April 19, 2024

Economic forecasts have been notably inaccurate for the past couple of years. Virtually every economist expected a recession in the second half of last year. But growth for the year was a solid 3.1%. Most economists expected the inflation rate to slow rapidly in 2024 which would allow the Fed to cut the funds rate four times by the end of the year. Now the expectation is for a single 0.25% cut. The problem is that the economic environment today is very different from what it was prior to the recession. Economic models are based on history. As long as the structure of the economy does not change much, they can be helpful. But in this case the world has turned topsy-turvy since the 2020 recession and, as a result, the models have broken down. Nobody – including our policy makers at the Fed — can be certain what comes next. The world has changed. We do not yet know what the new world looks like.

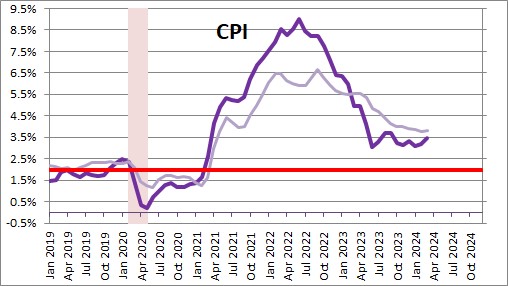

In 2021 the Federal Reserve told us that the inflation surge was being caused by supply shortages because the economy rebounded from the recession far more quickly than anticipated. Thus, the higher inflation rate would prove to be temporary, which meant that prices would eventually decline. They did not. Prices rose rapidly and then continued to rise at a slower rate. They never declined. As a result, the price of most food items – beef, chicken, pork, eggs, milk, bread are far higher today than they were a couple of years ago. Rents have surged. Ditto for gasoline, automobile insurance, auto repair. All of those items are necessities. You have to eat. You have to pay the rent. You have to keep the car working to get to work. There are no lower-priced alternatives. Younger, lower income earning families are most vulnerable.

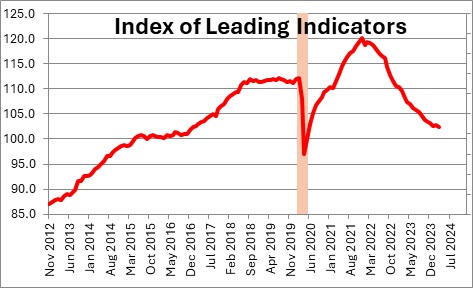

Many economists use the index of leading indicators published by the Conference Board as a tool to predict the next recession. While not infallible the index has a fairly good track record of predicting a recession 3-6 months in advance. This index peaked in December 2021 and has been in a steady decline for the past 27 months but there is little evidence that a recession is imminent. This index has never fallen this far, for this long, without a recession. So what gives? Is the economy simply taking longer to shift gears and a recession is still in the works at some point down the road? Or has the relationship between the economy and the ten indicators that comprise the index changed and they are no longer reliable leading indicators?

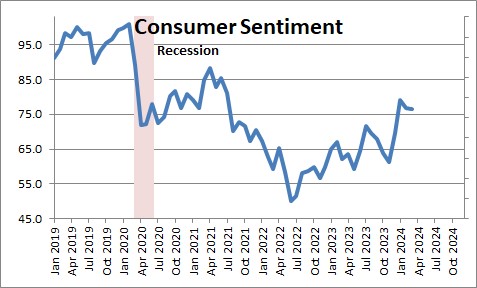

Consumer sentiment is still 20 points lower than it was prior to the recession as consumers fret over the still high inflation rate. Typically when sentiment falls sharply consumers retrench and consumer spending declines. Not this time. Consumers keep spending at a vigorous pace. But they are running up credit card bills to maintain their lifestyle which is not a sustainable development. Consumers cannot keep tacking on very expensive credit card debt. But with little debt outstanding at the moment, consumers are able to keep spending for some time to come. But exactly how long is that?

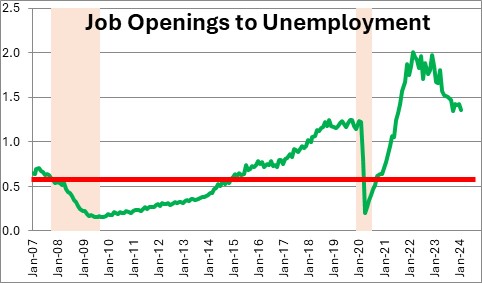

The labor market remains extremely tight. Job openings peaked at 12.0 million in March 2022. At that point there were 2.0 job openings for every unemployed worker. Today there are 1.4 . But that is not normal. Typically there are fewer job openings than unemployed workers. Prior to the recession the ratio averaged about 0.6. The labor market remains tight and it would be even tighter were if not for the influx of mostly illegal immigrants streaming into the U.S. from Mexico.

