October 4, 2019

A strong consensus has emerged that the economy has softened considerably which many people think will result in a recession by the end of next year. We could not disagree more. It seems to us that most economists are viewing slower employment growth as an indicator of a drop-off in demand. That may be true in some industries like manufacturing but, for the most part, smaller employment gains merely reflect tightness in the labor market. Firms cannot find enough qualified workers to hire.

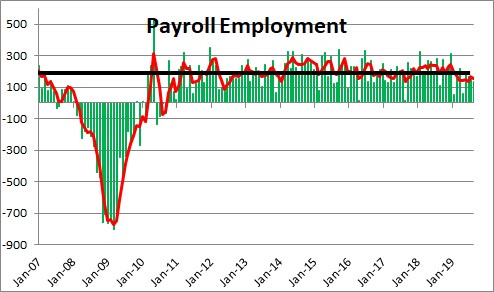

Payroll employment for September rose 136 thousand. Over the past three months it has climbed on average 157 thousand per month. That compares to an average increase last year of 223 thousand. The naysayers conclude that the economy has downshifted, slower growth will spread throughout the rest of the economy, and a recession is likely by the end of next year.

But hang on, we think they are misreading the tea leaves.

There is an alternative measure of employment which is used in the calculation of the unemployment rate. This measure of employment includes self-employed workers which are not included in the payroll employment data and it tells a very different story. Trends in the two series are similar even though monthly observations may vary widely. For example, in 2018 this alternative measure of employment rose on average 240 thousand per month, not significantly different from the 223 thousand average increase in payroll employment. But in September payroll employment rose by just 136 thousand. This alternative measure climbed by a whopping 391 thousand (after having jumped 590 thousand in August). While everybody is quick to jump on the slow employment bandwagon, this alternative series suggests that one ought to be careful about going too far down that road.

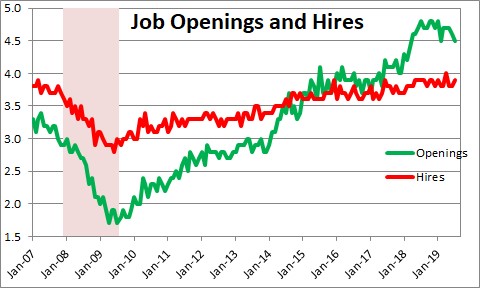

If the labor market is weakening, why are job openings continue to outpace hiring? That is a clear indication that firms want to hire more bodies than they can find.

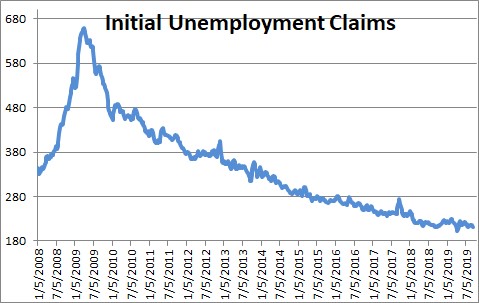

If the labor market is so weak why are initial unemployment claims (a measure of layoffs) and a leading indicator of future changes in employment at the lowest level since 1969?

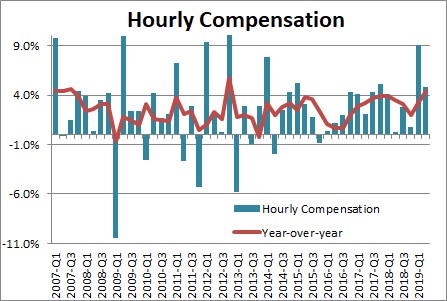

If the labor market is so weak why has worker compensation in the past year accelerated to a 4.4% pace? We suggest that firms are boosting compensation not only to keep their existing employees from jumping ship, but also to steal workers from other firms by offering more attractive compensation packages.

All of these factors suggest that slower employment growth is not the result of reduced demand for workers, but merely a reflection of the tightness in the labor market. Qualified workers are hard to find. Those two differing interpretations lead to very different conclusions. If the pessimists are right, slower employment growth will spread throughout the economy and perhaps even lead to a recession next year. If we are right, the economy remains on solid footing but growth is constrained because firms cannot find an adequate supply of qualified workers.

