May 2, 2024

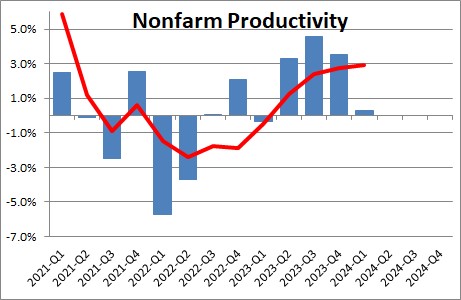

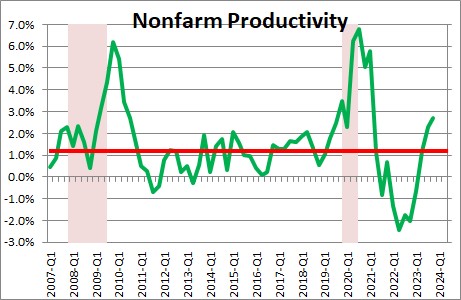

Non-farm productivity rose 0.3% in the first quarter after having climbed 3.5% in the fourth quarter after having jumped 4.6% in the third quarter. The first quarter increase consisted of a 1.3% increase in output combined with a 1.0% increase in hours worked. Hence, a 0.3% increase in productivity in that quarter. In the past year productivity has risen 2.9% which, with the exception of the pandemic years, is the biggest 4-quarter increase in productivity we have seen since 2010 — as we were coming out of the 2008-09 recession.

Productivity data are notoriously volatile so reading much into movements that occur over a couple of quarters is risky. But it is possible that because firms have been unable to hire as many workers as they wanted for the past couple of years they have been spending a lot of money on technology to boost output without increasing headcount. Could it be that all of that spending on technology is beginning to pay dividends in the form of faster growth in productivity? We think that is the case and, as a result, we expect productivity growth to continue at a rate far in excess of the 1.4% pace it has registered on average in the past 23 years.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me