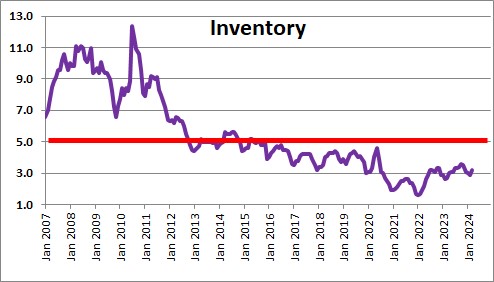

The supply of homes available for real estate agents to show a potential home buyer has shrunk to a near-record low lower. Realtors suggest that supply and demand in the housing market are roughly in balance when there is a 5.0-month supply of homes available for sale. Today there is a 3.2-month supply because homeowners today have a mortgage rate on their current home of 3.0-3.5%. If they choose to sell and place a mortgage on their next home, the new mortgage rate will be about 7.0%. That is not an attractive trade. Frustrated buyers have in many cases been able to find a new home that satisfies their needs because the available supply there is about 8.0 months. We have never experienced a situation in which homeowners are so reluctant to move.

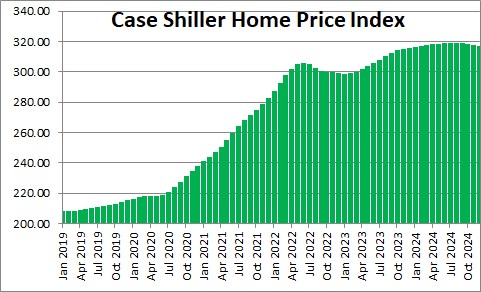

After the recession home prices skyrocketed. In two years home prices rose more than 40%. At the same time mortgage rates rose from 3.0% to 7.0%. Many first time home buyers have been shut out of the market. Given these unprecedent changes in the housing market what happens next?

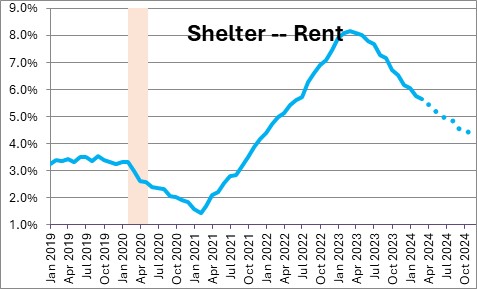

The shortage of homes available for purchase has boosted the demand for rental units which has lifted rents. In the past year rents have risen 5.6%. The problem is that shelter makes up one-third of the entire CPI index. There is no chance of achieving a 2.0% inflation rate when one-third of the index is rising at a 5.6% pace. Rents seem to be slowing, but not quickly.

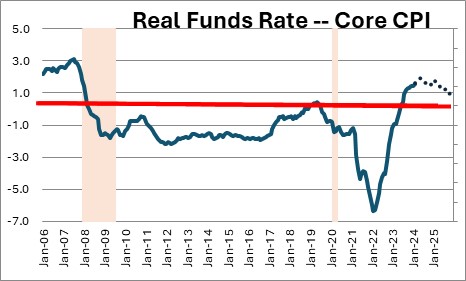

Finally, the Fed tells us that its policy is “neutral” when the funds rate is 0.5% above the inflation rate – i.e., when inflation is 2.0% the funds rate should be 2.5%. Today the funds rate is 5.5% the core CPI is 3.8%, hence the funds rate is 1.7% higher than the inflation rate. Fed policy appears to be ”restrictive”. But if Fed policy is “restrictive” why is the economy still charging ahead at a 3.1% pace? The equilibrium funds rate is probably no longer 2.5% but something higher. 3.0%? 3.5%? Nobody knows for sure.

The point of all this is that the world has changed dramatically since the 2020 recession. The interaction between the various sectors of the economy is not what it used to. The old rules do not work, and we do not yet know the new ones.

Stephen Slifer

NumberNomics

Charleston, S.C.

Stephen

Let’s not forget about $6 trillion in government spending, a massive budget deficit and geopolitical instability.

Hi Casey,

Government spending and budget deficits have been growing for years bupt they have certainly exploded in the past four years.