0.3% that had been anticipated. The economy appeared to be on a roll in January. As a result, first quarter GDP growth could continue at the same steamy pace as in the fourth quarter, and Fed easing is off the table for the foreseeable future. But hang on. Hours worked fell 0.2 hour in January. Keep in mind that to boost output in any given month employers can hire more workers or work their existing employees longer hours. In January firms clearly boosted employment, but they slashed the hours that those employees worked. As a result, output declined in January. That is not the conclusion that many economists and market participants reached following the release of the January employment report. Consider the following:

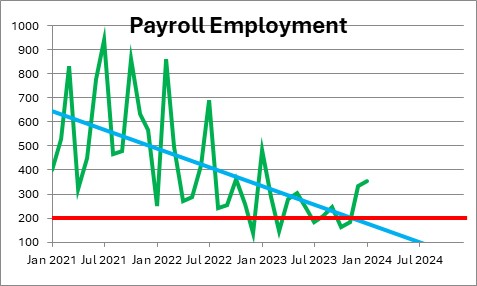

Employment in January jumped by 353 thousand workers after having climbed by 333 thousand in December. After having slowed steadily throughout most of last year, the pace of hiring picked up sharply in December and January. That is not what anybody expected.

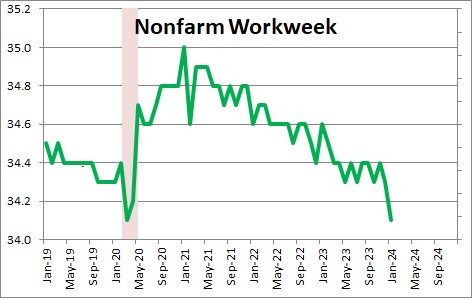

But in any given month employers have a choice of how they want to boost output. They can hire additional workers, or they can work their existing employees longer hours. While hiring surged in January the average workweek fell 0.2 hour to 34.1 hours after having dropped 0.1 hour in December. The combination of a sharp gain in employment and a dramatic drop in the workweek is highly unusual – and puzzling. On the surface it appears that employers are reluctant to lay off workers for fear that they may not be able to get them back once demand accelerates. Instead, they are adjusting the workweek as needed to satisfy the current demand for their product.

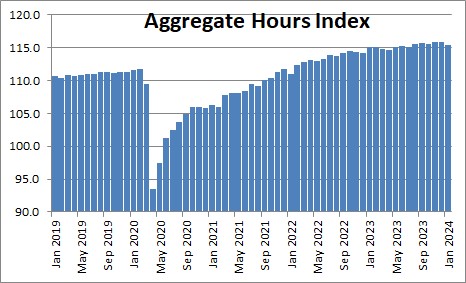

Once economists know how many people are working and how long they worked they can estimate how many goods and services they likely produced in any given month. The BLS publishes something called the index of aggregate hours worked which is essentially the product of employment and hours worked. That index declined 0.3% in January after falling 0.1% in December. Looking at the two increases in employment in December and January one could easily conclude that the economy was extremely robust in those two months. But looking at this index of total hours worked one reaches a totally different conclusion.

So what are we supposed to believe? It is not entirely clear. It is important to remember that these data were for December and January, which encompass both the sharp gains in employment during the holiday season and the subsequent drop in employment in January as these temporary workers were let go. A slight difference in the timing of these changes in employment can produce surprisingly strong – or weak – data in each of those months. Given that job openings remain robust and that the weekly data on layoffs have been largely unchanged, our sense is that the labor market is continuing to chug along at a moderate pace. But in the absence of additional data it is hard to know if the labor market is perhaps shifting gears. We continue to estimate first quarter GDP growth at 1.8%.

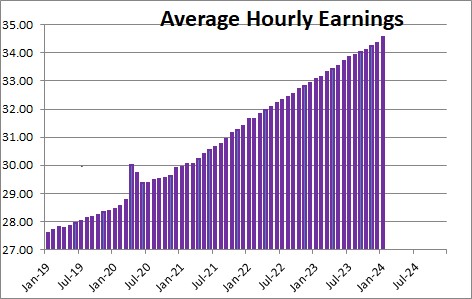

Then there is the matter of the big jump in average hourly earnings in January. According to the BLS hourly earnings jumped 0.6% in January to $34.55. That would be the biggest monthly increase in almost two years and it would certainly be consistent with a very robust labor market where firms are bidding aggressively to attract an adequate number of workers.

The 12 month growth rate in hourly earnings had been steadily slowing for almost two years but it now appears to have hooked upwards. Economists believe that earnings growth should continue to diminish as the year progresses. But the January run-up forces them to readdress that conclusion.

From the Fed’s viewpoint a resurgence of hiring and a re-acceleration of hourly earnings are inconsistent with slower GDP growth and a gradual reduction in inflation. We are not convinced that the labor market and the economy have changed all that much in the past couple of months. As a result, we continue to anticipate GDP growth of roughly 1.8% in the first couple of quarters of this year, and a gradual slowing in the core CPI from 3.9% currently to 3.2% by midyear. If that forecast is relatively accurate we should get the first rate cut in July.

But if the labor market is as strong as it appeared in January, first quarter GDP growth could be much more rapid than 1.8%. Indeed, the widely followed Atlanta Fed GDPNow forecast currently calls for 4.2% growth in the first quarter. The January employment report is the first hint of how the economy is doing early in the year, but there will be many more pieces of information to be received as the quarter progresses which will eventually cause the widely divergent GDP estimates to converge. For right now sit tight for now and await further information.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me