May 23, 2025

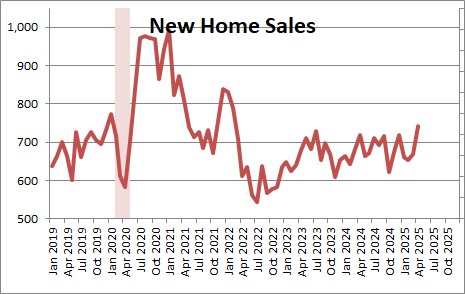

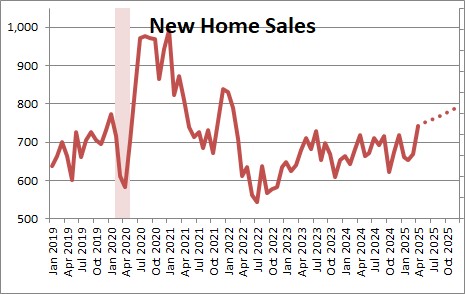

New home sales jumped 10.9% in April to 743 thousand after having risen 2.6% in March. In the past year new home sales have risen 3.3%. New home sales can be volatile from month to month, but it seems clear that they are in a gradual uptrend.

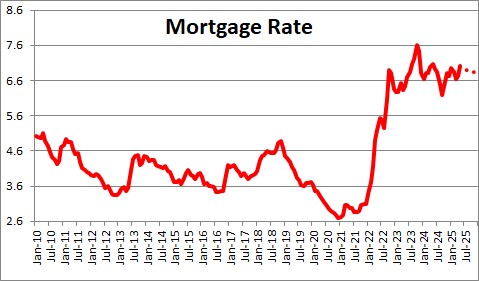

Mortgage rates are now 6.9%. If inflation remains relatively steady mortgage rates should remain at about that level at the end of the year.

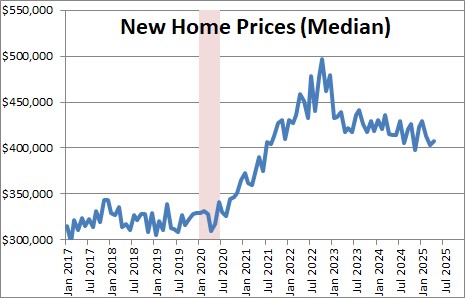

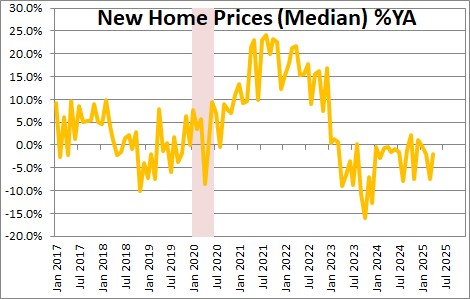

Home prices rose 0.9% in April to $407,200 after having fallen 2.1% in March. They tend to be rather bouncy from from to month but over the past year new home prices have declined 2.0%.

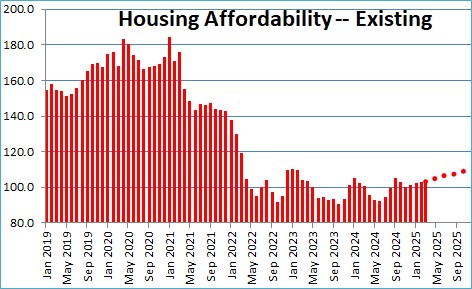

Housing affordability currently stands at about 103 which means that median-income earning consumers have 3.0% income required to purchase a median-priced home. If mortgage rates are fairly stead, home prices are fairly steady, and income continues to climb, affordability should rise as the year progresses, and that median income earning family should have about 10% more income than required by the end of this year. This should provide some stimulus for both new and existing home sales.

As a result, we look for new home sales to rise from 743 thousand currently to 790 thousand by the end of 2025.

Stephen Slifer

NumberNomics

Charleston, SC

Enjoyed your presentation today AND very well attended!

One idea that I have read lately, is changing the actual goal for inflation from the stated 2.5% to something higher. Apparently the reasoning is that the 2.5% is outdated and does not take into account our current economic environment.

Wanted to get your assessment of that possibility, so the Fed would actually change the goal?

Thanks!

Hi Richard,

First of all, thanks for coming. I, too, was pleased with the turnout. These people keep coming back year after year. The corporate tables sold out in 24 hours. I am flattered by the fact that so many people are interested.

There has been discussion about raising the desired rate of inflation from 2.0% to something higher. That is possible but, in my view, that is unlikely to happen. Inflation is a like a tax. It erodes purchasing power (as we have seen lately). If inflation goes up, workers will demand higher wages to compensate. So instead of having to lobby for a 2.0% pay hike every year, now people will have to lobby for 3.5% wage gains each year to just stay even (i.e., for real wages to stay the same. If inflation rises, interest rates will be higher (bond investors usually want a return of some amount above the inflation rate). If interest rates rise, it costs the government more to finance its debt. I personally think it is a bad idea.

And re: the fact that a 2.0% inflation target is outdated. Why exactly is that? The Fed did not have a problem keeping it at or below 2.0% for the past 20 years. It wasn’t long ago that the Fed was worried that the inflation rate was too LOW. It has jumped the past two years because of all those problems I mentioned at the conference. The Fed started raising rates in March of this year which, I think, was about 18 months too late. They let the problem get out hand. And we were adding more fuel to the fire in January and March of 2022 with additional fiscal stimulus when the recession ended in April 2020. Remember the chart re: the total amount of stimulus? $9.5 trillion of stimulus to fix a $2.2.trillion GDP shortfall. I don’t think the Fed should be fiddling with its target, it should do a better job of carrying out its policy.