April 5, 2019

The economy experienced a number of damaging shocks in the past six months as the stock market plunged in the fourth quarter followed by the protracted government shutdown. As a result, GDP growth in the fourth quarter slipped to 2.2%. We do not yet know what first quarter growth will be but it should be about 1.5%. It would be a serious mistake to interpret slower growth in those two quarters as a harbinger of subdued growth down the road. Why? Because recent data indicate clearly that the economy has shrugged off their temporary negative impact on growth. We expect a relatively robust 2.9% rate of expansion in the second quarter followed by roughly similar growth in each of the final two quarters of the year.

The path forward will be determined by confidence – The combination of investor, consumer, and business confidence.

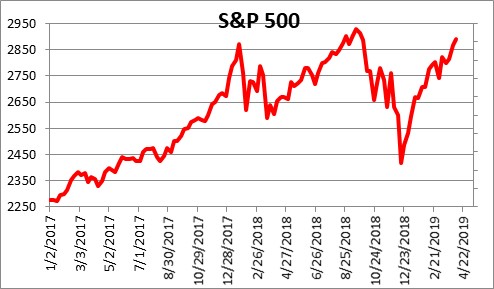

With respect to investors, after a sharp 20% selloff late last year the S&P 500 index has regained almost all of what was lost and is now less than 2.0% below its previous record high level. Earnings season is upon us and we will see a steady diet of first quarter earnings reports in the weeks ahead. The markets are poised for a string of disappointing data. We are unconvinced.

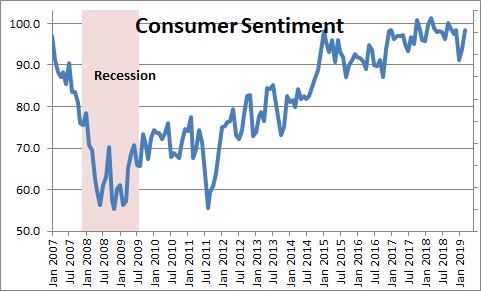

The upswing in stock prices will bolster consumer confidence. Indeed, the University of Michigan series on consumer sentiment has already fully recovered. At 98.4 in March it is just a shade below the September level of 100.1 which is where it was prior to the stock market drop. With the reassuring increase in payroll employment for March of 196 thousand, consumer sentiment may have increased further. We expect consumer spending to grow about 2.5% this year.

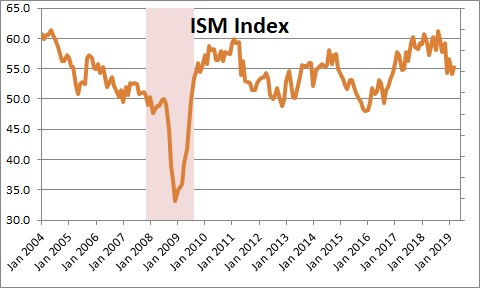

Business sentiment can be gauged by several economic indicators. First, the purchasing managers index reflects business leader’s judgment about the combination of orders, production, employment and prices. It has slipped in recent months to 55.3 from a high of about 60.0 at the end of the third quarter. But before leaping to a conclusion that the manufacturing sector has weakened, keep in mind that the ISM group tells us that the current level of the index is consistent with GDP growth of about 3.0%. Its earlier level was consistent with GDP growth of 4.5%. So, while manufacturing sentiment has softened, it remains at a lofty level that is indicative of robust GDP growth for the foreseeable future. The ISM group produces a similar index for non-manufacturing firms which looks virtually identical.

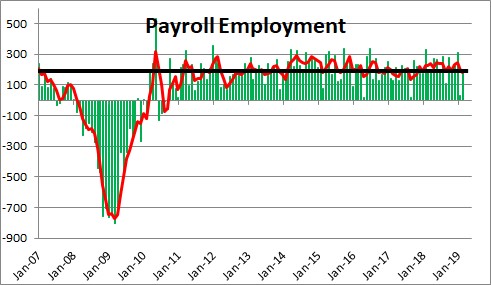

Business people can also vote with their feet through their hiring decisions. When the increase in payroll employment for February slipped to 33 thousand the naysayers concluded that the economy had downshifted and quickly lowered their GDP estimates for the year. But, lo and behold, employment registered to a stronger-than-expected increase of 196 thousand in March. Last year the monthly average increase in employment was 223 thousand. It certainly seems to us that employers remain eager to hire any roughly-qualified job applicant.

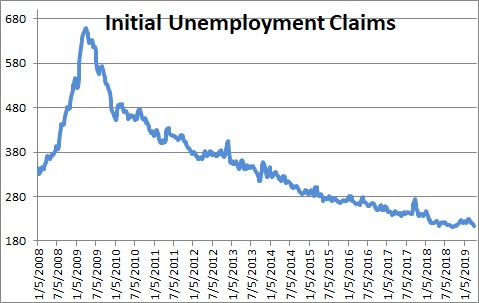

Economists often look at initial claims for unemployment insurance because it is a measure of layoffs. It also happens to be a leading indicator of future employment. At the end of March claims dropped to 202 thousand which is the lowest weekly level of claims in 50 years. That gives us confidence that we will see a robust employment gain in April, and that the economy will make up for lost ground in the second quarter and register (we hope) GDP growth of 2.9%.

Given what has been happening to consumer confidence, business confidence, the labor market, and the stock market, it is hard for us to understand why most economists remain so worried. As we see it, with the labor market very tight and additional workers hard to find, employers will continue to spend money on technology to boost output. The increase in investment will boost productivity growth. Faster growth in productivity will raise our economic speed limit within a couple of years to 2.8%. Faster growth in productivity will simultaneously offset much of the increase wages. Unit labor costs, labor costs adjusted for the increase in productivity, are currently rising at a 1.0% pace. As a result, the inflation rate will continue to rise at a subdued pace for the foreseeable future. And if the inflation rate behaves the Fed will be hard-pressed to raise rates further.

What’s not to like?

Could we be wrong? Of course. But if we are wrong, we are not under any set of circumstances staring at a recession by the end of this year or in 2020. Instead, our worst-case scenario would be for GDP growth of perhaps 2.2% this year instead of the 2.6% we currently anticipate. Alternatively, the herd of other economists that anticipate a recession within a year could just as easily be wrong. We obviously think they are barking up the wrong tree. They probably say the same thing about us. We will see.

Stephen D. Slifer

NumberNomics

Charleston, S.C.

Stephen, on who is “barking up the wrong tree,” I trust you. Your insights are always remarkable and accurate.

Darrel