May 2, 2025

In any given month employers can boost output by either additional hiring workers or by lengthening the number of hours that their employees work. Payroll employment climbed by 177 thousand in April In the past three months the average increase has been 155 thousand.

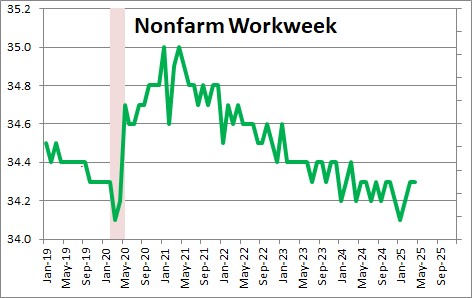

The nonfarm workweek was unchanged in April at 34.3 hours after having risen 0.1 hour in March Prior to the recession the nonfarm workweek was averaging 34.4 hours so it is roughly the same as was five years ago.

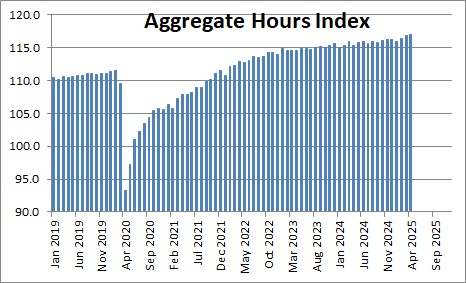

The changes in employment and hours worked are reflected in the aggregate hours index which rose 0.1% in April to 117.0 after climbing 0.4% in March. This index appears to be on track for an increase of 2.3% in the second quarter. We are currently anticipating GDP growth of 2.5% in the second quarter following the 0.3% drop in the first quarter, and we are expecting GDP growth of 1.9% for the year as a whole.

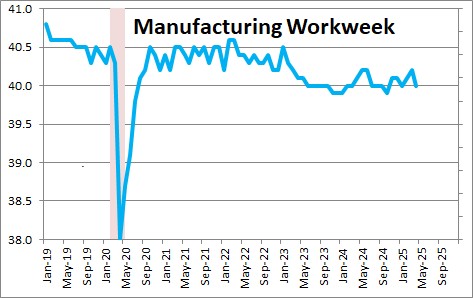

The factory workweek declined 0.2 hour in April to 40.0 after having risen 0.1 hour in March. The manufacturing sector has been fairly steady in recent months.

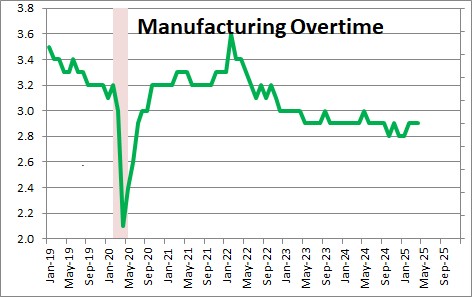

Overtime hours were unchanged in April at 2.9 hours after having been unchanged in March..

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me