April 4, 2024

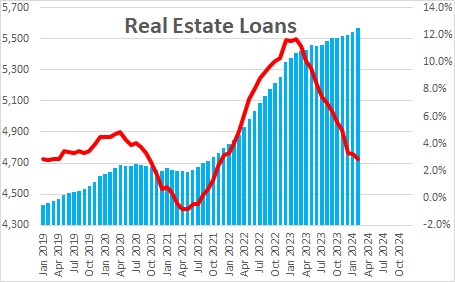

Real estate loans have been growing steadily for a number of months. Specifically, they rose at a 4.4% pace in February. That means that they have risen 2.9% in the past year. If home sales quicken this year, as expected, mortgage loans should also grow more rapidly as the year progresses.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me