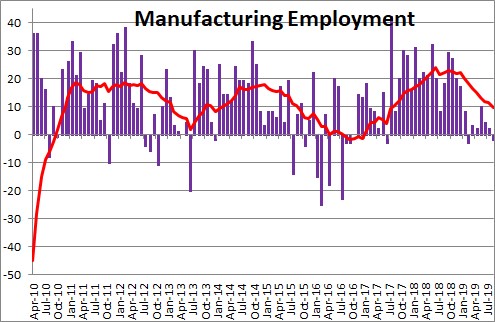

We do not want to argue that there are no soft spots in employment. There are. Specifically in the manufacturing sector. In the past year monthly employment gains appear to have slipped from roughly 25 thousand per month to perhaps 5 thousand.

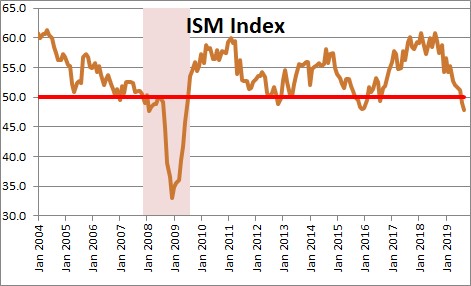

Clearly, the manufacturing sector is weak. The monthly Institute for Supply Management (ISM) report on conditions in the goods-producing sector has been steadily declining for a year. Indeed, in August and September the index slipped below the 50.0 level which means that in those two months the manufacturing sector actually contracted slightly.

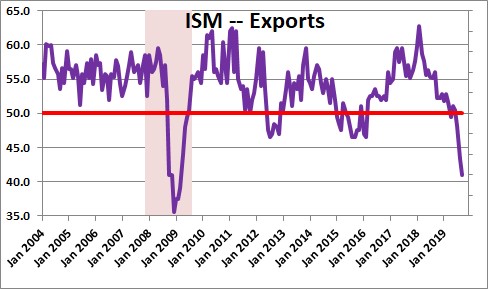

Why the drop off in the manufacturing sector? Trade. Exports orders have plunged as overseas growth has slowed dramatically. Indeed, the ISM index for exports is almost as low as it was at the bottom of the 2008-2009 recession. That sounds scary. But, once again, be careful.

The manufacturing sector is just 11% of the U.S. economy. Service-producing sectors are 70%, government is 12%. Thus, 82% of the economy seems to be doing just fine. The construction sector, which represents another 4% of the U.S. economy is gathering some momentum in response to near-record low mortgage rates of 3.6%. To argue that the weakness in manufacturing will pull down the entire economy is letting the tail wag the dog. That is not going to happen.

So, as we see it, one relatively small sector of the economy is exhibiting weakness and it gets a lot of play in the press. Many economists and market commentators are inferring that manufacturing sector weakness exists throughout the economy. That is not the case. Growth in other sectors is doing fine. As a result, GDP growth may get dinged slightly as third quarter growth slips to 2.3%. But there is nothing we see that suggests any long-lasting growth slowdown. We anticipate 2.4% GDP growth in 2020 versus 2.5% growth this year.

Stephen Slifer

NumberNomics

Charleston, S.C.

Great stuff Steve!

Stephen, thank you for you analysis. I think you are dead on.

Darrel

Hi Geoffrey. Nice to hear from you. I can’t for the life of me figure out why everybody is so negative. But, then again, they probably same the same thing about me. I guess time will answer all questions!

All the best.

Steve

Hi Darrel,

Thanks for your note. I keep plugging away but there are so many balls in the air right now I fear missing something! I keep wondering if this expansion has been going on so long that people are convinced that a recession just has to be around the corner. Or, perhaps, so many market participants only remember the 2008-2009 recession. After all the previous 2000 recession was almost 20 years ago. If their only experience is with 2008-2009 they are scared to death that the next recession will be equally ugly. Not sure.

Stay in touch.

Steve