July 22, 2022

The dance between growth, inflation, and Fed action continues this week as the Fed once again will raise the federal funds rate. The consensus is for an increase of 0.75% which would put the funds rate at 2.5%. Whatever the outcome of the meeting, this week’s rate increase is just another step in the Fed’s tightening initiative. How far it ultimately goes will be determined by how quickly the economy slows and how soon the inflation rate subsides. Those topics are hotly debated by economists who, not surprisingly, have widely divergent opinions. Once per quarter the Fed provides estimates of its expected GDP growth rate, the unemployment rate, and inflation for the next couple of years. But this is not that quarter. Revised forecasts are not due until September. That means that we will have to listen closely to what Powell says at the post-FOMC meeting press conference on Wednesday. Here is what we will be looking for.

With respect to GDP growth, in June the Fed thought GDP growth this year would be 1.7%. Given that first quarter growth had fallen by 1.6%, that means that it expected GDP growth in the final three quarters of the year to average 2.8%. That is pretty steamy. Latest data have been on the weak side so the Fed’s forecast has probably softened somewhat in the past month, but nothing that has been released seems likely to have caused a wholesale downward revision. While some economists believe the economy is already in a recession or soon will be, how does the Fed see things?

In June the Fed thought the unemployment rate at the end of this year would inch upwards from 3.6% to 3.7%. The labor market seems to be hanging in their fairly well. Payroll employment rose a solid 372 thousand in June. Layoffs have risen somewhat in recent weeks which suggests that the labor market has begun to soften. But is it likely to slow enough in the second half of the year to cause the unemployment rate to climb higher than the Fed thought one month ago? Probably not. Remember, the Fed needs the unemployment rate to rise above the full employment threshold of 4.0% to alleviate some of the upward pressure on wages. If it ends the year at 3.7% wage pressures will continue.

Finally, to start slowing its pace of tightening – or bring it to a halt – the Fed needs convincing evidence that the inflation rate is slowing. In June it expected the core personal consumption expenditures deflator to climb 4.3% this year and then slow to 2.7% in 2023. But in May the core PCE deflator had risen 4.7% in the past year. It is unlikely to slow beyond what the Fed thought at that time Hence, its view of its targeted inflation measure probably has not changed much.

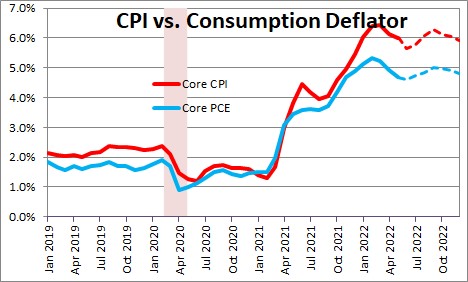

As an aside, one might wonder how the 4.7% increase in this inflation measure can be so much smaller than the 5.9% increase in the core CPI. There is a core conceptual difference between the two. The CPI measures month-to-month changes in a fixed basket of goods that consumers purchase. The PCE deflator is a weighted measure of inflation which means that the weights given to specific commodities change from month to month. For example, if the prices of butter and margarine are both unchanged in any given month, but consumers shift from expensive butter to cheaper margarine, the CPI will be unchanged but the PCE deflator will register a decline because it gives a bigger weight to the lower-priced product. Usually the difference is about 0.2%. But right now the difference is a whopping 1.2% (5.9% vs. 4.7%). That difference reflects the extent to which in this rapidly rising inflationary environment consumers are shifting to similar but lower-priced products. While it can be debated which is the better measure of inflation, the reality is that the Fed uses the core PCE deflator in determining what it needs to do to interest rates.

So where does this leave us? In June the Fed indicated that it expected to boost the funds rate to 3.4% by the end of this year and to 3.8% by the end of 2023. If it raises rates by 0.75% to 2.5% this coming week, it is clear that it intends to raise rates farther between now and yearend. The Fed’s view of the economy has probably weakened a bit in the past couple of months so it is unlikely that it will signal a need to raise rates beyond what it has already indicated. With inflation showing few signs of moderating, the Fed cannot signal a willingness to slow its projected path of rate hikes either. Powell needs to sound tough about the Fed’s willingness to do whatever it takes to slow the rate of inflation. But he cannot afford to hint at a slower pace of tightening until such time as the inflation rate shows convincing evidence of having slowed down. Stay tuned. The sage continues.

Stephen Slifer

NumberNomics

Charleston, S.C.

Steve, delighted that I have just received my first ever copy of your weekly Commentary, and have signed up going forward…

Maureen and I left Wilton after 28 years in 2005 and then lived in Charleston, SC until 2019 when we combined households w/our daughter, Rachael, & her family now in Charlotte.

My very best to you & yours!

Hi Bob,

Nice to hear from you. Glad you and Maureen are enjoying life in NC.

Steve