November 17, 2017

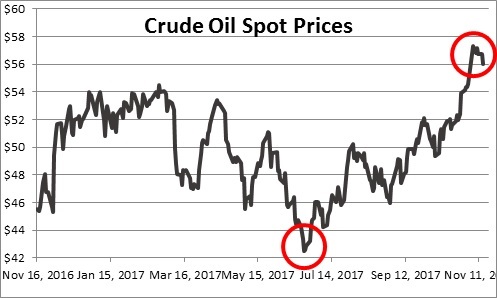

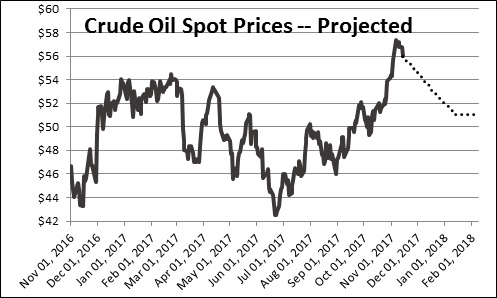

Crude oil prices reached a low of $42.50 in late June. They have since climbed to $57 per barrel. What has caused the recent run-up in prices, and what will crude and gasoline prices be in 2018?

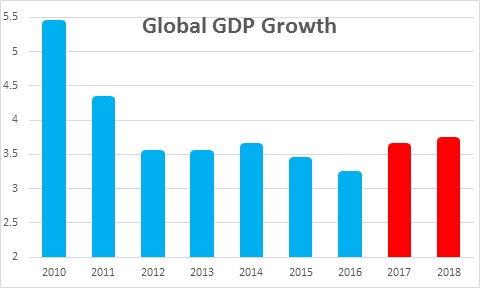

Since mid-year it has become increasingly apparent that global GDP growth has accelerated in virtually every region. In October the IMF raised its global GDP growth forecast for 2018 to 3.7% which would be the fastest pace of global economic activity since 2011. The United States had GDP growth of 3.1% in the second quarter, 3.0% growth in the third quarter, and fourth quarter growth is projected to be about 3.5%. This would be the first time growth has exceeded 3.0% for three consecutive quarters in more than a decade. An acceleration of growth is evident in Europe where the IMF expects growth of 1.9% in 2018 – the fastest pace since 2010. The IMF boosted its 2018 forecast for China by 0.2% to 6.5%. It has similarly lifted its growth expectation for emerging market nations, Latin America, and Africa. Thus, growth is accelerating all over the world and reflects a combination of tax cuts in the U.S., ultra-easy monetary policy in the U.S., the U.K., Europe, and Japan, and higher oil prices which have allowed many oil-exporting nations to emerge from recession.

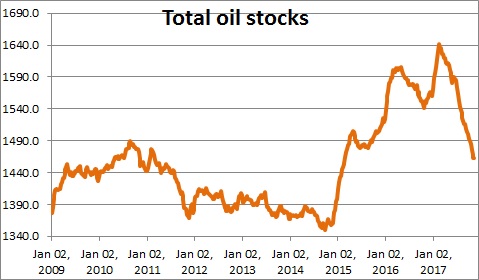

As demand has risen, previously bloated oil inventory levels have declined almost weekly since early February. Thus, the pre-September rise in oil prices from $42.50 to about $50 per barrel cannot be dismissed. It is being driven clearly by a pickup in demand.

But the subsequent rise in crude prices from around $50 in late August to $57 began almost to the day when Hurricane Harvey struck the Gulf Coast. Hence, one suspects that damage to production and refinery facilities in the region has been largely responsible for the additional price run-up.

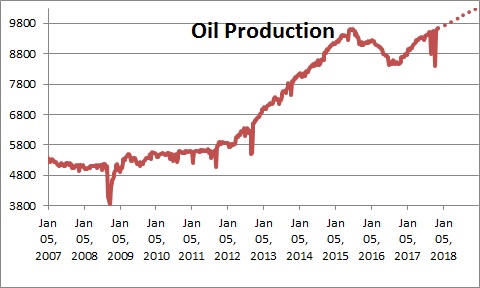

Oil production statistics from the Energy Information Administration show that production plunged in late September but has quickly rebounded to a near-normal pace of 9.6 million barrels per day. The IEA estimates that production will continue to climb to a record pace of 10.0 million barrels per day in 2018 (which eclipses the previous record of 9.6 million barrels per day set in 1970). But will that be sufficient to satisfy demand and reduce prices?

The IEA expects crude oil prices to slip from their current level of $57 per barrel and average $51.00 in 2018. But that is a forecast which may or may not prove to be accurate. However, it strikes us as a plausible scenario given that much of the recent run-up in prices appears to be the result of a hurricane-induced interruption in supply which means that it is likely to be reversed.

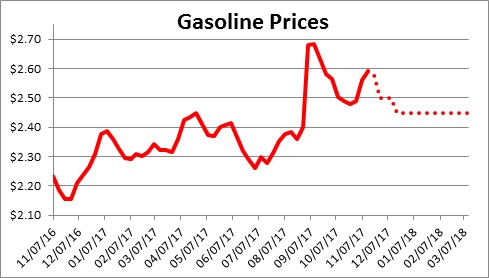

With respect to gasoline prices the situation is similar. Pump prices rose from $2.25 in the middle of this year to about $2.70 per gallon in the wake of the two hurricanes. They are currently at $2.60. The EIA expects gas prices to fall $0.15 further and average $2.45 next year. For those of us in the low country prices are generally about $0.25 lower than the national average which works out to about $2.20 per gallon.

The recent run-up in both crude oil and gasoline prices is impressive and perhaps somewhat alarming. While some of the rise since midyear reflects a pickup in global demand, a significant portion of the recent increase is hurricane related and will be reversed in the weeks and months ahead. If that is the case oil will not be a problem for 2018. But oil prices are notoriously volatile, and the EIA expectation of relatively stable prices next year reflects its estimate of the actual pickup in global demand, an estimate of the speed-up in production in the U.S., and some guess about the likely response by OPEC. OPEC ministers will next meet in Vienna on November 30 and are widely expected to continue the previously-adopted production cuts through March 2018. Thus, there are a lot of balls in the air and oil price movements may or may not behave as expected. For now, oil prices are not expected to be a major factor in the estimates of either GDP growth or inflation next year but, as always, we will see.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me