April 30, 2025

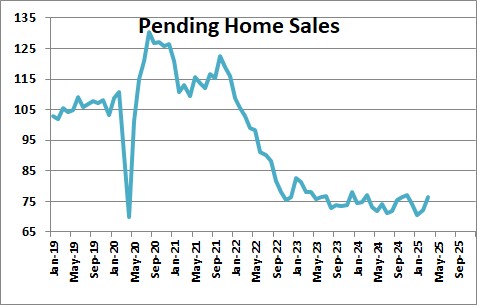

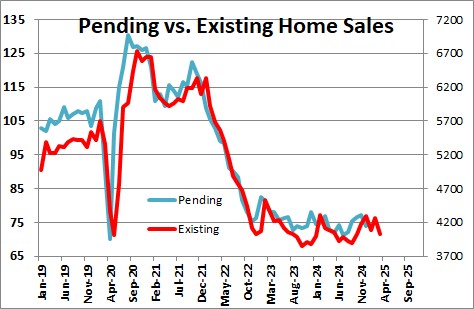

Pending home sales jumped 6.1% in March to 76.5 after having risen 2.1% in February.

The National Association of Realtors chief economist, Lawrence Yun said, “Home buyers are acutely sensitive to even minor fluctuations in mortgage rates. While contract signings are not a guarantee of eventual closings, the solid rise in pending home sales implies a sizable build-up of potential home buyers, fueled by ongoing job growth.”

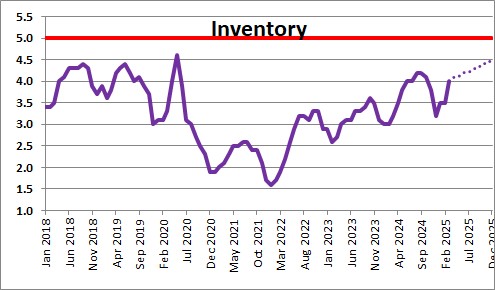

Current homeowners are reluctant to put their homes on the market which would mean trading in their current 3.0-3.5% mortgage rate for a 6.7% rate. As a result, the supply of homes on the market for realtors to show their clients remains very low/ However, housing inventory has been rising steadily for the past couple of years as potential sellers appear to have have postponed their next home purchase for as long as they can.

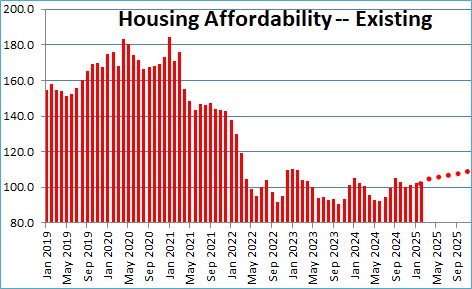

But going forward if the inflation rate continues to shrink gradually mortgage rates should decline. As rates decline more current homeowners should be willing to put their houses on the market. As supply increases prices will be relatively unchanged or even decline somewhat. And with continuing job gains and rising wages, consumer income should continue to climb. All of these factors should boost housing affordability in the months ahead. A median-income earning family today has almost about 2.0% more income than required o purchase a median-priced home. By the end of this year we expect them to have 15% more income than required. That has to boost both existing and new sales as we move into the new year..

We follow pending home sales because it is a fairly good indicator of existing home sales a month or two later. Pending home sales suggest that existing home sales should be relatively unchanged next month.

This series on pending home sales is collected by the National Association of Realtors and represents contracts signed, but not yet closed, on existing home sales. Thus, it is both a leading indicator of existing home sales and housing market activity in general. Not all these contracts go to completion. The buyer may not qualify for a mortgage, the house may not appraise at a sufficiently high value, or the house may fail the buyer’s inspection. But the series is clearly indicative of changes in housing market activity.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me