April 6, 2018

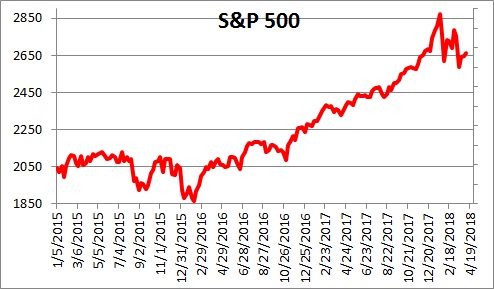

Sometimes when watching the stock market’s shenanigans, it is easy to lose track of the big picture. We get it. When the market moves up or down 500 points on successive days, it is easy to conclude that the stock market is emitting a warning signal that all is not right in the economy. Stock market volatility is unsettling. But sit back, take a deep breath, and try to figure out why the stock market has been reacting so violently. Determine in your own mind whether that is likely to have any long-lasting impact on the economy. If you are a consume are you any less willing to buy that new car or house? Do you have any desire to postpone that long-planned summer vacation? If you are a business person have you seen any drop-off in your order book? Are you considering layoffs or cutting back on the hours your employees work? Our guess is that in the current environment none of you are contemplating any of the above. As we see it the economy is expanding nicely.

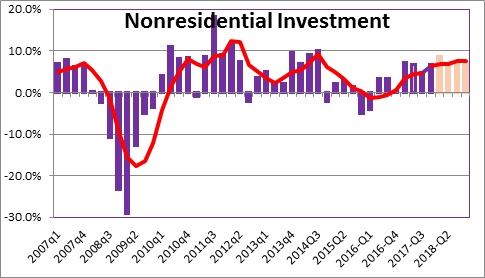

On Friday morning, April 27, we will get our first look at first quarter GDP growth. We expect it to be 2.5%. That means that in the last four quarters we have seen GDP growth of 3.1%, 3.2%, 2.9% and 2.5%. That represents average growth of 2.9%. In the previous four quarters it averaged 2.0%. Not too shabby. In that first quarter we anticipate consumer spending of 1.9% which is a bit on the slow side, however that follows a 4.0% increase in the fourth quarter of last year. Consumer spending seems to be holding up nicely at about 2.5%. Importantly, investment spending should surge to an 8.5% pace in the first quarter and register average growth of 6.8% in the past four quarters. Remember, this is the GDP component which registered virtually no growth in 2015 and 2016. It is amazing what tax cuts, repatriation of earnings, and regulatory relief can do to encourage business people to spend.

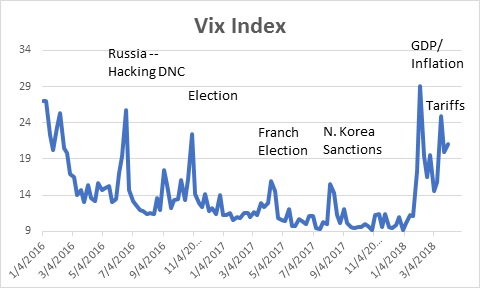

While first quarter GDP growth is now history, you might ask whether the recent stock market behavior is likely to impact the pace of economic activity in the second quarter and beyond. But first note that the S&P 500 index – despite its recent ups and downs – is only 7% below its record high level. It feels much lower than that. Also note that, thus far, none of the high frequency data series are sending out any warning signals.

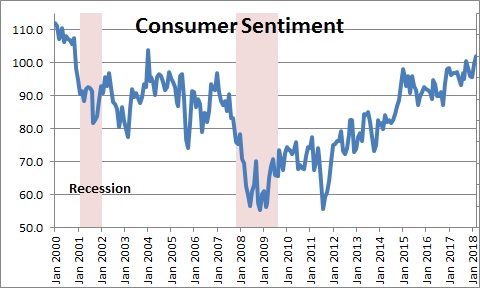

Consumer sentiment, for example, was 102.0 for the first half of March and 100.8 in the second half which gives an average level of 101.4 for the month. That is the highest level of sentiment since January 2004. The consumer does not seem to be bothered at all by the recent stock market volatility.

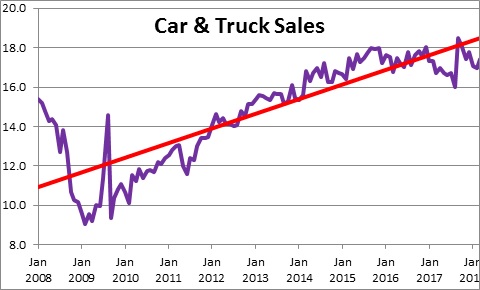

Car and truck sales climbed 2.5% in March to a respectable 17.4 million pace. Sales have slipped in recent months in part because of lousy weather conditions in many areas of the country. Eventually, the weather will improve, and sales will rebound.

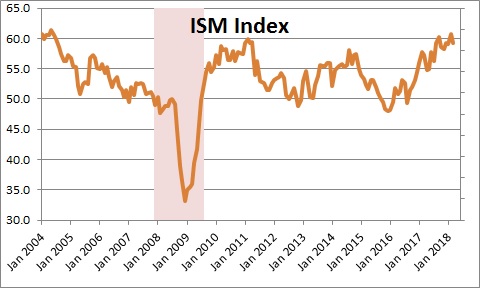

The Institute for Supply Management index of conditions in the manufacturing sector fell 2.4 points in March to 57.3, but that was from a February level which was the highest since May 2004. It is hard to characterize the March decline as an indication of emerging softness amongst manufacturers.

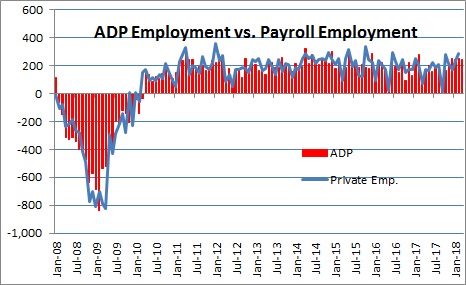

Then there is the ADP employment survey for March which revealed an increase of 241 thousand which is virtually identical to the 243 thousand average increase for the past three months. The labor market continues to be hot and one wonders where all these hirable bodies are coming from. Once again there is no hint of a change in business’ employment practices.

The stock market is clearly nervous about the possibility of a full-blown trade war. Fair enough. But the skirmish at this point seems largely focused on the Chinese. Trump seems intent on forcing the Chinese to alter their way of doing business which is a legitimate objective because China does not play by the same rules as everybody else. While nobody can predict exactly how this will turn out a couple of things are important. First, nobody wins a trade war. Trump’s tariffs may well inflict damage on the Chinese economy, but U.S. consumers and companies will also end up getting hit. Second, this is not the piece that will end the current expansion. Having said that, it could trim GDP growth a bit and boost inflation later in 2018 and beyond if these issues are not resolved in a timely manner.

Stephen D. Slifer

NumberNomics

Charleston, S.C.

Hi Steve,

Just wanted to say hi and hope you are doing well. I really enjoy your Numbernomics comments just as I did it the past at Lehman Bros.

Enjoy your weekend!

Best,

Mike

Hi Mike,

So nice to hear from you. Thanks for taking the time to send your note. I gather that you are still hanging in there at Barclays. I still look back fondly on the time spend at Lehman. Lots of great people to work with — and a good firm. Too bad about the ending, but we all go on.

All the best.

Steve