January 12, 2024

The next move by the Fed will be to lower interest rates. But when? Before the Fed begins to reduce the fed funds rate, it will first stop shrinking its balance sheet. It has been letting some securities mature each month without being replaced in an effort to reduce the amount of surplus liquidity in the economy (as measured by the money supply). By spring that surplus liquidity will essentially be eliminated and the Fed can end this practice. A separate decision to cut rates will depend largely upon further reduction in the core rate of inflation. With all excess liquidity in the economy having disappeared by spring, the core CPI will likely slow from 3.9% currently to perhaps 3.2% by midyear. This 0.7% reduction in the rate of inflation means that the real funds rate will have risen by 0.7% during that period of time. If by midyear the funds rate is 5.5% and core CPI has fallen to 3.2%, the real funds rate would be 2.3%. A real rate that high could actually slow the pace of economic activity. Not good. This increase in the real rate should be the catalyst for the initial rate cut sometime during the summer. With the economy still growing at a moderate pace, the inflation rate slowing, and interest rates beginning a likely two-year period of steady declines, it is easy to envision the current expansion continuing at least through the end 2026.

On January 25 we will get our first look at fourth quarter GDP. We expect to see growth of 1.8%. That represents a sharp slowdown from the surprisingly rapid 4.9% growth rate in the third quarter. However, the economy’s speed limit (its potential growth rate) is 1.8%. GDP growth of that magnitude is impressive. Thus, the economy continues to defy economists’ dire expectations. Having said that, consumers are dipping into savings and relying on credit cards to maintain their lifestyle. And after more than three years student loan borrowers are resuming monthly payments to the government. As a result, GDP growth is expected to slow to 0.7% in the first half of 2024.

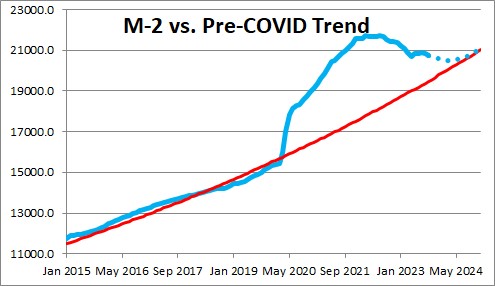

Our expectation that the core inflation rate will continue to shrink is based largely on growth in the money supply. We have been hawking this idea for the past several years. When the government shut down the economy in March 2020 the Fed purchased enormous quantities of government securities and continued its buying program through March 2022. Its action boosted the money supply and flooded the economy with liquidity. At the end of 2021 the economy had $4.0 trillion of surplus liquidity. No wonder the inflation rate soared! Since then, the Fed has allowed some of its security holdings to mature each month and not be replaced. In other words, it has been shrinking its balance sheet which has caused the money supply to contract. Today there is about $1.0 trillion of surplus liquidity remaining, and if the Fed continues to shrink its balance sheet in the early part of this year the remaining excess liquidity should be eliminated by spring. In March we expect the Fed to announce the end of this so-called “quantitative tightening” program.

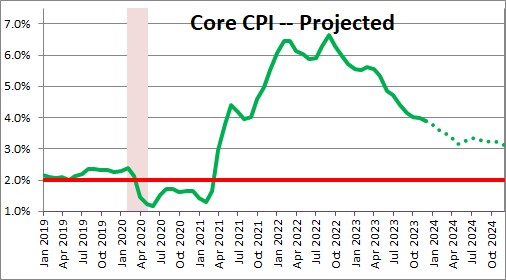

For the Fed to reduce the federal funds rate the Fed will require a further slowdown in the inflation rate. Today the core CPI has risen 3.9% in the past year, which is almost double the targeted 2.0% pace. Given that situation the Fed simply cannot begin to ease any time soon. However, with substantially slower 0.7% GDP growth in the first half of this year and the elimination of all surplus liquidity, the inflation rate should continue to shrink. By midyear the core CPI could reach 3.2%. Still above target, but clearly moving in the right direction.

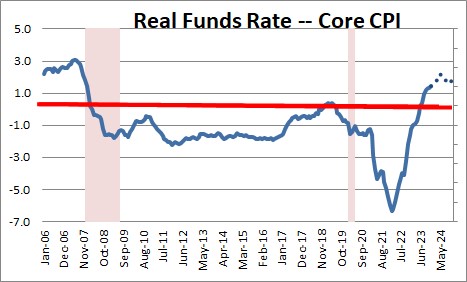

Slower GDP growth and reduced inflation will encourage the Fed to ease, but it will also examine the “real” or inflation adjusted fed funds rate which is how it judges the tightness of its monetary policy. The Fed thinks that its policy is neutral when the funds rate is 2.5% and inflation is at its target of 2.0%. In other words, it believes that a 0.5% real funds rate is “neutral”. Today the funds rate is 5.5%, core inflation is 3.9% and, hence, the real funds rate is 1.6%. By midyear if the funds rate is still 5.5% and core inflation has slipped to 3.2%, the real funds rate will have climbed to 2.3%. This means that in the first half of 2024 Fed policy as measured by the real funds rate will have actually gotten tighter by 0.7%. With slow GDP rate and a steady reduction in the inflation rate, that additional tightening seems unwarranted and should be the catalyst for the Fed to lower the funds rate – probably in July – and offset that additional tightening by the end of 2024. We expect three 0.25% rate cuts by yearend. That would mean the funds rate ends the year at 4.75%. The core CPI is expected to increase 3.1% in 2024. Thus, the real funds rate at that point would be 1.6%. That is still far higher than the 0.5% real funds rate that the Fed thinks is neutral which means further significant rate cuts should be expected in 2025 and 2026. If the Fed will be steadily lowering interest rates until mid- 2026, it seems highly likely that the economy will continue to expand at least through the end of that year.

Stephen Slifer

NumberNomics

Charleston, S.C.

Always a pleasure to read your take and analysis!