February 24, 2023

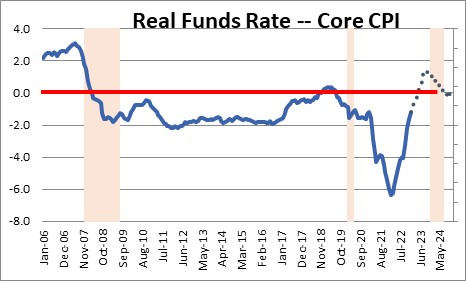

The past few weeks have burst the soft landing bubble. First quarter GDP growth estimates have been rising steadily from 0.5% at the beginning of the year to 2.0-2.5% currently. All inflation measures were revised higher in the final few months of last year and showed no signs of moderating in January. While inflation has peaked for the cycle, the notion that it will decline rapidly has fallen completely off the radar. That is a disturbing scenario from the Fed’s viewpoint. As a result, we have raised our peak funds rate from 5.5% to 6.0% in the third quarter. That should raise the real funds rate to 1.4% by September which should be enough to trigger a mild recession in the first half of 2024. Make no mistake, the inflation rate has peaked for the cycle and will continue to slow because the Fed is producing declines in the money supply on a monthly basis which will eliminate the remaining excess liquidity by yearend. This should produce a steady drop-off in inflation in the months ahead. At 4.75% today the funds rate is getting closer to where it needs to be but the real funds rate remains negative A further adjustment in the funds rate to the 6.0% mark and additional slowing in inflation to 4.6% will boost the real funds rate to +1.4% by summer which should be enough to do the trick and produce a mild recession in the first half of 2024.

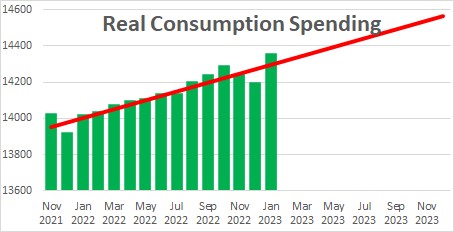

In mid-February the retail sales data for January jumped 3.0% following declines of 1.1% in both November and December. Previously the view had been that the economy was slowing rapidly because the consumer was running out of gas. The subsequent release of the personal consumption expenditures data for January – which include spending on both goods and services — revealed a blockbuster increase of 1.8%. That began the mad scramble amongst economists to revise upwards their first quarter GDP estimates from 0.5% or so initially to 2.0-2.5%. With GDP growth of 3.2% in the third quarter, 2.7% growth in the fourth, and 2.0% in the first quarter, the idea that economic activity was slowing quickly enough to allow the Fed to take its foot off the brake completely disappeared.

Further obliterating the soft landing scenario is the fact that wage growth appears to be accelerating. Following monthly gains of 0.4% in both November and December, wages jumped 0.9% in January. Wages are income which could provide the fuel for a resurgence of consumer spending. An apparent quickening in the pace of economic activity is clearly disquieting to the Fed.

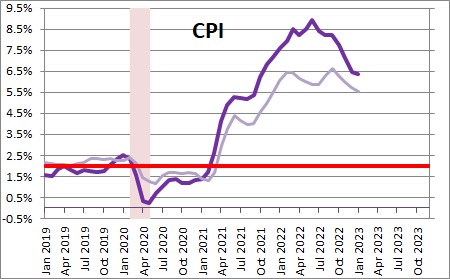

The situation has gotten even worse given upward revisions to the inflation data. The overall CPI index has slowed from a peak of 8.9% in June of last year to 6.3%. But that was the result of a significant drop in gasoline prices. The more important core CPI had appeared to slow down appreciably in late 2022, but upward revisions to data for the final few months of last year and a 0.4% increase in January make it clear that the slowdown in this key measure has been marginal.

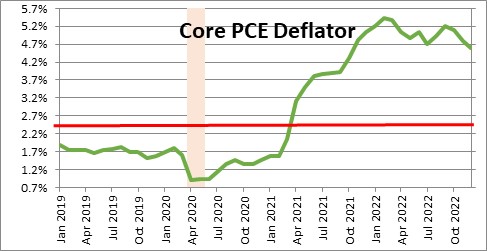

While the CPI is the most widely followed measure of inflation, the Fed’s target is the personal consumption expenditures deflator ex the volatile food and energy components. The core rate of this index has been equally slow to materialize. Its peak was 5.4% early last year and now stands at 4.7%. For what it is worth, we expect it to slip to 4.3% by the end of this year. The target is 2.0%. Not even close.

The combo of faster GDP growth and stickier-than-expected inflation makes the Fed’s job more difficult. With the funds rate currently at 4.75% and the core CPI at 5.5%, the real funds rate is -0.75%. In all previous cycles that rate has had to be positive to produce significantly slower GDP growth and reduced inflation. With upward revisions to the inflation data the real funds rate at midyear has slipped to +0.5% (a funds rate of 5.5% and the core CPI at 5.0%. That does not seem high enough to do the trick. An increase in the funds rate to 6.0% during the summer and a further slowdown in inflation to 4.6% would boost the real rate to 1.4% by September — a level that is more likely to produce the desired result.

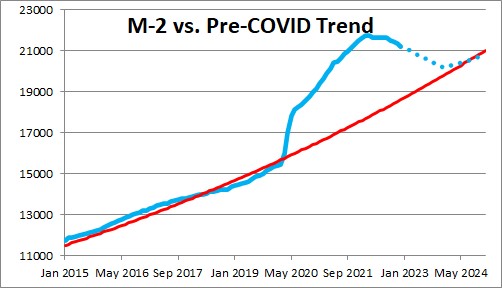

Finally, we want to stress the idea that the inflation rate has peaked and is headed lower because of the Fed’s newfound constraint on the money supply. We have talked about this endlessly. During the recession the Fed bought $2.5 trillion of Treasury securities and continued buying them through the end of 2021. Money supply growth exploded and, at one point, the level was $4.0 trillion higher than it should have been. That meant there was $4.0 trillion of surplus liquidity in the economy. That is why inflation has soared. But the Fed began to shrink the money supply early last year and it has now declined in each of the past five months. As a result, the gap has shrunk to $2.6 trillion and if the money supply continues to contract through yearend the excess liquidity should largely disappear by December. For that reason, inflation is on a downward path and should exhibit a steady slowdown as the year progresses. After allowing money growth to explode and being a year or so late to begin the tightening process, the Fed finally seems to be on the right track. We are on a trajectory towards sustainable GDP growth of 1.8% and 2.0% inflation, but it is taking a bit longer than the Fed hoped to get there.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me